Eurozone stock markets are slightly higher, US futures outperforming as officials promote their debt ceiling deal to secure sufficient support to pass the vote in Congress, while Asian markets closed narrowly mixed. Most Asian equities declined today ahead of the deal vote but also due to the concerns regarding China’s outlook and rising tensions with the US, after Beijing declined the Pentagon’s request for a meeting between US Defense Secretary Lloyd Austin and China’s Defense Minister Li Shangfu at a security forum in Singapore in June. Russia launched a wave of air strikes on Kyiv today, while in Moscow videos shared on social media showed drones flying low over the Russian capital. Treasury yields declined across the curve on debt dated from 5 years to 30 years.

Meanwhile as investors had started to price in a US debt deal on Friday, confirmation of the agreement should have a limited impact.

- FX – USDIndex has moved up to 104.48 as confidence in the debt ceiling deal strengthens. EUR dips to 1.0677, JPY retests 140.92 for a 2nd day in a row and Cable is still within its range at 1.2325 lows.

- Stocks – Hang Seng dropped as much as 1% today , marking the fifth day of declines and taking its losses from the Jan. 27 peak to about 20%. JPN225 closed 0.3% higher, CAC 40 is up at 0.1%, the DAX is up at 0.2%, US500 and US100 rose 0.3% and 0.4%, respectively. Nvidia +2.54% and Tesla +4.72%.

- Commodities – USOil returned to 72.10 as the market’s risk-on sentiment cooled slightly and mixed messages from major producers clouded the supply outlook ahead of their meeting over the weekend.

- Gold – extended lower to $1933, leaving the doors open for a potential move to $1920 and $1900.

- Cryptocurrencies – BTC held yesterday’s gains above $27530.

Today – Fedspeak will remain heavy before the upcoming blackout period. Barkin speaks on policy and the economy. We also have Eurozone economic confidence, US consumer confidence, home prices, the US House vote on the deal and the May reading of China’s manufacturing PMIs.

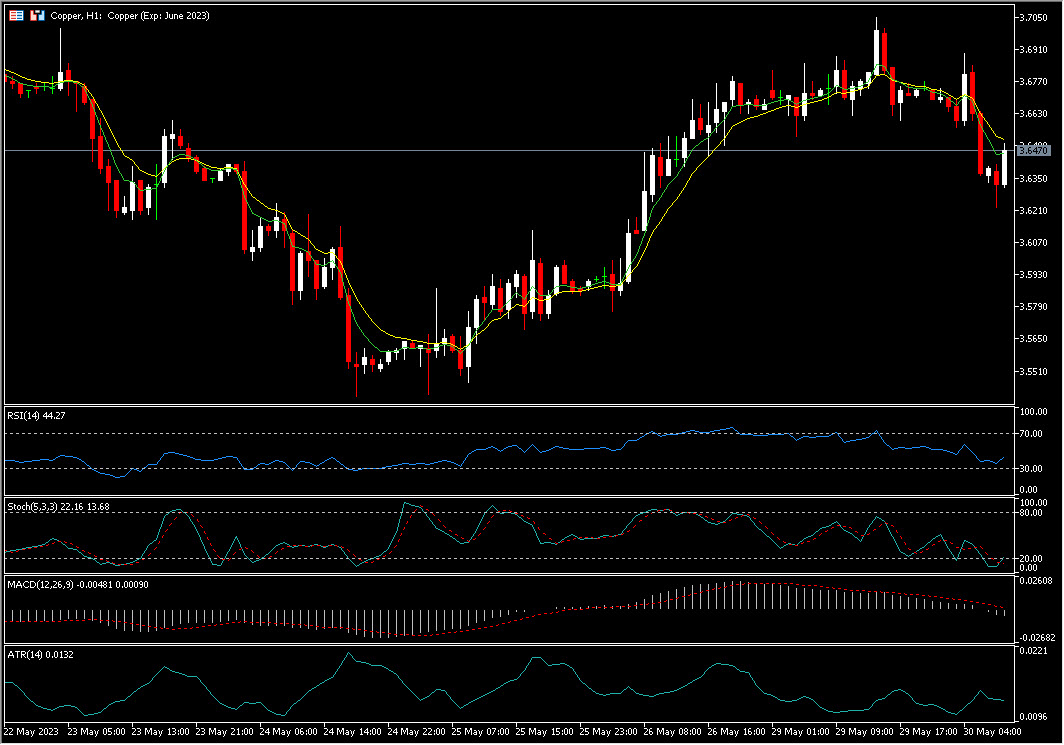

Biggest FX Mover @ (06:30 GMT) Copper (-0.60%) pullback to 3.6210. MAs flattened, MACD histogram & signal line are close to 0, RSI 42.67 & falling, H1 ATR 0.0129, Daily ATR 0.0899.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.