- Analysts see very little potential for Tesla’s stock price to rise in the medium term. Economists also indicate the stock may fall outside of the NASDAQ’s top ten influential stocks.

- The USA100 continues to trade within a descending triangle with no real bullish momentum. However, investors turn their attention to the upcoming earnings season.

- Investors start the countdown to the next earning season with only 16 days to go. However, for now investors turn their attention to tomorrow’s US GDP and Friday’s Core PCE Price Index.

- The Japanese Yen gains after attempting to gain momentum after small gains over the past week.

USA100

Technical analysts do not deny the USA100 continues to trade within a bullish trend and the current descending triangle pattern shows weaker momentum than previous retracements. However, economists are advising investors will now start to ready their portfolios for the upcoming company quarterly earnings. The upcoming earnings season will confirm the performance of companies within the first quarter of 2024. However, intraday short-term signals, indicate a slight decline while honouring the support levels.

The price of the USA100 has fallen slightly below the 75-bar EMA, which indicates weakness but has not crossed low enough to signal a full correction back to $18,005. One of the reasons for the decline is NVIDIA which has fallen 2.55% and Tesla which is 0.75% down so far today. Investors also note that only 4 of the top 15 stocks are trading higher so far today.

Many investors are either reducing their portfolio’s exposure to Tesla stocks or completely removing them. However, Tesla is the 9th most influential company for the NASDAQ holding more than 2.34% of the index. According to economists, almost 90% of experts are reducing their predictions for the financial performance of the company in the next quarter. This is despite the CEO, Elon Musk, advising the company is stable and will continue to perform well.

This week, economists at GLJ Research maintained a sell indication, and are adjusting their target price to $123.53, well below the current level, in the expectation that car sales in the first quarter will decline to 406,500–417,500 compared to the consensus forecast of 462,000. So far in 2024, the stock has depreciated 29%, but technical analysis points toward the price declining to $150.00.

Another factor which investors will monitor is the performance of Apple’s new headphones. Apple stocks are also down 7.00% in 2024. The NASDAQ’s strong performance is largely thanks to NVIDIA, Meta and Microsoft.

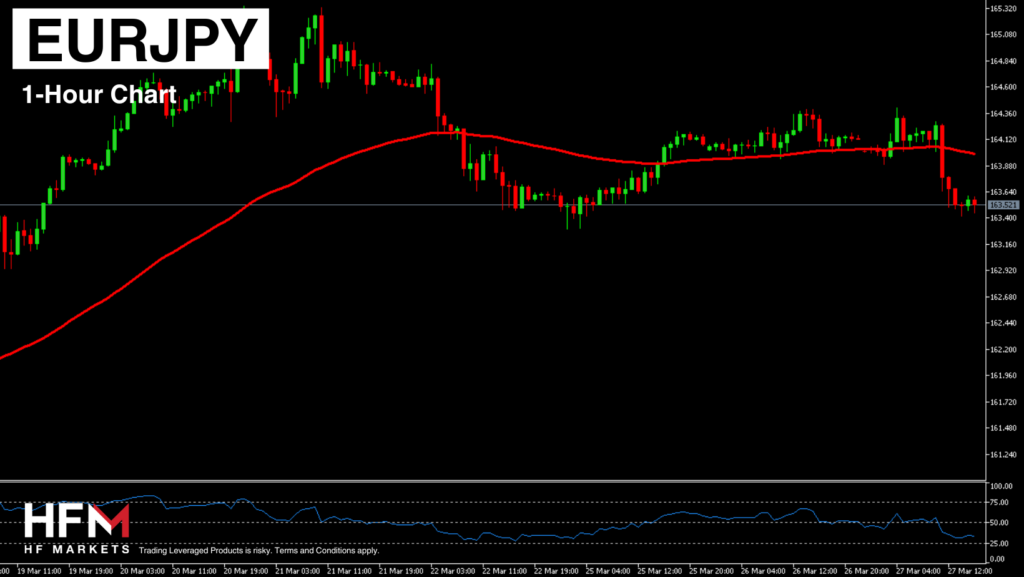

EURJPY

Over the past 5 trading days the EURJPY has formed a lower high but is yet to confirm a lower low. With today’s bearish price action, the asset is now attempting to form a price breakout but has already formed a break on the Fibonacci breakout levels. Therefore, price action mainly is indicating a downwards trend. This would also be backed up if the lower low is finalised.

Japanese government officials believe that the negative performance of the Yen is associated solely with speculative activity, while most experts note that the regulator’s interest rate, even after increasing to 0.10%, is another negative factor for the Yen. This is because it is still relatively low compared to other central banks. Also, certain government officials have negatively reacted to the increase in rates. However, many economists are also advising the Yen can still gain momentum as other central banks start to cut interest rates.

Michalis Efthymiou

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.