European stock futures are marginally in the red and US futures are also slightly down after a largely weaker session in Asia, but sentiment in Europe should be bolstered at least to a certain extent by the vote on a no-deal Brexit in London late yesterday, with MPs now set to vote for a delay in the Brexit date tonight.

GBP surged to highs on the latest Brexit vote, which saw “Amendment A” adopted that rules out leaving the EU without a deal in any scenario. The vote split was close, at 312 to 308. GBP jumped to session highs with another vote on “Amendment F” pending and apparently Remainers are threatening to resign, causing the whips to have a major conference on the Commons floor to avoid an embarrassing exodus.

In the original vote, a resolution to leave the EU without a deal (specifically on March 29, but leaving the option for leaving without a deal in the future) was rejected by a majority of 43.

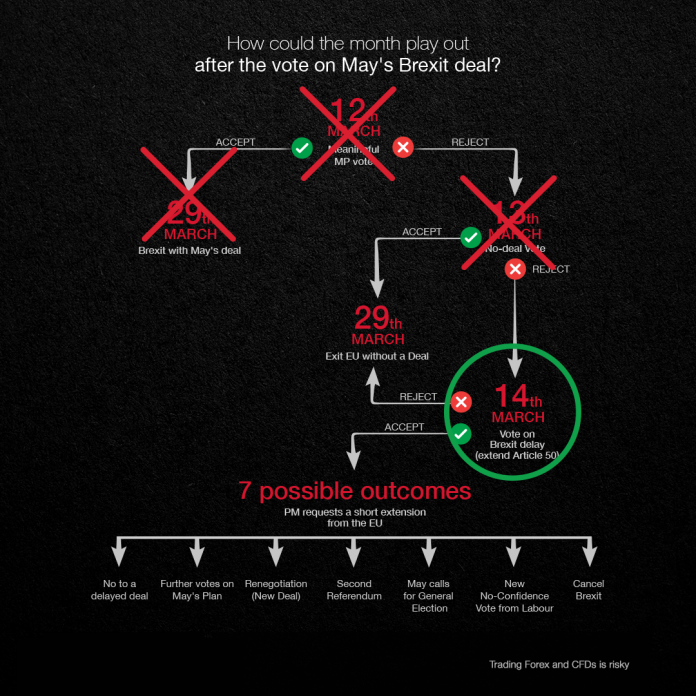

Neither the motion nor the resolution are legally binding, but demonstrates the power and intent Parliament has to take over the Brexit process. Parliament will today vote on delaying Brexit, which is expected to pass by a large majority. Amid the fast-paced developments, it’s become clear that at least 20 members of the ERG group in Prime Minister May’s Tory party (Eurosceptics, so-called Brexiteers) do not intend to vote for May’s Withdrawal Agreement unless there is a full concession from the EU on the Irish backstop.

This suggests that the twice failed Brexit deal would flop again in a third vote, with most pundits not expecting the EU to make the necessary concessions. The referendum option, at this juncture, doesn’t seem to have sufficient support. This shifts the odds more in favour of a long delayed (21 months) and “soft” Brexit deal, by cross-party consensus.

Cable stormed to a 9-month high to 1.3380 before correcting to and settling in the upper 1.3200s. The pair is still showing a 2.1% gain on the week, while Sterling is up by an averaged 5.1% against the Dollar, Euro and Yen on the year-to-date.

The next Resistance levels for Cable stands at 1.3380 (yesterday’s high), 1.3400 (50% Fib. level from 1.4450 downleg) and 1.3440 (June 10 high). Support levels come at 1.3240 (7-month Resistance converted to immediate Support), 1.3140 (61.8% Fib. expansion level) and 1.3050 (200-day EMA).

From the technical perspective the overall outlook remains positive, recording high volume, with RSI in an uptrend forming higher lows as the pair moves within the upper Bollinger band pattern.

All this still doesn’t remove the uncertainty for businesses, but it should at least remove the risk of an immediate cliff edge scenario.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.