In recent years, gold prices have fluctuated dramatically in the global market, often attracting the interest of investors and speculators. Variables that impact gold prices include inflation, central bank monetary policy and geopolitical threats or recessions. It is important to remember that high interest rates drive up the cost of credit, which can deter investors from purchasing assets such as gold that do not generate current income or interest.

Indeed, gold is often seen as a hedge against inflation. When the value of money decreases, the price of goods and services increases, in turn increasing the attractiveness of gold as a store of value. However, in the event of disinflation, the incentive to invest in gold will of course diminish. Gold may come under pressure, if inflation declines, especially if interest rates continue to rise.

Under such conditions, investments that offer fixed returns, such as bonds or bank deposits, theoretically become more attractive. Therefore, we can anticipate that gold prices may come under pressure in a high interest rate environment. And the prospect of further interest rate hikes is still high, both in the US and in Europe. The predicted interest rate for the Eurozone is currently close to 4%, while for the Fed it is 5.40%.

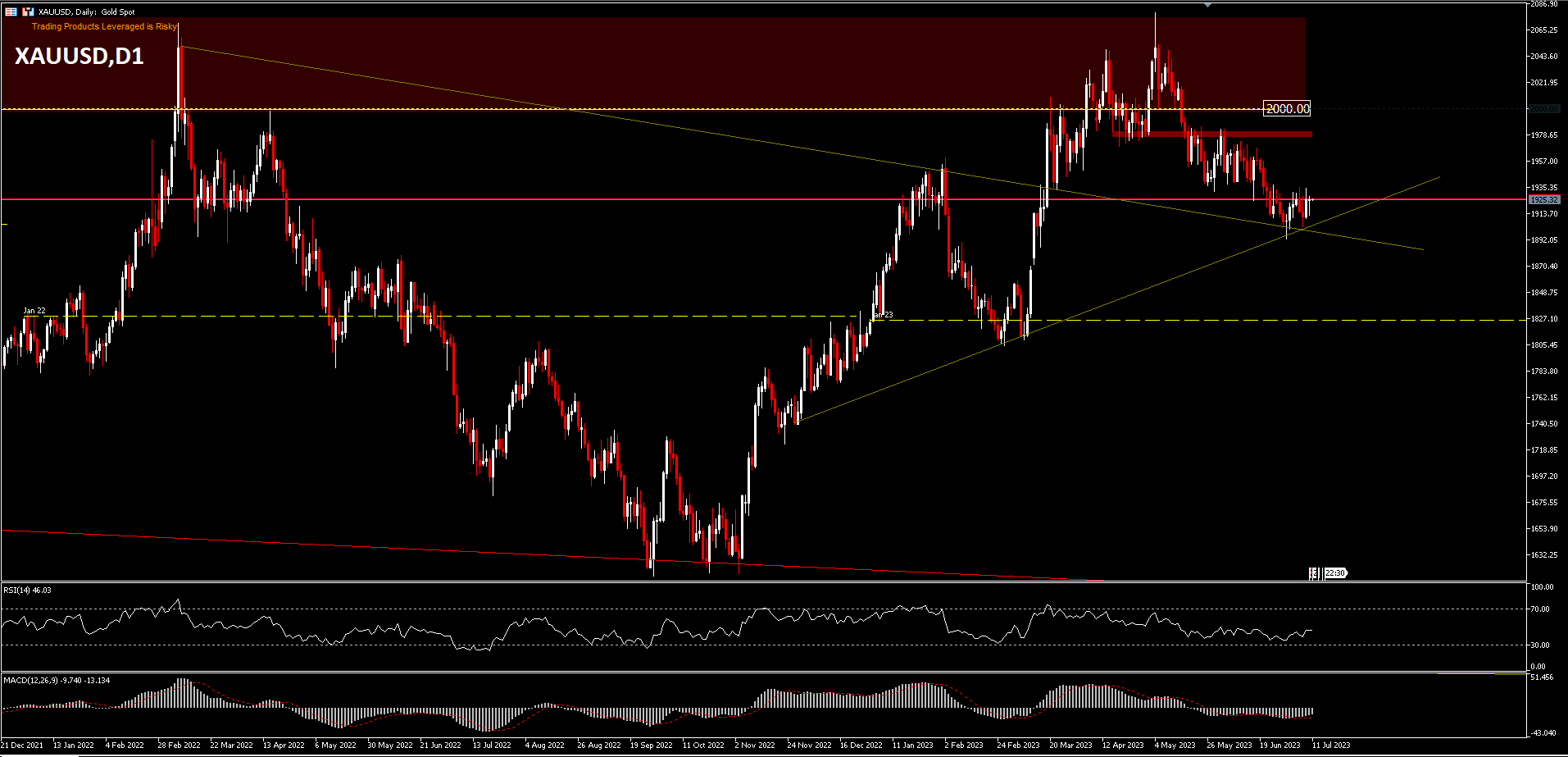

If you look at the XAUUSD chart, the bounce around the $2000 level has occurred three times which seems to have been the resistance level for the last three years. It could be that this level is a significant stronghold, as the price has never been able to permanently rise above that mark, whether due to pandemics, wars, or the heat of inflation. Gold prices may not correct below the $1600 level until the end of the year, but gold could repeat past patterns if additional factors present, such as an unexpected recession or peace, or lower geo-political tensions. And still the main trigger for gold’s superiority could start with USD weakness, lower interest rates, or a recession that is favourable for gold.

Meanwhile, in Monday’s trading (10/07), gold prices fluctuated slightly around $1920, as investors balanced the possibility of additional monetary tightening against concerns about a slowdown in the world economy. Weak performance in Chinese producer and consumer prices contributed to warnings of a stuttering recovery and the growing threat of deflation. The mixed payroll report from the US showed that job growth slowed, but wages grew strongly and the unemployment rate declined.

It is anticipated that the upcoming US CPI report on Wednesday will provide a further update on inflationary pressures. Although there are questions regarding the need for additional rate hikes beyond July, traders expect the Federal Reserve to raise the funds rate by 25 basis points this month with a probability of around 92%. It is anticipated that other important central banks such as the BOE, ECB and BOC will continue to tighten their policies.

In other news, more countries are repatriating gold reserves in anticipation of the impact of sanctions imposed by the West on Russia, according to an Invesco survey of central banks and sovereign wealth funds. Last year’s financial market turmoil caused monetary and fiscal authorities to rethink their strategies, amid the reality of higher inflation and persistent geopolitical tensions. More than 85 per cent of the 85 sovereign wealth funds and 57 central banks that took part in the Invesco Study believe inflation will now be higher in the coming decade. Gold and emerging market bonds are seen as good instruments. However, the West’s freezing of almost half of Russia’s $640bn gold and foreign exchange reserves appears to have triggered a shift.

Geopolitical concerns, combined with opportunities in emerging markets, also prompted some central banks to diversify over the dollar. There was a seven per cent rise in respondents who believe the rise in US debt is also negative for the dollar, although most still see no alternative to it as the world’s reserve currency.

Nearly 80 per cent of the 142 institutions surveyed saw geopolitical tensions as the biggest risk over the next decade, while 83 per cent cited inflation as a concern over the next 12 months.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.