GBPJPY, H1

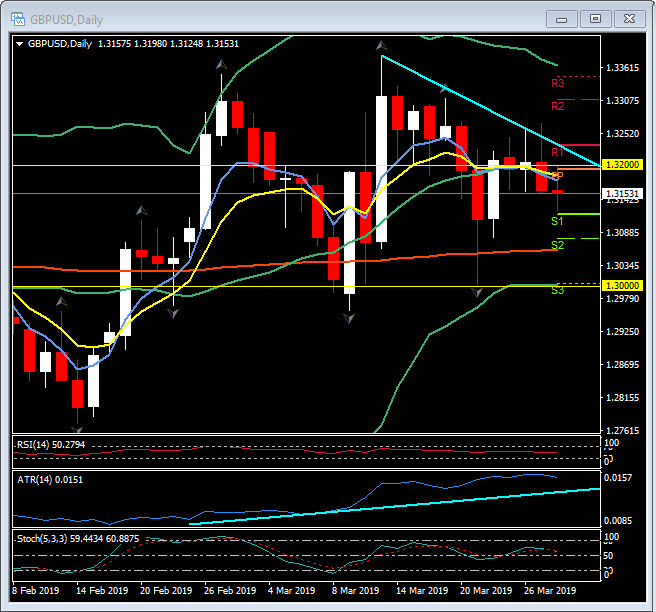

A perfect storm of recession fears, safe haven bids and Brexit deadlock helped GBPJPY spike lower and below the key 145.00 level. Cable too moved below overnight lows at 1.3140 to spike down to 1.3125 and EURGBP rose to 0.8560.

Brexit remains the main driver for Sterling. There are two central takeaways from the latest developments:

1, A series of votes (8 in total) in the House of Commons failed to produce any sign of a consensus on Brexit, other than there being an overwhelming consensus against a no-deal scenario;

2, Northern Ireland’s DUP reaffirmed its objection to Prime Minister May’s EU Withdrawal Agreement, with one member also — crucially — affirming that the party won’t abstain on a third vote on the deal, should one be held, and would vote affirmatively against it.

From the DUP’s perspective, this makes sense; as we have mentioned before, the party is fundamentally and passionately a “Unionist” party, and thereby disconcerted by the possibility that the Irish backstop part of May’s Brexit deal would insert a customs border down the Irish Sea, which would effectively separate Northern Ireland from the rest of the Union. We don’t expect the DUP will change its mind (assuming, as looks more than likely, that Brussels won’t make a treaty-level concession on the backstop).

This suggests this could be the end of the road for May’s deal, although it still has a glimmer of hope as May has been winning a degree of acquiesced support among the hardline Brexiteer group in the Tory party. She also has additional support from some Labour members representing leave constituencies.

Most political pundits seem to be suggesting that it will nonetheless be much harder for her deal to cross the line without the support of the DUP votes. It’s also not clear how May would satisfy the parliamentary requirement for her deal to be “substantially different” for it to have the opportunity to be voted on again.

As things stand, a referendum or a general election are starting to look like attractive options, though further parliamentary votes are due over the coming days and a lot could still happen at what is a very fluid juncture.

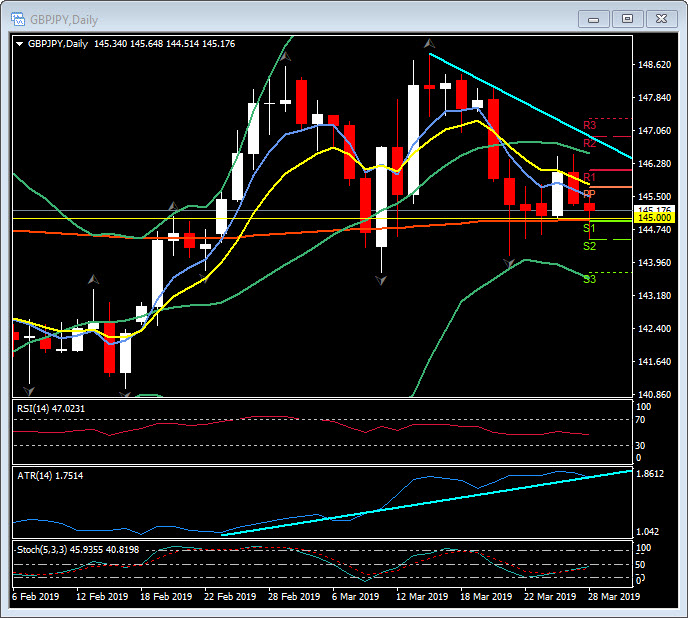

Sterling has so far continued to hold up but is becoming increasingly more volatile. The daily average true range (ATR) for GBPUSD has risen from 87 pips a month ago to 150 pips today and GBPJPY daily volatility has risen from 107 pips in February to over 180 today. Key psychological support levels for both pairs sit at 130.00 and 145.00 respectively.

Sterling has so far continued to hold up but is becoming increasingly more volatile. The daily average true range (ATR) for GBPUSD has risen from 87 pips a month ago to 150 pips today and GBPJPY daily volatility has risen from 107 pips in February to over 180 today. Key psychological support levels for both pairs sit at 130.00 and 145.00 respectively.

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.