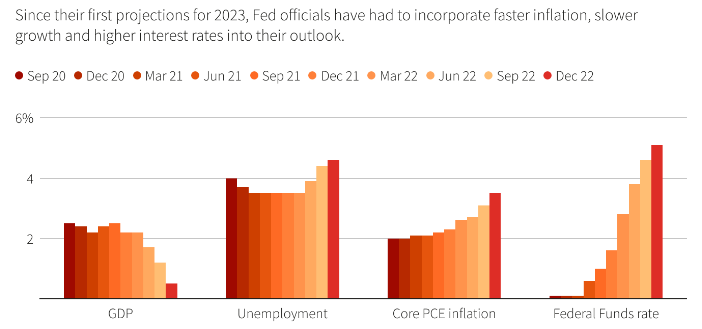

Not a good week again for the stock market, notably after FOMC and Fed Chair Powell’s speech. The Fed officials insisted on ‘higher rates for longer run’ in battling inflation, possibly above 5% next year, a level not seen since 2007. According to the central bank’s summary of economic projections for 2023, core PCE inflation is expected to remain above 3%, unemployment shall rise to 4.6%, while GDP is projected to undergo a slump towards 0.5%.

Fig.1: Fed’s Projection for 2023. Source: Reuters

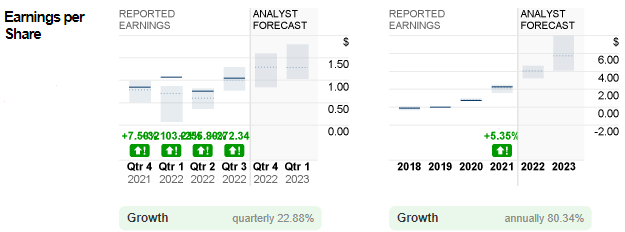

At market close, USA500 ended below November’s closing price, at 3844. Among the listed companies, the electric car conglomerate – Tesla Inc. suffered its worst weekly loss since March 2020, by over -13%.

Fig.2: Stock Heatmap. Source: TradingView

The heavy selling of the company stock is led by the increasing pessimistic global economy outlook, plus the ongoing Twitter-related affairs that Elon Musk had to deal with. Recent news reported that Twitter had suspended a group of local journalists’ accounts for sharing Musk’s “live location information”. The action has drawn criticism for jeopardizing press freedom, and could “violate the spirit of the First Amendment and the principle that social media platforms will allow the unfiltered distribution of information that is already in the public square”.

Following acquisition of the social media platform, to being de-listed and going private, there is still much to be done for Musk in tweaking the platform’s content rules, finances and its priorities – this could most likely shift some of his attention from Tesla. Also, raising funds for the struggling Twitter could be another issue. There is still $13B in debt financing + interest that has to be paid. Investors are worried that a fund raising that is not going well could prompt the billionaire to sell his Tesla stocks again. It was reported last week that 22 million Tesla shares worth approximately $3.6B were being sold by Musk.

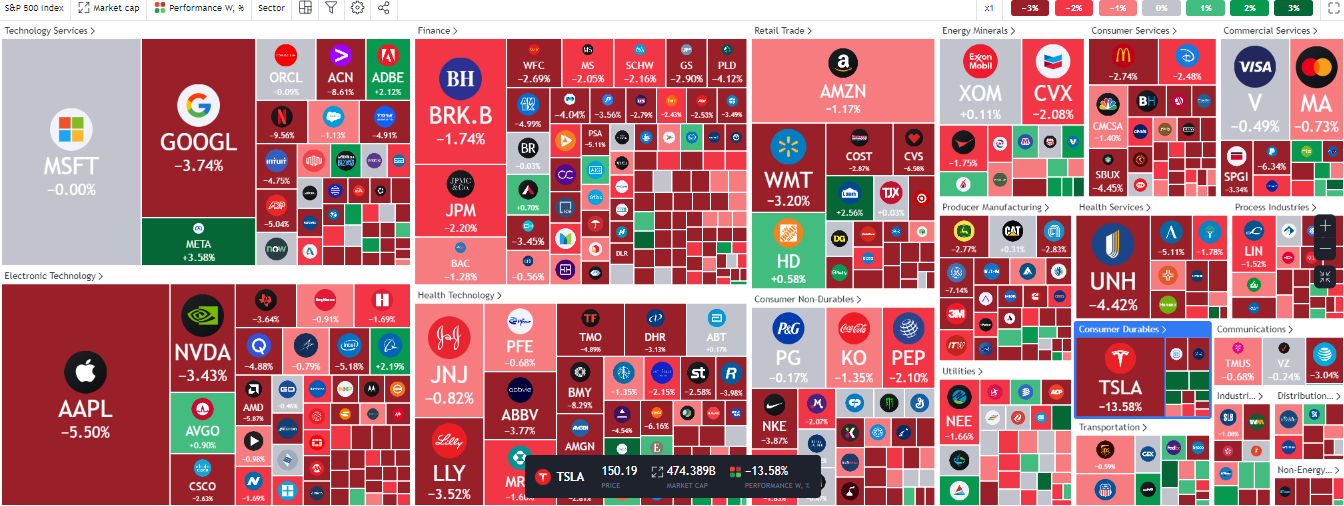

Fig.3: Reported Sales of Tesla versus Analyst Forecast. Source CNN Business

Fig.3: Reported Sales of Tesla versus Analyst Forecast. Source CNN Business

In Q3 2022, Tesla’s sales revenue slightly missed consensus estimates, at $21.5B (versus $22B), as the automaker had vehicles ended in transit which adversely affected profits. Nevertheless, its sales revenue has jumped 27% (q/q) and 15% (y/y) respectively.

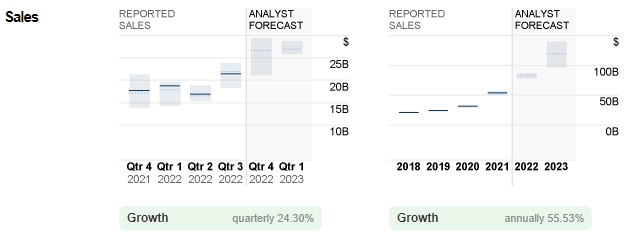

Fig.4: Reported EPS of Tesla versus Analyst Forecast. Source: CNN Business

On the other hand, EPS was in line with analysts’ expectations, at $1.05. Tesla Inc. shall report its Q4 2022 financial results on 25th January. Consensus estimates for sales hit $26.7B, whereas EPS is expected to reach $1.29. This would bring the overall sales and EPS for 2022 to $83.7B and $4.08, respectively. In 2021, reported sales were $53.8B, whereas EPS were $2.26.

Technical Analysis:

Pressured under a strong bearish trend, Tesla share price currently traded around $150, a level not seen since November 2020. Further sell-off could bring the asset price to test psychological level $100 and June 2020 low at $95, followed by next support zone $52- $56 (March/April 2020 low). On the other hand, a technical rebound could bring the bulls towards the nearest resistance at $320, followed by $560 and the 100-week SMA.

Click here to access our Economic Calendar

Larince Zhang

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.