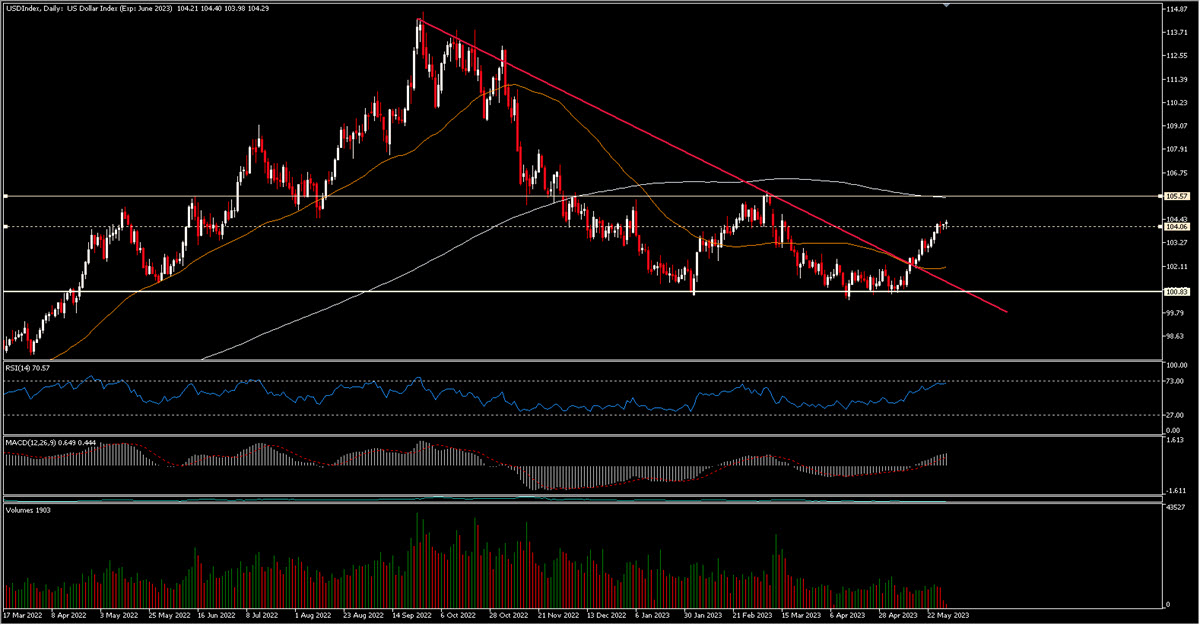

About two weeks ago in this post we considered the hypothesis that the USD was about to temporarily end its downtrend that began last autumn:today we will see how it is doing by focusing on the most important pair, which weighs 57.6% of the USD Index basket: the EURUSD.

Over the next 3 days there will be a lot of data from the Eurozone on inflation, consumer sentiment, and various GDPs; in 2 weeks’ time (15/06) it will be the ECB’s turn again. But today we will focus only on technical analysis and charts.

Technical Analysis

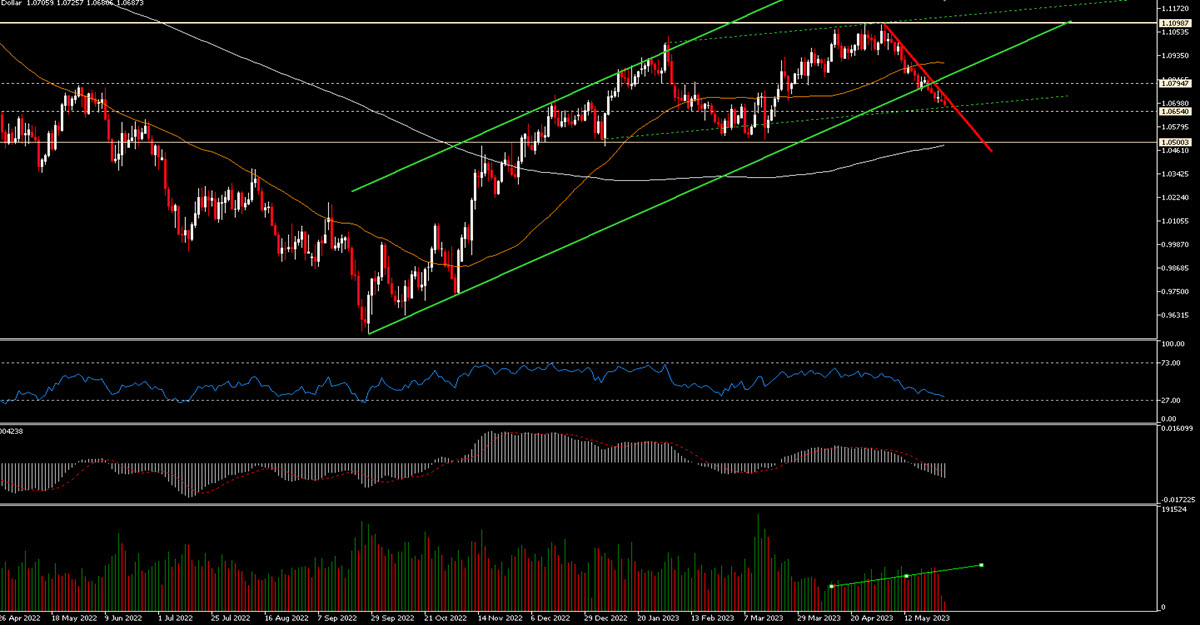

In the long term weekly chart, we can clearly see the importance of 1.105 /1.11 upwards and even more so of 1.05 downwards, levels that have shown their importance from 2014 onwards. Technically, this latter one looks really strong.

EurUsd, weekly

On the daily chart we can see that having reached 1.11, the downward phase began: this also broke the bullish channel in light green, indicating at least a slowdown in the appreciation of the pair. We tried to draw the hypothesis of a bullish sideways consolidation phase (dark green dashed channel) and we will see if the price will move within it. What is certain are the static levels: 1.08, 1.05 and in between 1.0650, among all the least ”clean” level. The bearishness is very clear at the moment and you should take into account how relentless the FX movements tends to be; it is also interesting that the move -on this descent from 1.11 to 1.06875- is on the back of increasing volumes although lower than those recorded until March. RSI is negative without being oversold, MACD is negative, ATR (10) daily is coming down to 55 pips, the lowest ”realised volatility” since 2021.

On the daily chart we can see that having reached 1.11, the downward phase began: this also broke the bullish channel in light green, indicating at least a slowdown in the appreciation of the pair. We tried to draw the hypothesis of a bullish sideways consolidation phase (dark green dashed channel) and we will see if the price will move within it. What is certain are the static levels: 1.08, 1.05 and in between 1.0650, among all the least ”clean” level. The bearishness is very clear at the moment and you should take into account how relentless the FX movements tends to be; it is also interesting that the move -on this descent from 1.11 to 1.06875- is on the back of increasing volumes although lower than those recorded until March. RSI is negative without being oversold, MACD is negative, ATR (10) daily is coming down to 55 pips, the lowest ”realised volatility” since 2021.

EURUSD, daily

Finally the downward movement could continue in the coming hours with an important first target at 1.0650 and then the next supports about every 50 pips at 1.0600, 1.0550; finally, the pivotal 1.05. This is a really strong support and the MA 200 will pass close to that level as well.

In short, fighting the trend is not a good option and it is important to wait for the reaction at certain levels, without anticipating it. Comparing to the broader USD Index, 1.05 would correspond to about 105.57, which is resistance on that chart while the Index’s RSI (14) is already printing 70.72.

USD Index, Daily

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.