Another soft inflation report in the way of PPI further fueled expectations the FOMC will be done hiking rates after the upcoming 25 bp increase on July 26. That view further fueled the rallies on bonds and stocks, while knocking the USD sharply lower. The bull curve steepened to -86 bps from -89 bps previously. Wall Street climbed on the Fed view, the drop in yields and on strong earnings news from Delta and PepsiCo. Bitcoin surged on Friday morning in Asia to breach the $31,000 resistance level, after Ripple Labs achieved a partial victory in its three-year lawsuit against the US Securities and Exchange Commission (SEC).

- FX – The USDIndex continued to tumble, falling below the 100 level to test 99.24, the weakest since spring 2022. It looks like bearish momentum will continue to pressure as the softening in inflation and the less hawkish Fed outlooks weigh.

- EURUSD has rallied further, climbing to 1.1242, and GBPUSD jumped to 1.3140. Yen has benefited only marginally with USDJPY dipping to 137.24.

- Stocks – The US100 surged 1.58% to hit 15,729 with the US500 up 0.85% to 4542, while the US30 edged up 0.14%. #Pepsico +2.38%, Amazon +2.68%, CRM +1.36% and Tesla +2.17%.

- Commodities – USOil spiked to 77.06. Speculation that the Fed is close to peak rates and fresh optimism that China will step up support measures have boosted confidence in the demand outlook. Meanwhile supply constraints are starting to bite amid signs that Russia is finally making good on its output cut announcement. Vessel tracking data showed shipments through Russia’s western ports falling substantially in the four weeks to July 9. The EIA meanwhile said the global market is expected to tighten in the second half of the year.

- Gold – holds steady above $1950.

Today – Michigan Sentiment Index and European Commission releases Economic Growth Forecasts.

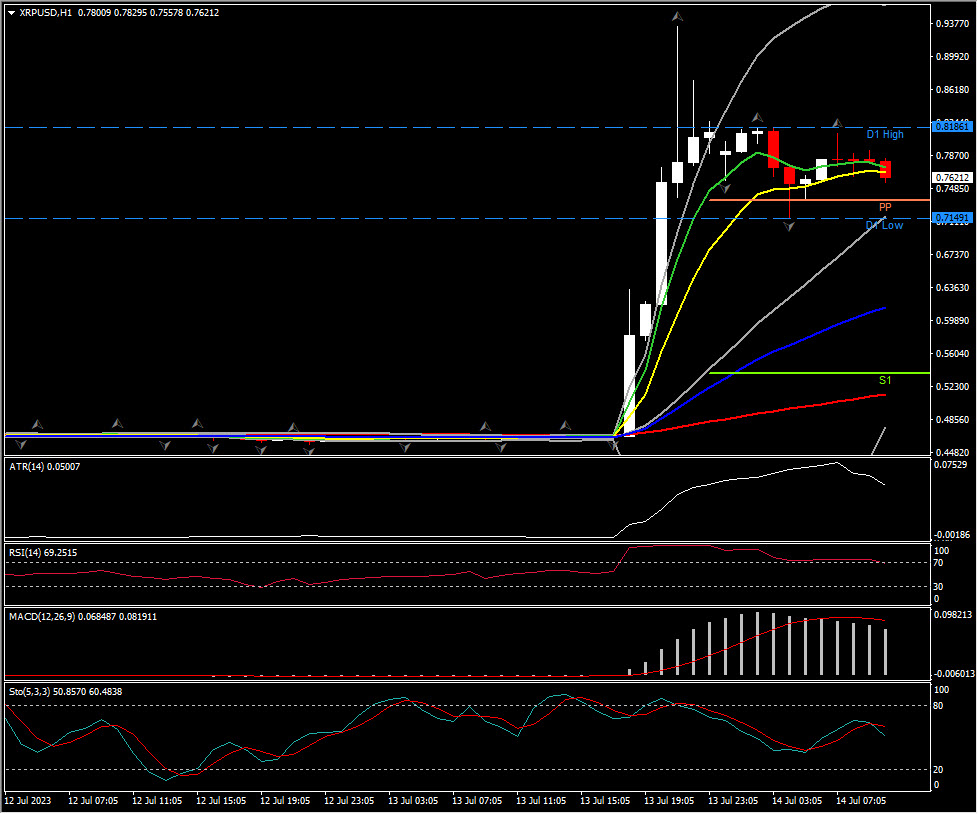

Biggest Mover @ (06:30 GMT) XRPUSD (+75%) rallied to 0.9334.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.