EGB yields are broadly higher, amid a broad rise in global rates, as stock markets started the second quarter with improved optimism about the outlook for global growth. Hopes of progress in US-Sino trade talks, as well as an unexpected rebound in China’s manufacturing PMI helped to strengthen sentiment during the Asian session, with a rally in Chinese equities leading a broad strengthening in global stock markets. Eurozone data releases were bond friendly and helped to put a floor under Bunds.

The final reading of the Eurozone March manufacturing PMI brought a slight downward revision in the overall number to just 47.5. Italian, French and German manufacturing readings are now all in contraction territory although national survey numbers suggest that this is largely due to weakening global demand and geopolitical trade tensions.

This backs the assertion that the domestic economy is still doing well and with hopes of progress in US-Sino trade talks, European manufacturing sentiment should also stabilise, although Brexit uncertainty continues to cloud over the outlook, and again for the manufacturing sector in particular.

Meanwhile, Eurozone March HICP inflation came in at 1.4% y/y, down from 1.5% y/y in February. The deceleration in the core reading to an 11-month low of just 0.8% y/y from 1.0% y/y is a weaker than expected number though and has added to expectations of ongoing weakness in inflation numbers.

However, while the data backs the ECB’s dovish shift that was evident at the March meeting, it doesn’t provide sufficient ground for additional steps, especially as national confidence numbers for Germany provide evidence that the domestic economy is actually holding up rather well.

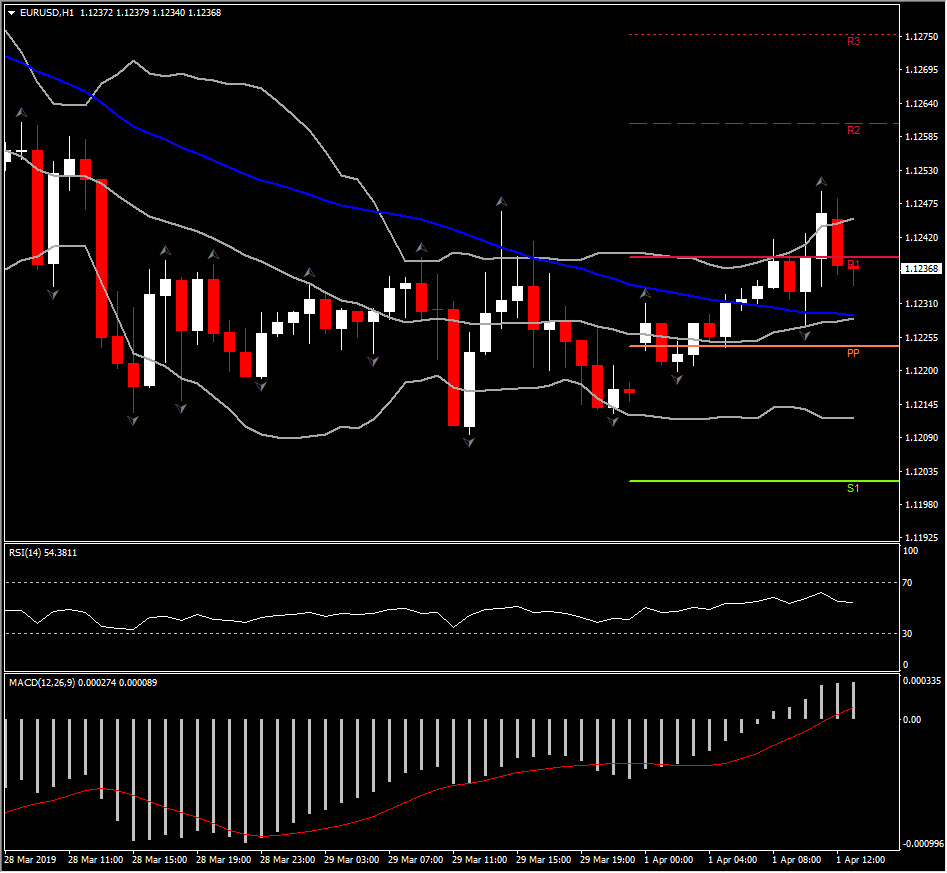

Meanwhile, in the currency market, EURUSD has settled above Friday’s 3-week low at 1.1210, with the Euro finding a supporting upswell from a buoyant EURJPY cross and a generally softer Dollar today, which has offset weakness in EURGBP.

As EURUSD is currently trading to the southwards the next intraday support level comes at the Pivot point of the day at 1.1225. Resistance is set at 1.1260. As momentum indicators are mixed, only a retention above 1.1240 could suggest the retest of the Resistance level.

Ahead this week, the final March services PMI data out of the Eurozone, Brexit developments and the US March jobs report on Friday, along with another round of US-China trade talks, will be the major focal points. On balance, it is expected that these events could have a net bearish effect for EURUSD, assuming there are fresh signs of momentum in the trade negotiations, and that the March payrolls report in the US rebounds from February’s weakness.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.