The euro fell more than 0.12% to $1.1161 in Friday trading [27/09], after French and Spanish inflation fell more than expected, fuelling speculation that the European Central Bank (ECB) may accelerate interest rate cuts. French inflation fell to 1.5% in September, the first time below 2% in more than three years, fuelled by lower energy costs.

With inflation cooling across the Eurozone, the ECB has cut interest rates twice this year. However, the recent private sector contraction has increased bets of another rate cut in October, with markets seeing a 70% chance. Nonetheless, the ECB warns inflation could rebound and stability may not return until late 2025. More data from Italy, Germany and the Eurozone, due for release next week, will offer further insight.

Meanwhile, September’s Eurozone manufacturing and services sector PMIs provided a rather disappointing insight into the state of the region’s economy. The Eurozone manufacturing PMI fell to 44.8, the lowest level since December 2023, indicating a sustained contraction in the industrial sector. The breakdown showed weakness in new orders and order queues. Among the major countries, German manufacturing remained very weak in September, while France’s manufacturing PMI was more stable.

On the services side, the Eurozone PMI fell to 50.5 in September, the eighth consecutive month in expansion territory, but still the lowest reading since February 2024. Here too, incoming new business weakened and the German services PMI fell, while the French services PMI reversed the Olympics-related improvement seen in August. The combined or overall Eurozone PMI fell to 48.9 in September from 51.0 in August, the first reading in contraction territory for the combined PMI since February this year.

The PMI survey potentially foretells a slowdown in the region’s economic growth momentum and even a possible contraction, later this year. Against this backdrop, there is a possibility of Eurozone GDP growth declining for the rest of 2024 and 2025. The PMI survey also noted reports of softening input costs and output prices. Markets will be watching the upcoming CPI release for any confirmation of this easing of price pressures, with a benign CPI potentially paving the way for the European Central Bank to accelerate its pace of monetary easing with another rate cut, soon after its October meeting.

On the other hand, the Eurozone Economic Sentiment Indicator fell slightly from 96.5 to 96.2 in September. The Employment Expectations Indicator rose from 99.4 to 99.5. The Economic Uncertainty Indicator rose from 17.5 to 17.8. Industrial confidence fell from -9.9 to -10.9. Services confidence rose from 6.4 to 6.7. Consumer confidence contracted to -129 from -13.4. Retail trade confidence fell from -7.9 to -8.5. Construction confidence rose from -6.3 to -5.8. The EU Economic Sentiment Indicator was unchanged at 96.7.

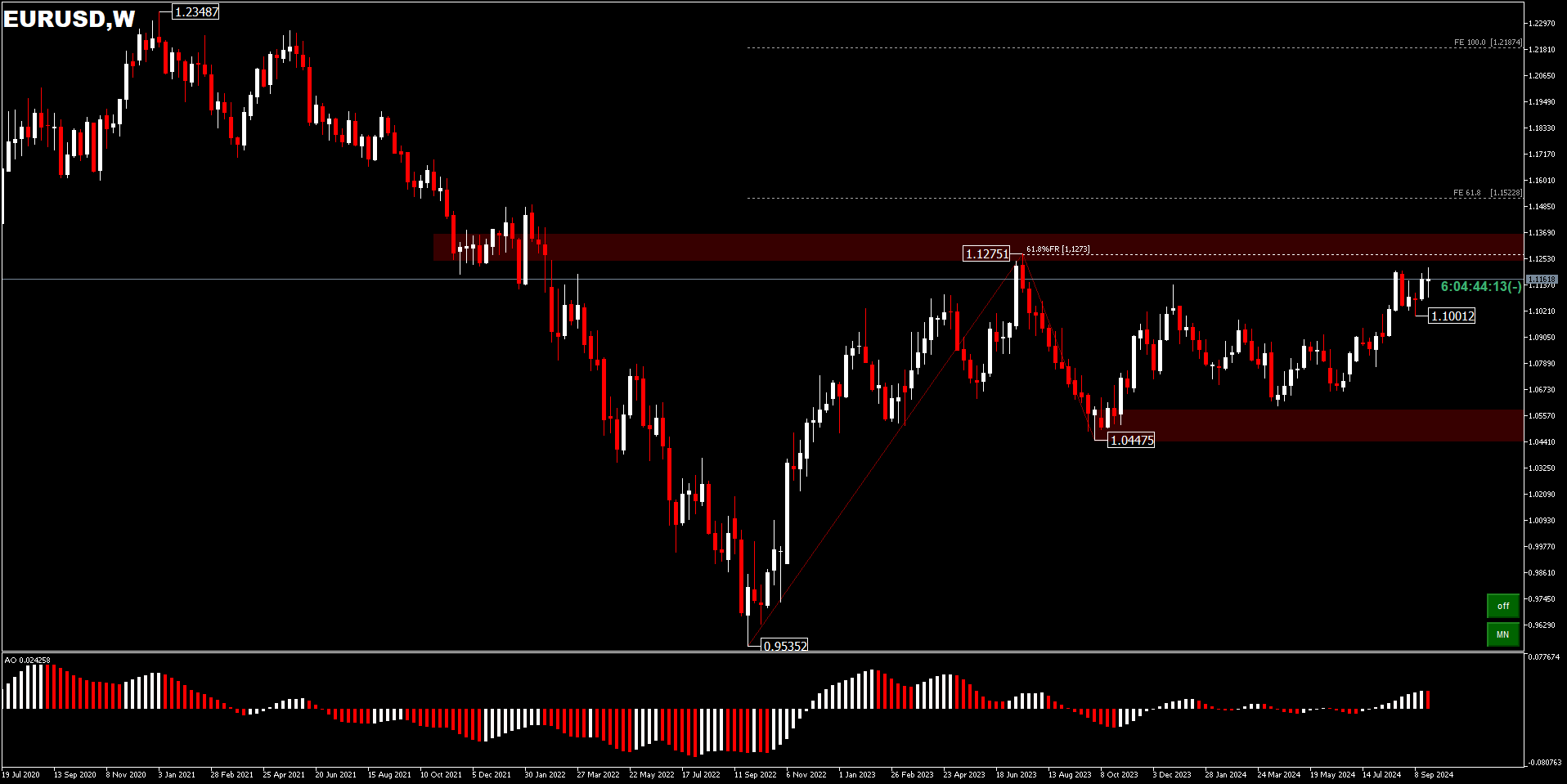

In the forex market, the EURUSD currency pair has benefited from the decline in the US dollar exchange rate, due to expectations of massive Fed rate cuts. EURUSD grew by more than 1% in September, approaching the 2024 price peak [1.1275].

From a technical perspective, the corrective pattern from 1.1275 should have been completed at 1.0447. A decisive breakout of 1.1275 will confirm the resumption of the overall uptrend from 0.9535. The next target is the FE61.8% projection of 0.9535 – 1.1275 pullback and 1.0447 pullback at 1.1522. This will now be the preferred scenario as long as 1.1001 support holds. A drop below 1.1001 support will only prove, however, the resurgence of the US dollar’s strength, after the pair was unable to surpass 61.8%FR [1.1273] level of 1.2348 and 0.9535 pullback.

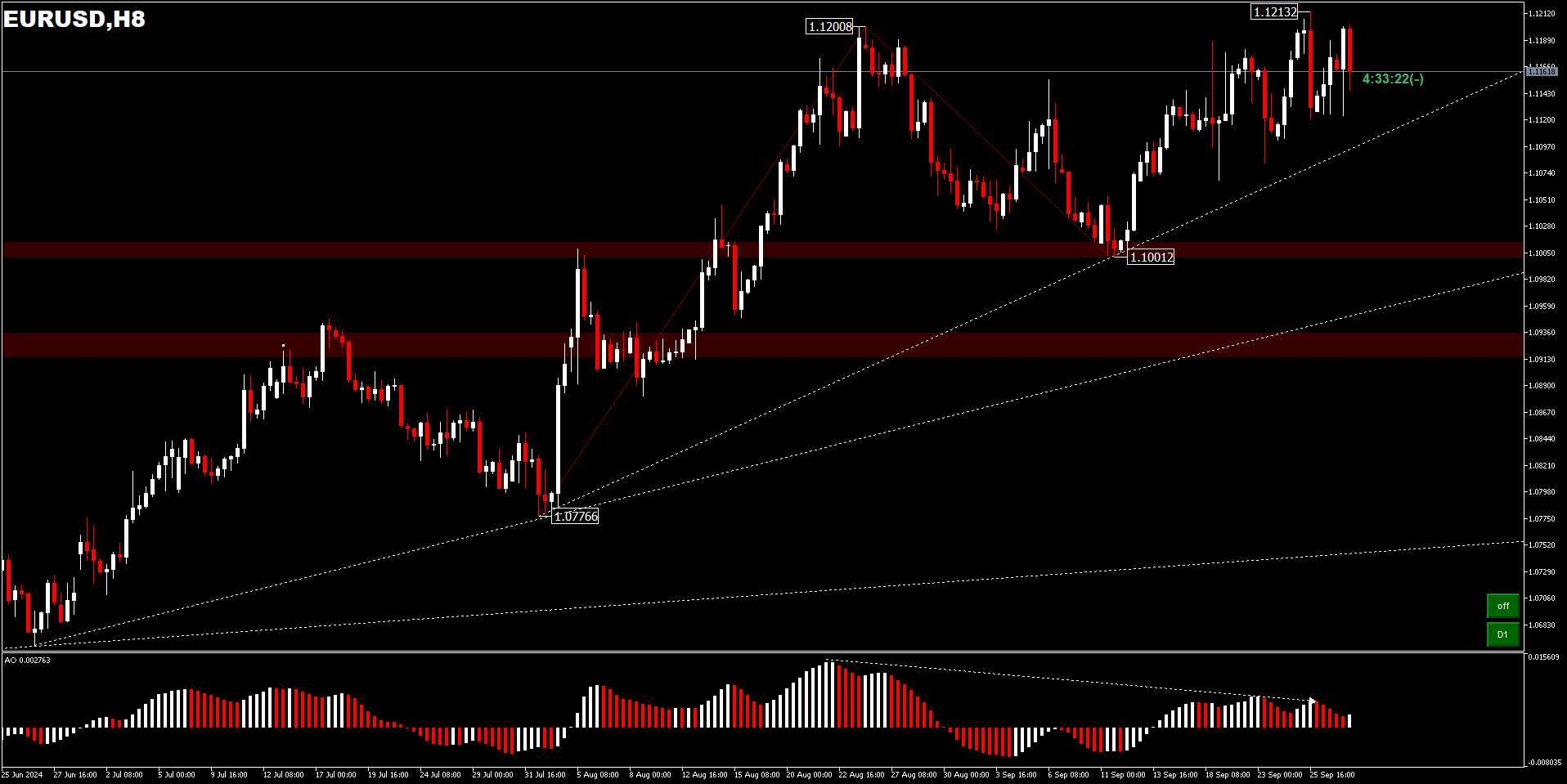

EURUSD [H8] moved up to the 1.1213 level last week, but quickly re-stabilised within the range. Initial bias remains neutral this week first. Further rallies are expected, as long as 1.1001 support holds. A move above the 1.1213 level, should continue to test last year’s peak at 1.1275 [FE61.8%]. A strong breakout there will resume the larger uptrend. The next short-term targets are the FE100% projection of 1.0776 – 1.1200 drawdown and 1.1001 at 1.1426. But considering the AO divergence bias, and the failed follow-through rally attempt, then the pair could erode the previous gains with a drop below 1.1000 which would invalidate all bullish scenarios.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.