EURO

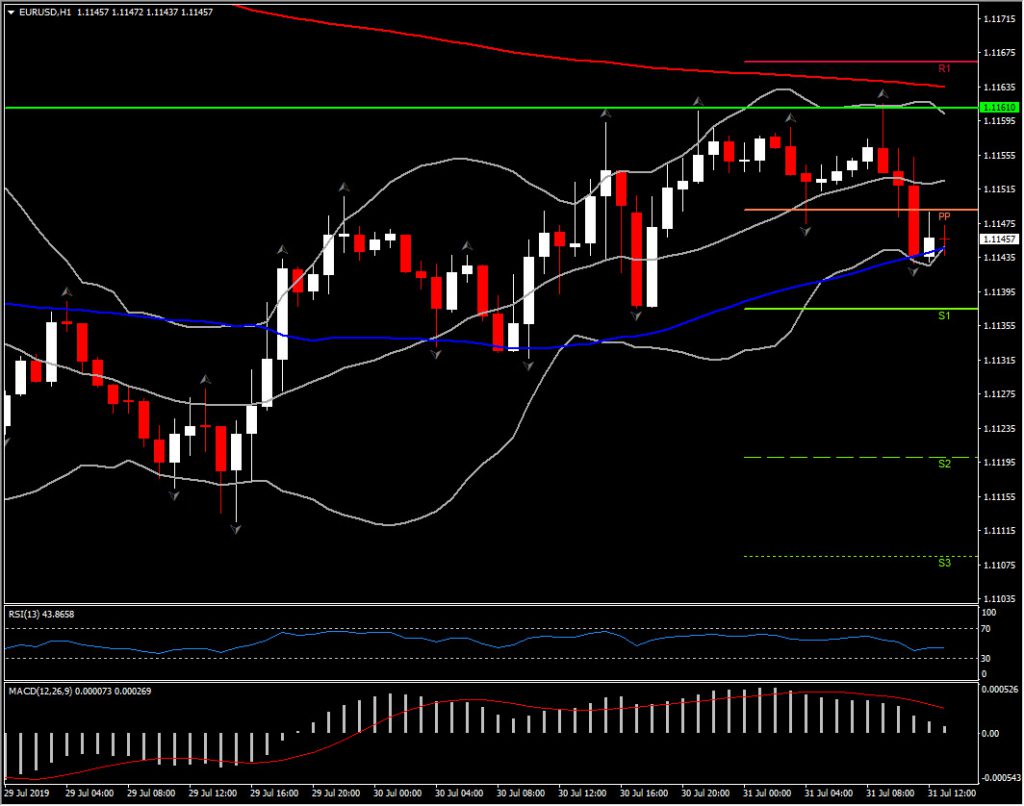

EURUSD has settled lower, back under 1.1150, after earlier eking out a 4-session high at 1.1162. The 25-month low seen last week at 1.1101 remains in scope.

The asset turned lower ahead of the Fed decision but also due to the weak Eurozone data earlier.

- Eurozone GDP growth slowed to 0.2% q/q in the second Quarter of the year, from 0.4% q/q in the first Quarter. GDP was boosted by special factors at the start of the year, including stock building ahead of the original Brexit date and with these falling out of the equation and geopolitical trade tensions hitting manufacturing orders, the decline in the quarterly growth rate was no surprise. On the contrary, the risk of a full blown recession is rising with the risk of a no-deal Brexit scenario.

- Eurozone HICP inflation fell back to just 1.1% y/y in the preliminary July reading from 1.3% y/y in June. With growth slowing down and the improvement on the labour market starting to fizzle out, chances are that inflation will continue to undershoot the ECB’s target range, thus adding to arguments for a comprehensive easing package in September.

Meanwhile, the main focus today is fully on the Fed. A 25bp rate cut is fully factored, so focus will be on the central bank’s forward guidance. Given recent data, and given recent remarks by some of the more dovish members at the Fed, there is the potential for markets to be disappointed, having overly priced in an aggressive easing path. The Chairman Powell is expected to leave the door open for additional easing, but he won’t likely satisfy expectations for a string of easings into 2020. If this happens, the US dollar could be in for an up phase, which, in turn, would pressure EURUSD. The pair has Resistance at 1.1157-62, and Support at 1.1095.

Pound

On the flipside, Brexit remains an ongoing concern, with Pound gaining some ground today due to firm US Dollar. Sterling has settled above yesterday’s major-trend lows, but with little sign of even a half decent dead-cat bounce as markets weight higher odds for a no-deal Brexit scenario under the new UK prime minister, Boris “I’m serious about a no-deal” Johnson.

Cable printed a fresh 28-month low at 1.2119, and EURGBP a 22-month high at 0.9190.

There is potential for a sharp short-squeeze positioning rebound, given the large net short exposure to the Pound, but there seems little scope for a sustained recovery while the new UK prime minister remains steadfast in his rejection of the Irish backstop, and given his threat to leave, deal-less, the EU free trade area (and the EU’s 40 trade agreements with 70 countries), and while Brussels remains steadfast in its conviction that there can be no deal without the Irish backstop.

One reason to be not-too-bearish on the Pound is that, as it stands, Johnson is in a weak position as Parliament has the numbers to stop a no-deal scenario from happening (the government’s working majority is set to fall to one from two following a by-election tomorrow). Boris has been saying that there won’t be a general election, but he might have no choice to risk it if wants to strengthen his hand (two thirds of Parliament would have to vote for a new election, but is unlikely to be an obstacle), as Brussels is unlikely to feel too pressured by his bluster of a no-deal Brexit.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.