The US30 is the second oldest stock market index in the world. It is made up of 30 Wall Street reference companies, and is mainly composed of so-called “value” stocks that have been neglected for too long in favour of “growth” stocks, which have taken advantage of the enormous liquidity flows due to the Covid crisis. These same flows led to a rise in prices (inflation) which in turn led to a rate hike by the US Central Bank causing a market pivot in favour of the stocks that make up the US30 creating a huge rebound in the price which is currently around $33,681.

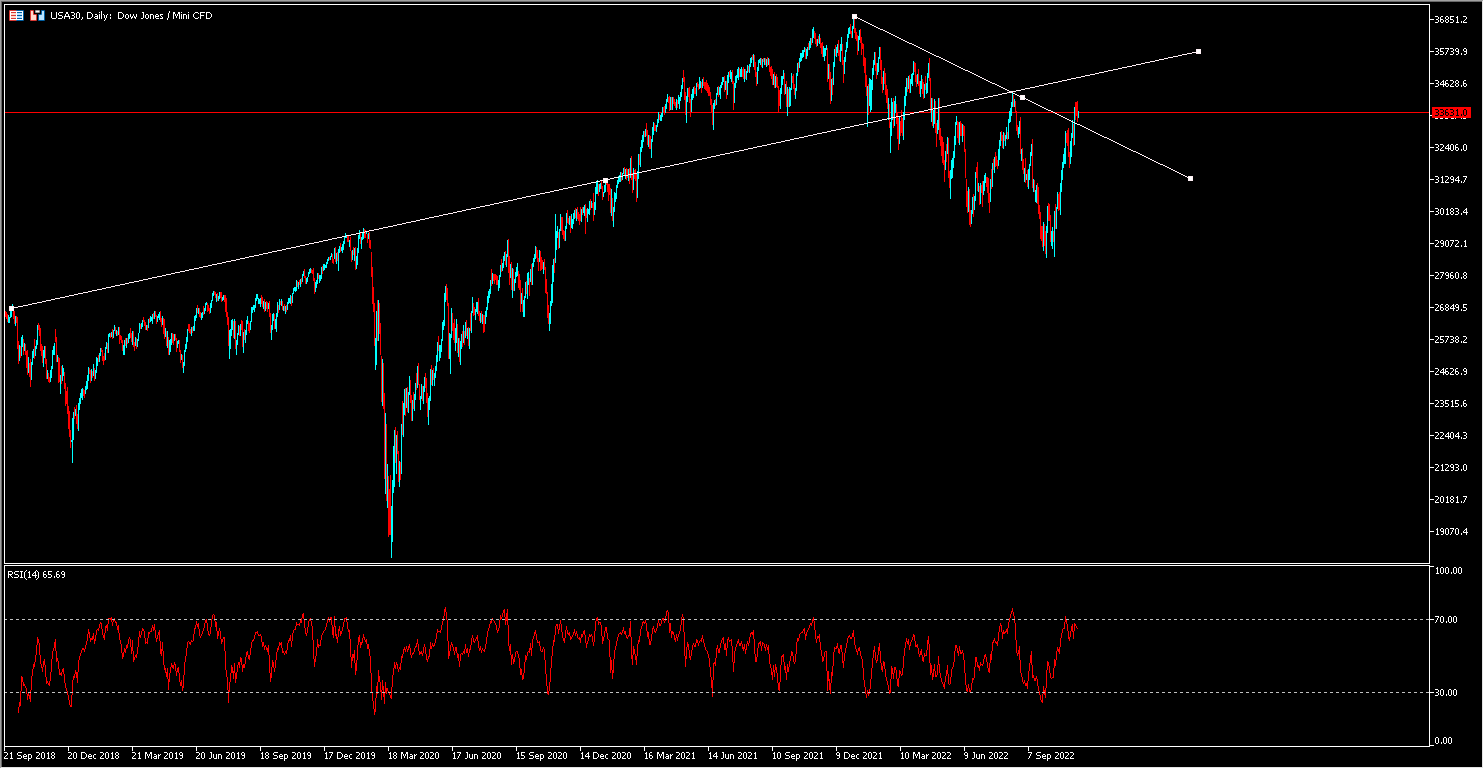

The US30 has managed to break above its downtrend line (see chart above) as market participants anticipated a less hawkish monetary policy and are now expecting interest rates to slow to 0.5 basis points by December. The Fed’s monetary policy seems to be having an effect, inflation in October fell to 7.7% year-on-year, yesterday’s Producer Price Index (PPI) figures also slowed to 0.2% in October.

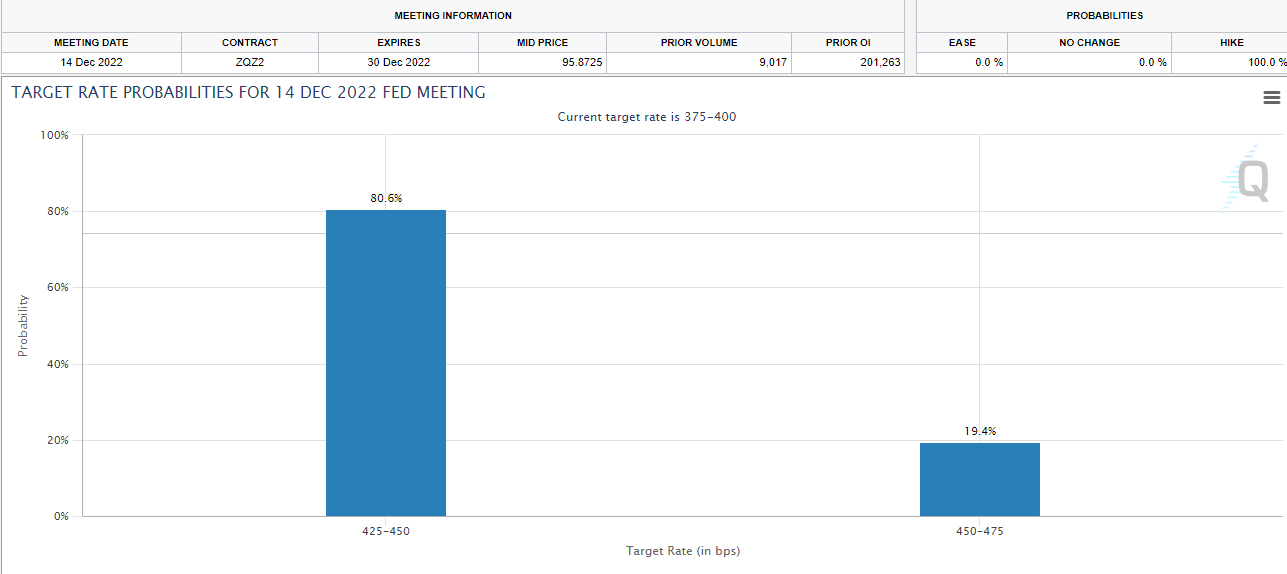

source: cmegroup

The decline in margins is a factor that economists and Fed members have anticipated, as supply chains have loosened, inventories have risen and demand has fallen, leading to fiercer price competition. Lael Brainard, Fed vice president said, “You would actually expect increased competitive pressure to start bringing those costs down” and then added “That’s a process you would expect at this point in the cycle. I’m certainly looking at that closely. And of course, it would contribute to disinflation.”

The question one might legitimately ask is whether the Dow, as well as the markets, have reacted in an excessive manner? A view that Fed Governor Chris Waller seems to have embraced, saying “The market seems to have gotten excited about this CPI report alone. Everyone should take a deep breath, calm down. We have a long way to go.” This is not the first time in the past year that inflation has fallen, he recalled, only to return. The rate is well above the 2% target.

Technical analysis

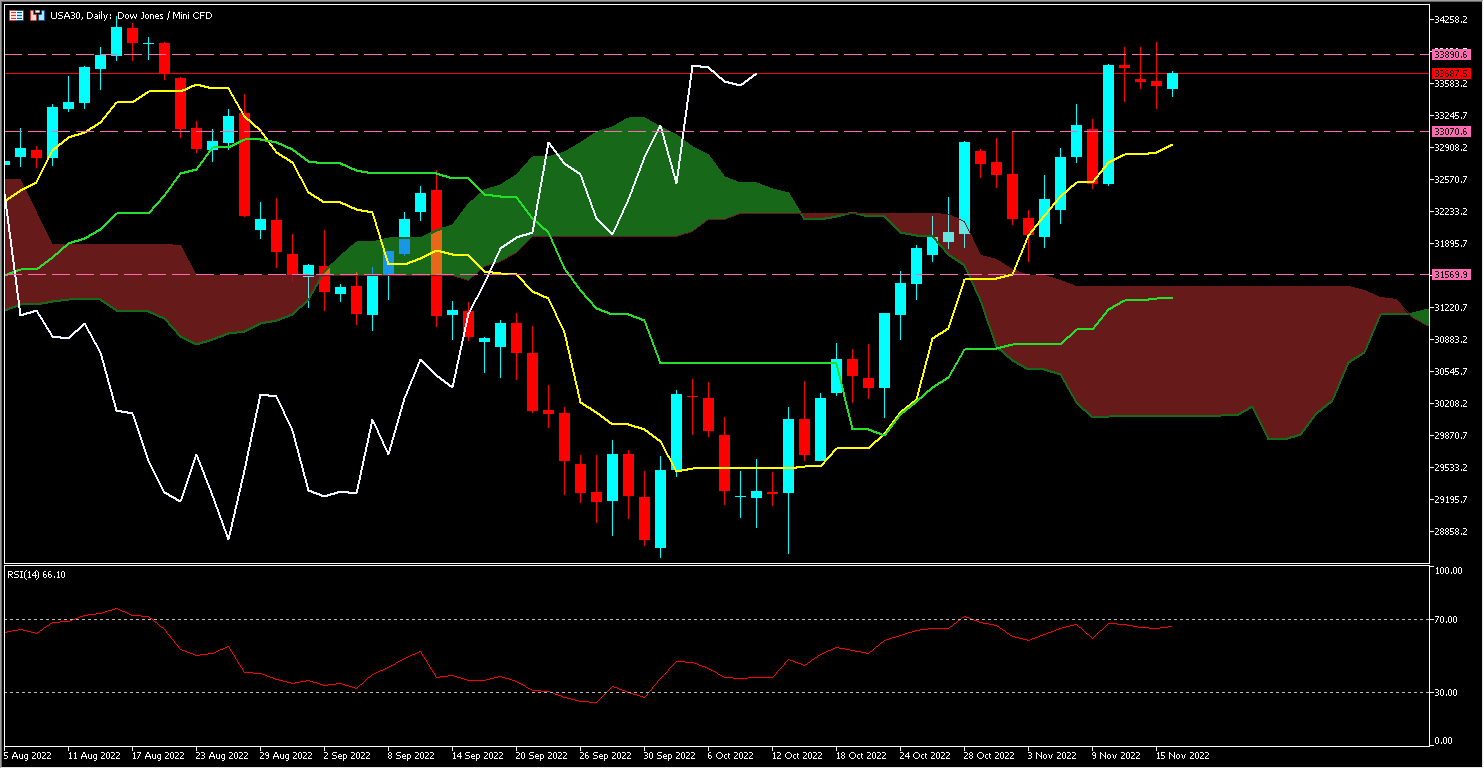

The US30 is currently at the $33,687 level above the cloud, its Kijun (Lv), its Tenkan (Lj) while the Lagging Span (Lb) is above the cloud as well as its countermark, clearly signifying a bullish momentum. If the price continues this movement, it could initially reach $33,890 and then $34,627, in the case of a trend reversal it could test the $33,070 support, if it breaks, it could then test $31,159.

Click here to access our Economic Calendar

Kader Djellouli

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.