USOIL [WTI] crude oil prices jumped 3% breaking above $70 per barrel on Tuesday, after Iran launched a series of ballistic missiles at Israel, raising fears of a wider regional conflict in the Middle East. The Israeli Defence Force intercepted a large number of missiles and declared that there was no longer a direct air threat from Iran, allowing people to come out of shelters.

Tensions in the Middle East have risen sharply, with Israel intensifying its air strikes against Hezbollah, the Iranian-backed militia that killed its leader, Hassan Nasrallah. On Tuesday, Israel sent ground troops into southern Lebanon.

The extent of the oil market reaction will depend on the scope and damage of any Iranian attack, which could dictate Israel’s response and further destabilise the region. Elsewhere, Libya is preparing to restart its oil production after resolving an internal conflict. Libya produces 1.2 million barrels per day, but production dropped to below 450,000 barrels in August due to political instability.

The evolving situation is clear, however if Israel starts attacking Iranian crude facilities or blockades the Strait of Hormuz, crude could take off. Elsewhere, we’ll see the big OPEC meeting, which will provide some answers to last week’s market-shaking news regarding Saudi Arabia and their potential to ignore the $100 price target, as well as the possibility of further postponement of production cuts from OPEC beyond December.

Meanwhile, the National Hurricane Centre is tracking 5 storm systems in the Atlantic basin as of this morning, with tropical storm Kirk expected to become a hurricane by the end of the week. As of yesterday, according to the US Bureau of Safety and Environmental Enforcement, 3% of crude oil production and 1% of natural gas production in the Gulf of Mexico were still offline following Hurricane Helene.

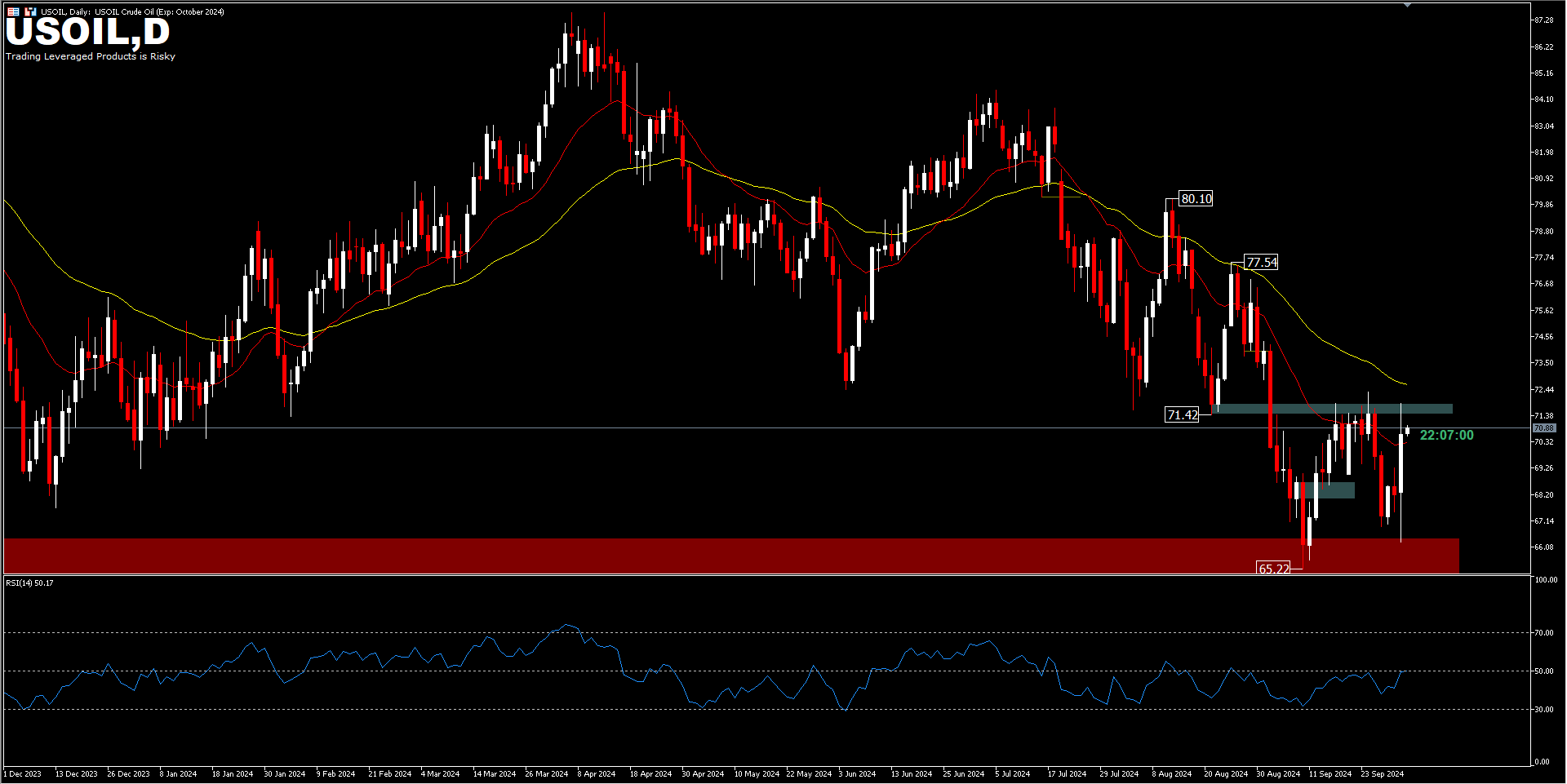

From a technical perspective, an increase in geopolitical tension could lead oil to move higher, but negative sentiment still haunts demand. The current price position is above the 20-day EMA, but still below the 71.42 support which is the current resistance. RSI looks neutral at 50.00. A move above 71.42 will confirm the botomming of 65.22 and the price could move to test the 50-day EMA around 72.79, and further for the important 75.00 level. As long as 71.42 support holds, oil prices could re-enter the consolidation phase.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.