FX News Today

- Yields plunged, sending the bond below the 2% for the first time ever, and a new all-time low at 1.914%. The 10-year dropped to 1.47% and the 2-year tested 1.46%, before rates edged up slightly. This meant investors were willing to lend the government money for three decades for less than the overnight rate.

- USDJPY pivots at 106.15, EUR is down to the 111.00 handle after more talk from ECB members of QE and rate cuts at the September meeting. Cable rallied to 1.2150 after good UK retail sales figures, yesterday but has slipped back to 1.2100.

- Bank of Mexico cut rates 25 bps to 8.00%. Policy expectations were mixed, hence weakening the peso slightly. This is the first easing in five years.

- Better than expected retail sales and productivity data, and a solid earnings beat from Walmart boosted equities. Wall Street pared its gains and fell into the red as the 10-year yield fell below the 1.50% mark, but it bounced and stocks recovered slightly, though an anxious tone prevailed.

- Market sentiment remains fragile as data continue to signal downside risks to growth. USOil is trading at $55.20 per barrel recovering from overnight lows under $54.00, Gold holds a bid at the $1520.00 handle.

Charts of the Day – The Wall of Worry

Technician’s Corner

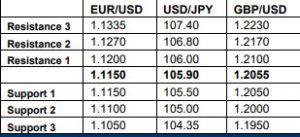

- EURUSD: Fell from highs yesterday ay 1.1158 o the 1.1100 handle following comments from ECB’s Rehn’s calling for “impactful and significant” stimulus in a WSJ interview. Today the pivot point sits at 1.1118 with S1 at 1.1080 and R1 at 1.1148. The 20 moving average has dipped to 1.1112 and the 5 period sits at 1.1105.

Main Macro Events Today

- Housing Data and Building Permits (USD, GMT 12:30) – Housing starts should rise to a 1.260 mln pace in July, after a dip to 1.253 mln in July. Permits are expected to improve to 1.270 mln in July, after falling to 1.232 mln in June. Overall, starts and permits should show a firm path into Q3, and the Q3 averages are expected of 1.263 mln for starts and 1.295 mln for permits.

- Michigan Consumer Sentiment Index (USD, GMT 14:00) – The preliminary August Michigan sentiment reading is forecast at 97.5, up from the final July sentiment at 98.4.

Support and Resistance levels

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.