USDCAD, Daily

The Dollar majors have been plying narrow ranges in very thin conditions, with European centres remaining closed, along with Hong Kong and Australia, among others. The Euro lifted moderately,while USDJPY has been in directional stasis and Cable has remained settled near 1.3000.

However Antipodeans along with Loonie have been seeing some movement. USDCAD edged at 1.3355, with the Canadian Dollar firming concomitantly with a rise in Oil prices on news that the US is clamping down on curtailing exports of Iranian exports.

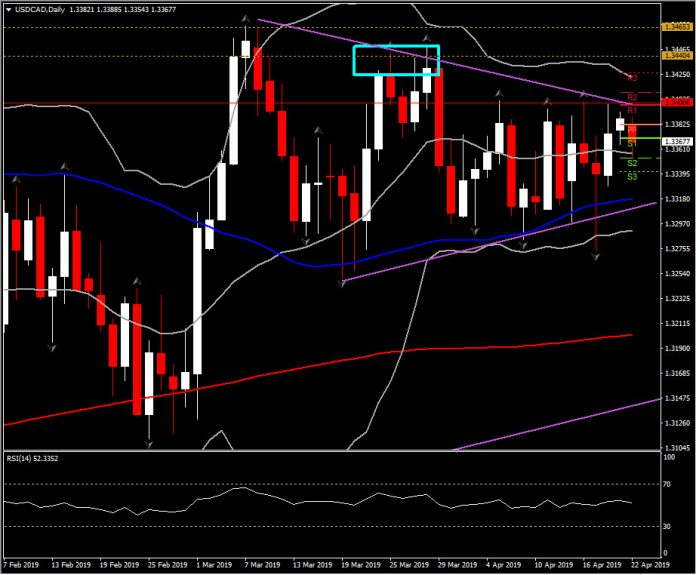

The bigger picture of the USDCAD though holds in the upside as the asset has been trading within an upwards channel for more than 2 years now. However the latest descending triangle, which has been identified in the daily chart since early March, is giving us some doubts regarding an upside movement at least in the near term. However the positive bias is supported not only by the 2-year up-channel, but also by the fact that the asset holds above 20-, 50- and 200-day SMA.

Hence, as overall bias remains strongly positive, a flip to the downside could be triggered on the break below the 1.3350 (confluence of 20-day SMA and also today’s low). This could suggest the retest of the 50-day SMA but also the bottom of the descending triangle, between the 1.3300-1.3318 area.

On the upside, the immediate resistance holds at Friday’s high, at 1.3392. Next Resistance is set at 1.3400, which is considered to be a strong hurdle as it coincides with R1 of the day, the ceiling of the triangle but also month’s Resistance zone which has been retested 3 times so far.

On the fundamental front, the Bank of Canada’s announcement (Wednesday) is the focal point of an otherwise thin calendar this week. A steady 1.75% policy setting is widely anticipated. As for the growth and inflation outlook, a repeat of the cautious optimism that has prevailed so far this year is expected. Recent economic data has been consistent with the BoC’s view that the expansion will resume in the second half of this year after the current “detour.” While the flow of data has, in our view, eliminated the previously slim chance of a rate cut this year, ample uncertainty over the growth and inflation outlook remains, keeping the outlook for steady policy intact. Our projection remains for a rate hike late in 2020.

In general, the focus this week will be on fresh signs that corroborate the return-to-growth picture in major global economies. A continuation of this theme would be supportive of currencies that performer with higher beta characteristics, such as the Dollar bloc units, while currencies of the low-yielding safe haven type, such as the Yen, would be apt to underperform.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.