Economic Indicators & Central Banks:

- Rate cut hopes for the US are fading, which is weighing on stock markets. Bonds have found a footing, at least outside of the US, and the 10-year Bund yield is down -1.4 bp, after the 10-year JGB corrected -1.3 bp.

- A rise in February JOLTS, albeit after a downward revision to January, and a better than expected factory report, exacerbated the sell off in longer dated Treasuries.

- Disappointing delivery news from Tesla, along with weakness in the health and retail sectors, weighed on sentiment.

- Rising geopolitical risks boosted Gold and Oil.

- Fed’s Mester(Voter) & Daly (Voter): They still see 3 cuts this year, which helped trim losses. Mester stated that she will not vote for a cut at the May meeting given the lack of sufficient data but said she would not rule out action in June.

- China’s manufacturing activity expanded at the fastest pace in 13 months in March. Yuan declined despite data.

- Today: EU Inflation & Core, US ADP, US ISM Services and Fed Powell speech. OPEC ministerial meeting is also on tap and it is expected to confirm current output cut targets.

Market Trends:

- Wall Street slumped as well on JOLTS and hence the Fed outlook and the rise in yields with the major indexes falling over -1.0% before paring losses. The Dow finished with a -1.0% drop, while the S&P500 was down -0.72% and the NASDAQ -0.95% lower.

- Stocks have sold off across Asia, with Hang Seng and ASX underperforming and losing more than -1%. US futures are also in the red, while European futures are narrowly mixed.

Financial Markets Performance:

- The USDIndex climbed to hit 105.10, but it lost traction and slid to close at 104.52 with a pick up in downside momentum after the Fedspeak. Monday’s 105.019 close was the first with a 105 handle since mid-November.

- The AUD & NZD (often used as liquid proxies for the CNH), are under pressure as a result of a stronger USD and a weaker CNH.

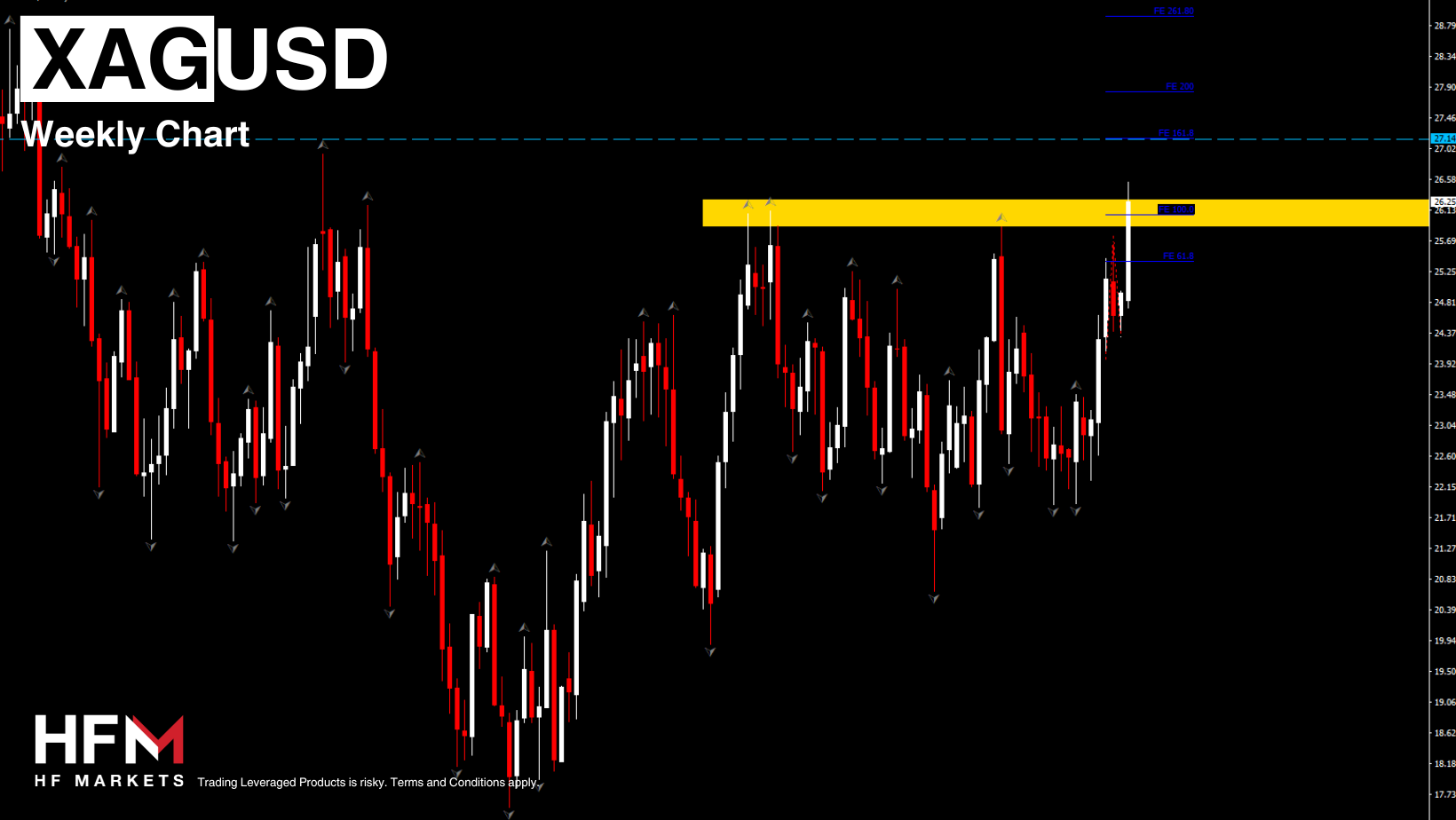

- Gold (+11% this year) surged to a new all-time peak at $2288 even as Fed rate cut bets were pared. Silver hit a 2-year high.

- USOIL was up 1.9% at $85.30 per barrel with additional support from expectations for rising demand.

- Bitcoin at $66.3K, under pressure for a 3rd day in a row.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.