FX News Today

- Bund yields slightly higher in opening trade after cautious session on Asian stock markets.

- EU hands UK another 2 weeks to avoid no-deal Brexit, eyes May 22 exit if deal passes, otherwise PM May must come up with a Plan B. If the deal gets through, an extension until May 22 has already been backed by the EU-27.

- Japan’s nationwide core CPI undershot expectations at 0.7% y/y in February.

- The European calendar focuses on Eurozone prel. March Manufacturing PMI readings.

- Gold whipsawed back toward $1,300 by resurgent USD index near 96.5

- EURUSD corrected back under 1.1400.

- USDJPY up from 5-week low of 110.28.

- WTI crude has settled slightly below $60.0 after posting a fresh 4-month high at $60.39

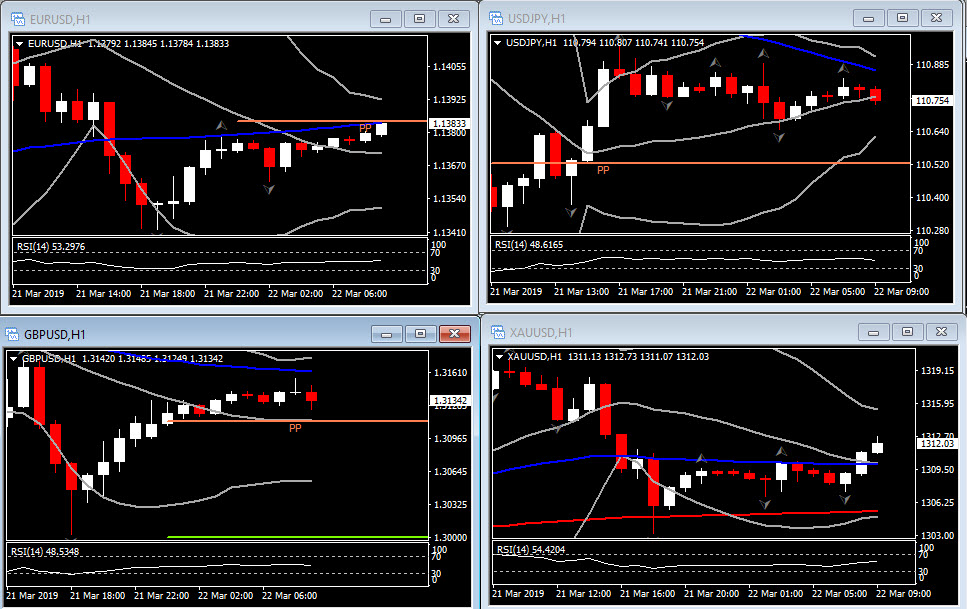

Charts of the Day

Technician’s Corner

- EURUSD is slightly below Pivot Point of the day and the 38.2% Fib from the week’s peak, at 1.1385. A decisive break could lead towards 1.1410 Resistance. However indicators are not supportive, as they remain negatively configured.

- GBPUSD topped at 1.3160, however the last 4 small body candles along with the latest doji candle suggest that upside movement might reach an end. Support at 1.3113 and 1.3000.

- USDJPY dropped further into London open, down to 110.70. Indicators retreated from neutral zone, with RSI looking lower. The next Support level is at 110.64, and 110.36.

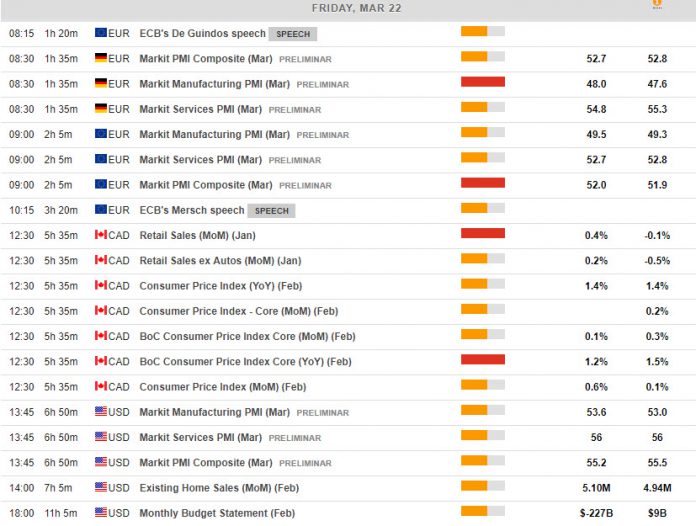

Main Macro Events Today

- Eurozone Manufacturing PMI – Eurozone Manufacturing PMI is expected to improve marginally to 49.5 from 49.3 and the services reading to ease slightly to a still strong 52.7 from 52.8, which should leave the composite slightly higher at 52.0, versus 51.9 in the previous month.

- Canadian CPI – The CPI is expected to climb 0.5% in February (m/m, nsa) after the 0.1% rise in January, boosted by stronger gasoline prices and seasonal strength in February’s CPI.

- Canadian Retail Sales – The Retail sales are anticipated at 0.3% in January after the 0.1% dip in December.

- US Home Sales – Sales are estimated to grow 0.6% following a 1.0% December decline. The I/S(Inventory to Sales) ratio should edge down to 1.32, from 1.33.

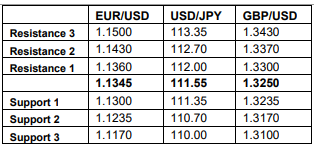

Support and Resistance

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.