FX News Today

- Risk aversion eventually won the day on Thursday, as stocks gave back modest early gains and yields drifted lower from opening highs.

- Bonds rallied as stocks were pressured by President Trump’s announcement that Mexico will be hit by 5% tariffs that will gradually rise to 25% in a bid to curb immigration.

- The latest escalation in the global trade war, coming after China’s manufacturing PMI fell more than expected and is now in contraction territory, added to fears that the world economy is heading for recession and sparked a new rally on global bond markets that left the 10-year Treasury rate down -4.5 bp at 2.168%.

- The WTI future fell back to $55.97 per barrel following the EIA inventory data which showed a 300k bbl fall in crude stocks. The Street had been expecting a 1.0 mln bbl decrease, though the API reported a 5.3 mln bbl draw after the close on Wednesday.

- European stock futures are selling off in tandem with US futures after a largely weaker session in Asia overnight.

- Today’s data calendar will likely underpin the rally in bond markets, with preliminary German and Italian inflation data set to confirm that Eurozone HICP fell back sharply in May, thus adding to the arguments of the doves at the ECB ahead of next week’s council meeting.

Charts of the Day

Technician’s Corner

- USDCAD – H1 – found support under 1.3490 early in the session, later bouncing to 1.3547 highs (Wednesday’s post-BoC high) as Oil prices fell to fresh 2-plus month lows. WTI crude bottomed at $56.78, down from opening highs near $59.20. Year’s high at 1.3660-1.3664 is now the next Resistance level, with Support now at 1.3481, which was yesterday’s low.

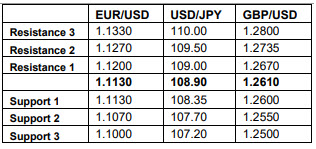

- USDJPY – H1 – ran out of steam over 109.90. The pairing has since fallen back under 109.00, taking its cue from Wall Street, which has about squandered all of its earlier gains. The usual talk of Japan exporter offers from the 110.00 mark has been heard, which could have prompted some position squaring ahead of the level. In the bigger picture, trade wars and general risk-off conditions will likely limit further gains going forward. Next Support area between 108.00-108.50.

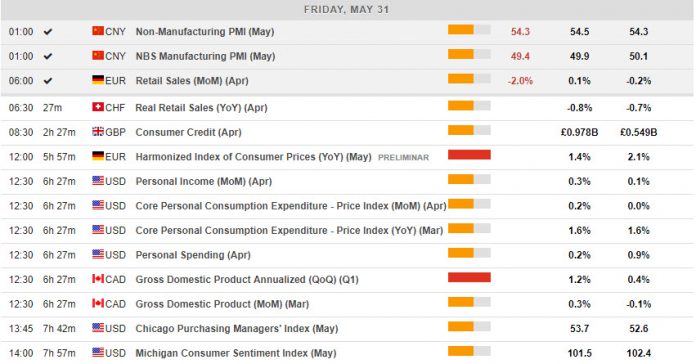

Main Macro Events Today

- Harmonized Index of Consumer Prices (EUR, GMT 12:00) – The preliminary German HICP inflation for April jumped to 2.1% y/y from 1.4% y/y. However the reading for May is expected to fall back to 1.5% y/y.

- Personal Consumption Expenditures (USD, GMT 12:30) – The April income/consumption report is expected at 0.3% in income. It is also projected to show a 0.3% increase in the PCE chain price index versus a prior 0.2% gain, as well as a 0.2% rise in the core versus unchanged previously. Such gains won’t cause a ripple at the Fed as annual rates remain well below the Fed’s 2% target.

- Gross Domestic Product (CAD, GMT 12:30) – The Q1 GDP is expected to increase to 1.2%, after it slowed to a 0.4% growth rate in Q4 from 2.0% in Q3 (q/q, saar).

- Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.