The Bank of Canada (BoC) will announce its monetary policy decision this week, where consensus expects the BoC to increase its pace of monetary easing and deliver a 50 bps rate cut.

The Canadian dollar depreciated to just above $1.3800; a fresh low since August, after the Canadian CPI report revived bets that the Bank of Canada might deliver a 50bps rate cut this week. The annual inflation rate fell to 1.6% in September, the lowest since February 2021 and now below the central bank’s target of 2%. Meanwhile, the annualized Median CPI and Trimmed-Mean CPI, which are the two core inflation measures favored by the central bank, held steady at 2.3% and 2.4% respectively.

Last week, the jobs report came in stronger than expected, showing the Canadian economy created 46.7K jobs in September, well above the forecast of 27K, and the unemployment rate unexpectedly fell to 6.5%. Last month, Governor Tiff Macklem left open the opportunity for a larger rate cut, should inflation and the economy slow faster than expected.

Clearly, Canada’s benign inflation environment provides a strong argument for a large rate cut, with September headline inflation slowing below the central bank’s target. Meanwhile, even with some changes in recent months, activity data and sentiment surveys also remain consistent with an overall slowdown in economic growth in the coming quarters.

The Bank of Canada estimates a neutral range for the policy rate between 2.25% and 3.25% and this week’s announcement will be accompanied by fully updated economic projections. Given the good overall data, there is a strong case for the Bank of Canada to lower its policy rate by 50 bps to 3.75% at this week’s announcement.

For the Canadian dollar, any hawkish surprise could provide a much-needed boost, as the CAD has depreciated about 2.6% against the US dollar from its September peak. However, a 50 bps cut is the most likely outcome, although only 75% is factored in.

Therefore, the Loonie could come under pressure if expectations are confirmed.

However, investors will also be looking for clues on future cuts.

If Macklem keeps the door open for a further 50 bps reduction, this will put the Loonie at risk. However, if he sounds somewhat more optimistic about the outlook, investors will probably factor in some rate cuts in the next few months, potentially lifting the Loonie.

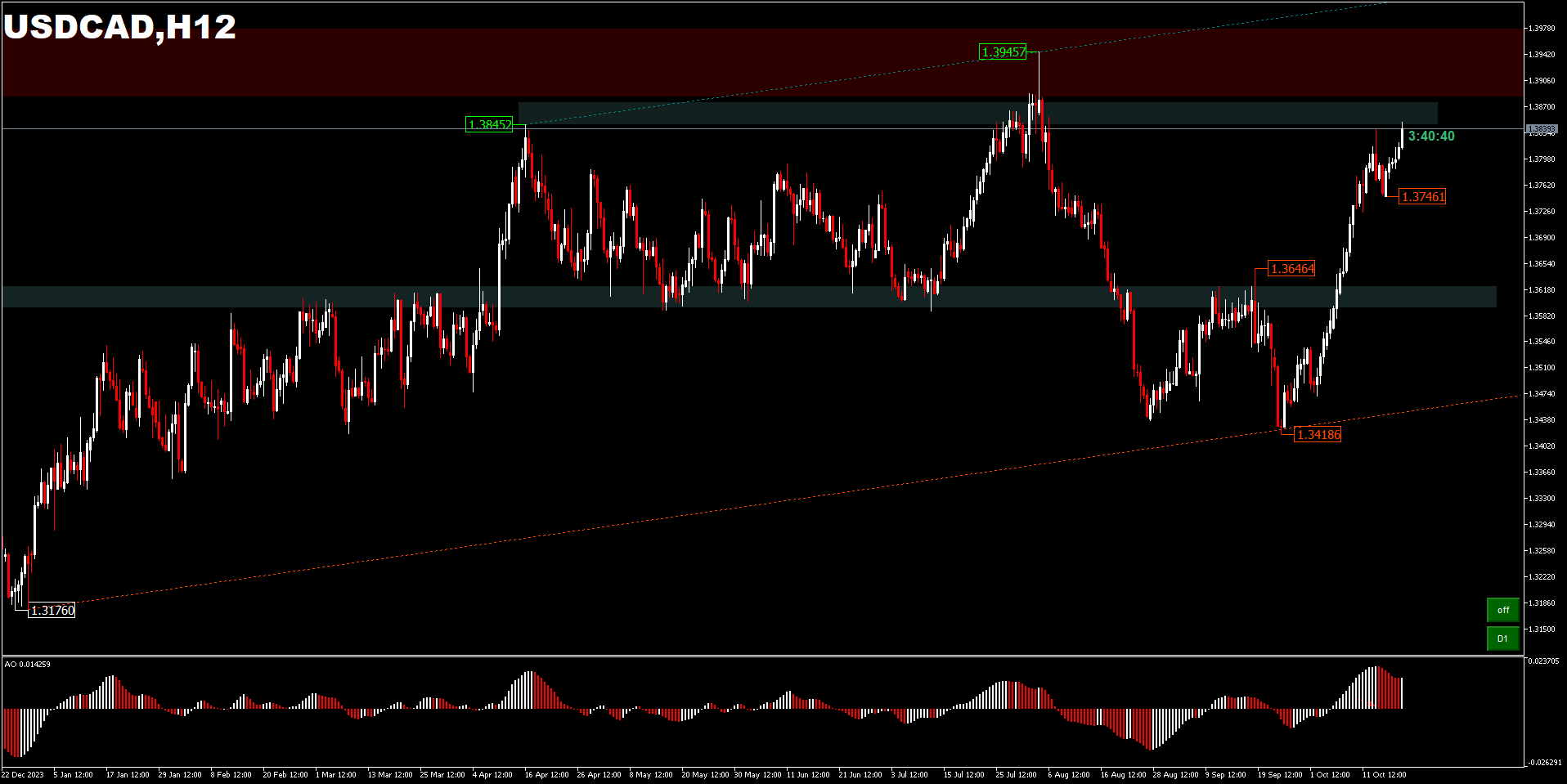

In the forex market, USDCAD extends its 1.3418 rebound and the intraday bias becomes positive again. On the upside, there are two resistances that buyers are counting on, namely 1.3945 and 1.3976. Nonetheless, another pullback can’t be ruled out, but the downside should be limited above 1.3646 resistance turned support.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.