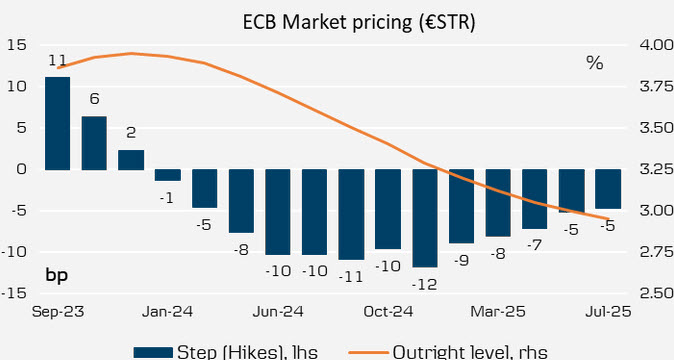

We woke up to the news that the money markets are now pricing in a full 25 bps hike in the rate by the ECB by the end of the year. We are talking here about OTC swaps (EONIA) and for now – as the futures market is not open at the time of writing – we cannot be more specific about the month the markets are pricing in, but it is most likely December. We can, however, show you yesterday’s situation, where the derivatives market was pricing in a total of 66 bps down for 2024, with a return to the CURRENT deposit rate (3.75%, not the official 4.25%) only in June, and the year closing – according to current expectations – at 3.50% (also on the deposit rate). In short, in 15 months from now the ECB rate is expected to fall by 0.25%. Not a lot. Higher for Longer.

There is a slight chance of a hike at next week’s meeting: odds stand at 40% which indicates that such a move would be perceived as a surprise leading to a decent short term rise in the EUR. Lagarde and company don’t seem to have any interest in providing such a surprise at the moment because despite sticky core inflation, other economic indicators are quite negative. Perhaps they will try to play on other factors such as the premature end of the extraordinary quantitative easing programme PEPP or the change in minimum reserve margins required from the banking sector. For now, let’s focus on the EURUSD.

TECHNICAL ANALYSIS

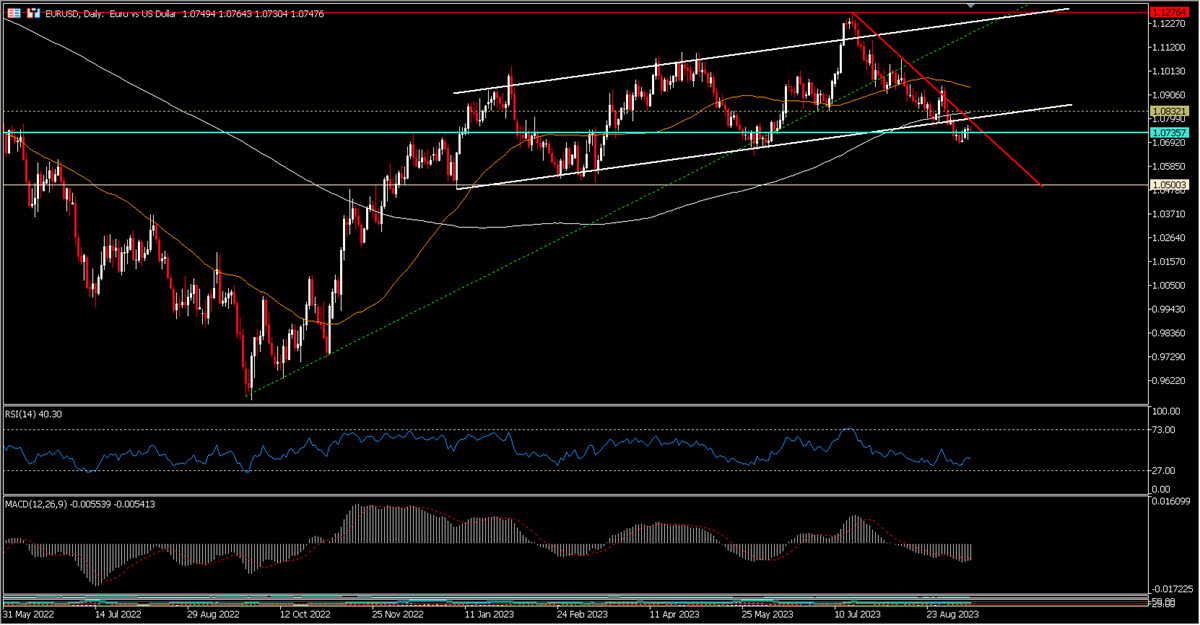

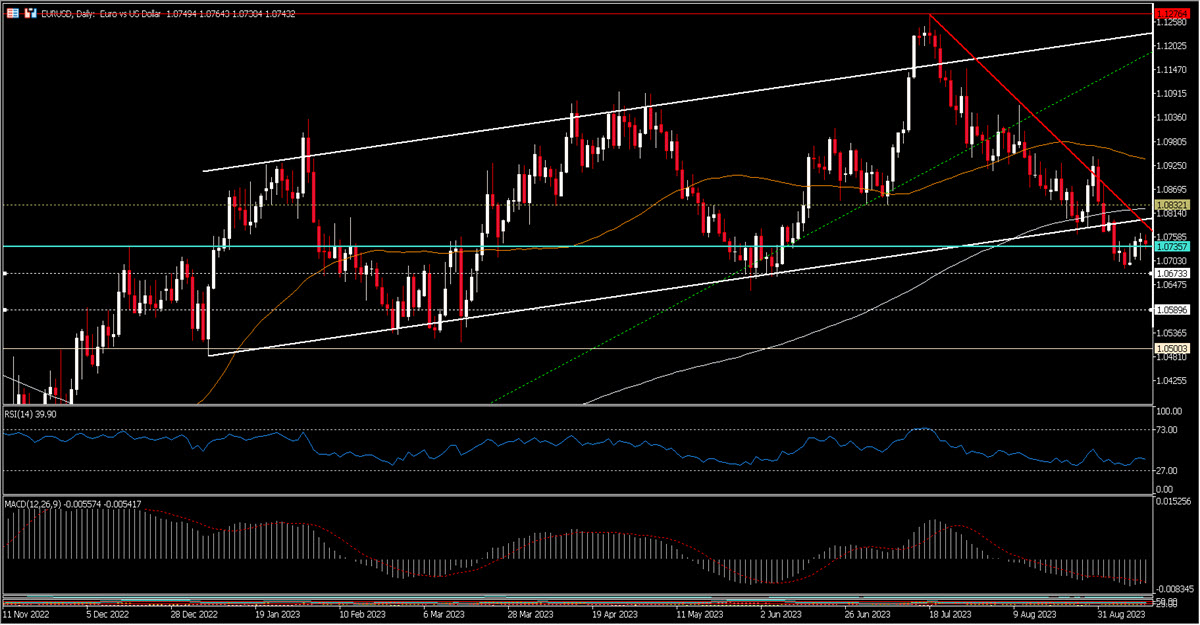

The technical situation of the EURUSD has deteriorated consistently in the space of a couple of months, from 1.1275 touched on 18/07 to the current 1.0746 (-4.69%): indeed, this pair looks worse off than the Cable we analysed yesterday, being clearly below the two long-term moving averages we are used to using (50d and 200d) and also below the slightly bullish channel that has guided prices since the beginning of the year (but still within the margin of error).

The 1.0735 area is very important and strong, having been the base (support) in the post covid period, from January to May 2020, before a rally in the 1.2270 area. But it was definitely a different economic context. We get at the week before the ECB also very close to the downtrend of the last 2 months, which now passes through 1.0845. Given also the normal persistence of currency trends, we tend towards a continuation of the bearish movement in the short term (at least until next week’s meeting), with supports in the area of 1.0675 and then 1.0590. 1.05 is also a very strong area.

What will happen on the day of the meeting is a binary outcome and a possible surprise from the ECB will give short term wings to the EURUSD and probably lead it to test the bearish red line. But let’s not forget that at the moment the long-term expectations between the US and European central banks do not differ that much (close to the end of the tightening cycle) and therefore other motivations will probably explain the future movement of this fundamental pair.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.