Commodity indexes declined sharply last week as oil prices plunged on the back of a rise in US crude stockpiles and hopes of a ceasefire between Israel and Hamas. The gold price declined for a second week as safe haven flows eased. Middle East jitters picked up again today, as Israel advised the evacuation of Rafah. Here’s a comprehensive analysis of the key market movements:

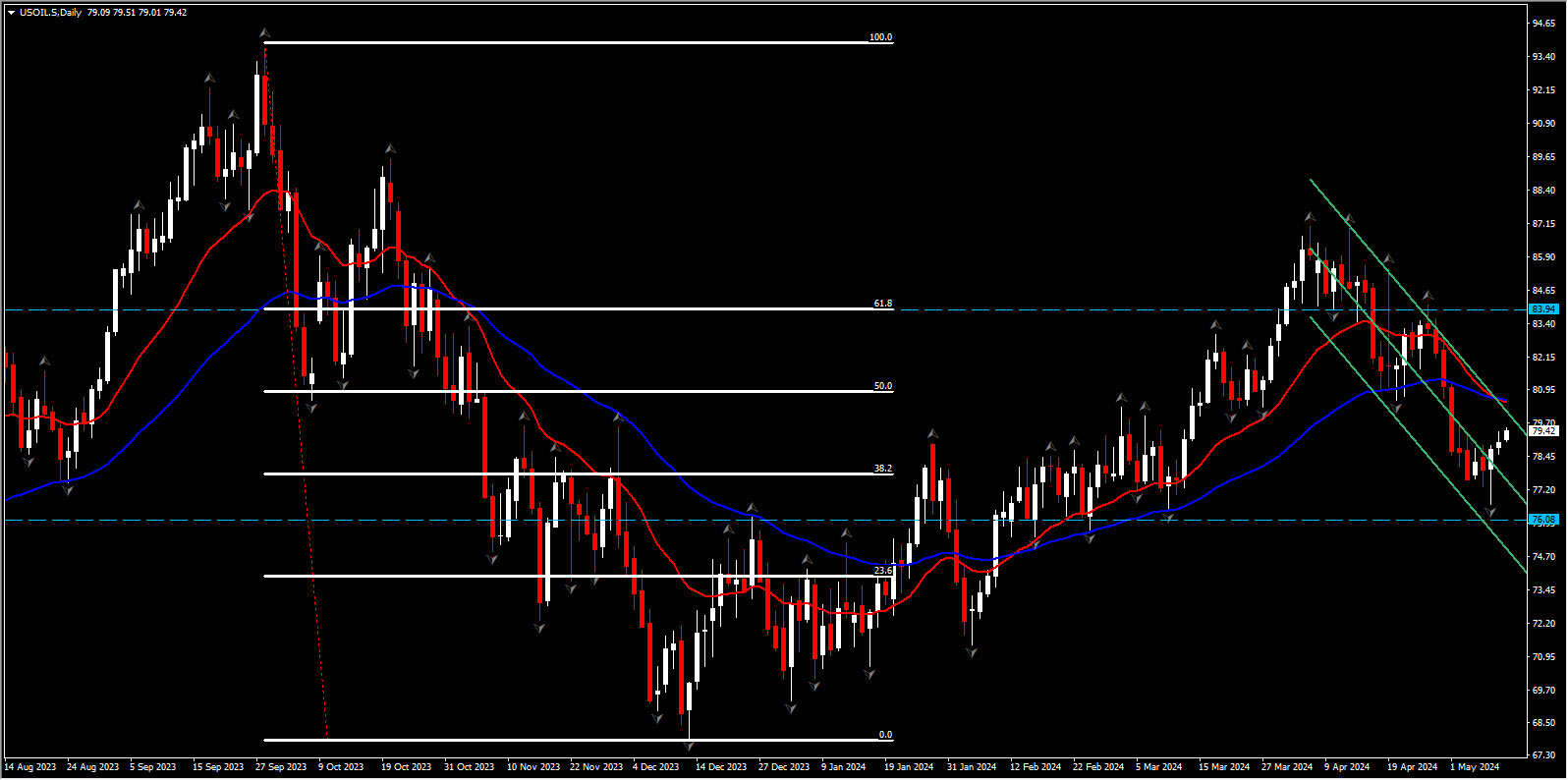

Oil Market Dynamics:

Oil prices experienced a sharp decline last week, attributed to optimism surrounding a potential ceasefire between Israel and Hamas, coupled with a notable increase in US crude stockpiles. However, the market saw a reversal, this week as Saudi Aramco announced unexpected hikes in its official selling prices for June, signaling confidence in future demand. The price for key Arab Light crude was hiked by more than investors had anticipated, which added to the uptick. The move signaled confidence in the demand outlook and was in line with the cartel’s recent statement that voluntary output cuts could be extended through the second half of the year.

On top of this, Israel closed the Kerem Shalom humanitarian crossing into Gaza and told civilians to leave Rafah. This was interpreted as a sign of an attack on the city, and concern that an escalating conflict could hit supplies has picked up again.

Moreover, the operationalization of Canada’s Trans Mountain pipeline expansion bolstered hopes for increased oil supply to global markets. Canada’s newly expanded Trans Mountain pipeline helps to deliver more barrels from Alberta towards tanker berths on the Pacific coast. Chinese energy groups Sinochem and Sinopec will be among the first customers for the cargoes, and Canadian officials suggested that the project will provide reliable energy sources to global buyers. The current week also witnessed a continuation of the upward trajectory in oil prices, driven by renewed expectations of interest rate cuts and positive trade data from China.

Moreover, the operationalization of Canada’s Trans Mountain pipeline expansion bolstered hopes for increased oil supply to global markets. Canada’s newly expanded Trans Mountain pipeline helps to deliver more barrels from Alberta towards tanker berths on the Pacific coast. Chinese energy groups Sinochem and Sinopec will be among the first customers for the cargoes, and Canadian officials suggested that the project will provide reliable energy sources to global buyers. The current week also witnessed a continuation of the upward trajectory in oil prices, driven by renewed expectations of interest rate cuts and positive trade data from China.

Gold & Copper Market Update:

Contrary to Oil, Gold prices experienced a correction for the second consecutive week, primarily influenced by the anticipation of interest rate cuts following the US jobs report. Haven flows also picked up again on tensions in the Middle East and Ukraine, which reignited demand for gold, leading to a notable surge in prices. Over-the-counter sales have also remained robust. The gold price jumped more than 1% to the highest level in three weeks and at $2374.54 per ounce is close to testing all-time highs.

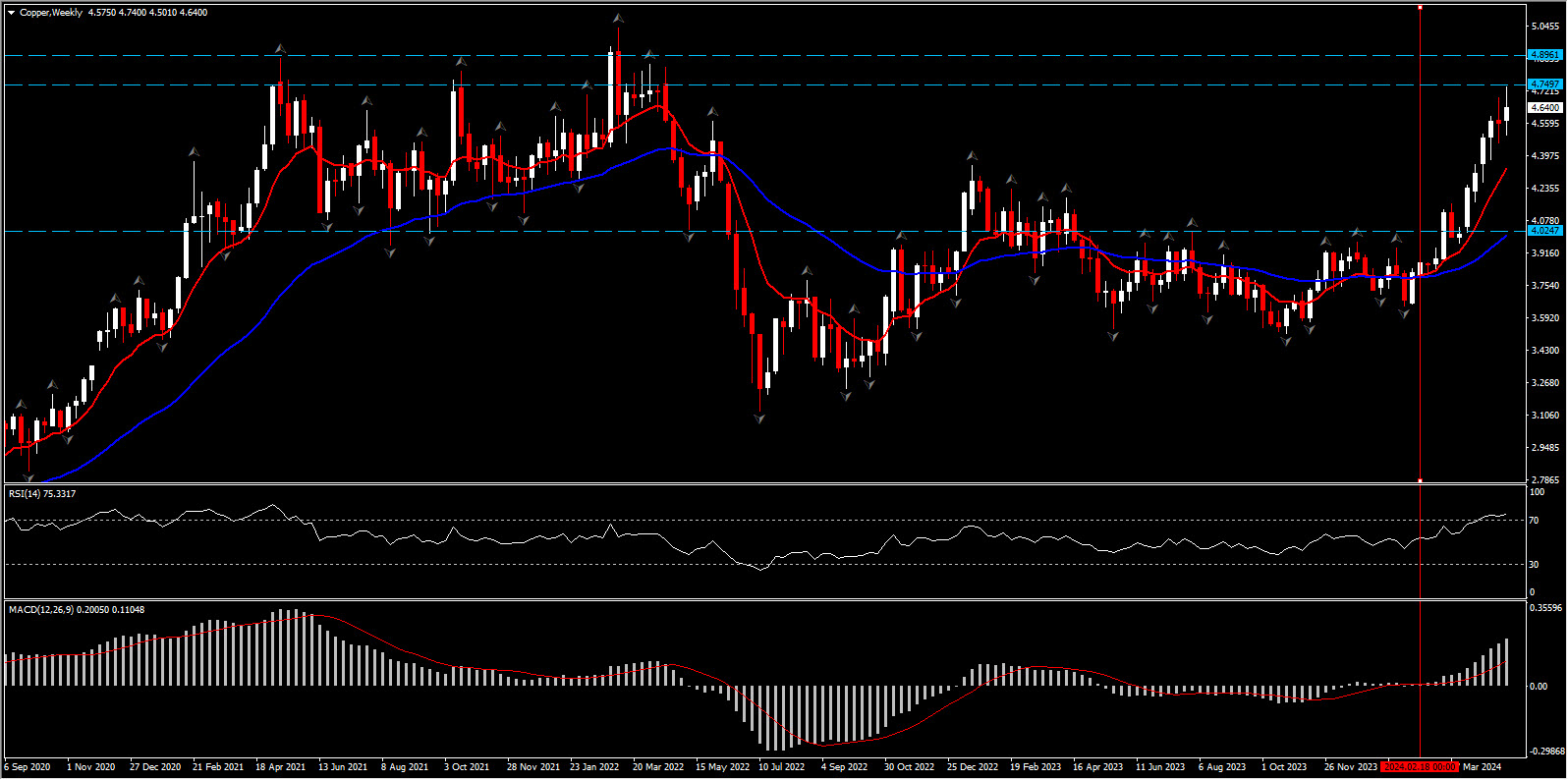

Silver prices remained relatively stable throughout the previous week but witnessed a significant uptick amidst industrial demand and safe-haven flows. Similarly, Copper prices experienced a surge, reaching highs not seen in over two years, fueled by supply concerns and a bullish long-term demand outlook.

Analysts suggest that a substantial price increase may be necessary to incentivize investment in new copper projects, indicating a potential long-term supply shortfall. The FT pointed out last week, “the pipeline of new projects is thin, and exploration budgets for copper have fallen since the early 2010s”. The article flagged that “some analysts think prices would need to rise by around 20% from current levels to attract investment in new projects”. Even if there are sufficient funds, it can take “well over a decade to move from discovery to production”, so supply shortages are unlikely to be addressed any time soon, even in the most optimistic scenario.

In the mining sector, it is cheaper for miners to buy out a rival than invest in new mines. Indeed, BHP, the world’s largest mining group, is reportedly mulling an improved offer for Anglo-American after its USD 31 bln bid was rebuffed. Anglo-American owns lucrative copper mines in Chile and Peru, but its takeover would of course only boost BHP’s access to copper, and not the total amount of global supply.

The volatile market conditions witnessed in recent weeks underscore the influence of geopolitical factors and supply dynamics on commodity prices. As investors navigate through uncertainties, strategic acquisitions and long-term demand projections are likely to shape the future landscape of the commodities market.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.