The ante has been upped significantly after the Withdrawal Agreement was resoundingly rejected by the House of Commons yesterday evening in London. May’s Withdrawal Agreement was rejected by a large majority of 149 votes, an even larger defeat when MPs voted it down the first time around on January 29.

Donald Tusk’s spokesman responded with dismay, stating that the vote “has significantly increased the likelihood of a no-deal Brexit.”

Sterling briefly ticked up on the initial announcement and indeed, some feel that the hard core Brexiteers missed their chance yesterday and that with a majority of MPs likely to vote against a no-deal Brexit, a delay and possibly a referendum now look to be on the cards, with the ultimate result, maybe an even softer Brexit than May’s deal. Nothing is secured yet though and for now the default remains that the UK exits the EU at the end of the month, with or without a deal.

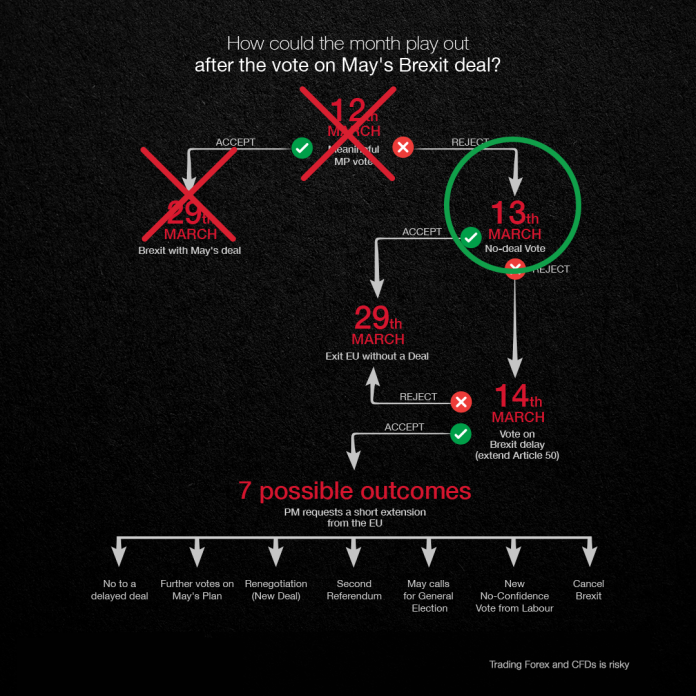

This week’s voting marathon is not over though.

Parliament will today vote on whether to exit EU without a deal, which is expected to be rejected by a large majority. The House will then vote, tomorrow, for delaying the Brexit process, which is expected to pass with a strong majority (a motion for delay in February won a 502 majority in the 650 seat House).

The delay question is also not straightforward however, as the EU and every member of the EU 27 will want to know what use any extension would be put to. Hence a credible justification is needed in order to agree to a delay. So the short one-off extension that May wants may not fly in Brussels.

It would only take one veto to rupture the delay, though member states have a self-interest incentive to acquiesce to a delay. The UK also has the power to unilaterally revoke Article 50, which would terminate Brexit.

Despite the blows that the UK Prime Minister has received, her position is secure as a confidence vote in her leadership can’t be tabled for another year (having recently survived one) while Labour’s machinations for a general election via a confidence vote on the government won’t likely fly as the Tory-DUP governing alliance has the votes to prevent it. Parliament is also in position to wrest control of Brexit given that there looks to be sufficient cross-party support for a soft version of Brexit, and, less assuredly, another referendum (although this may be starting to look attractive to members).

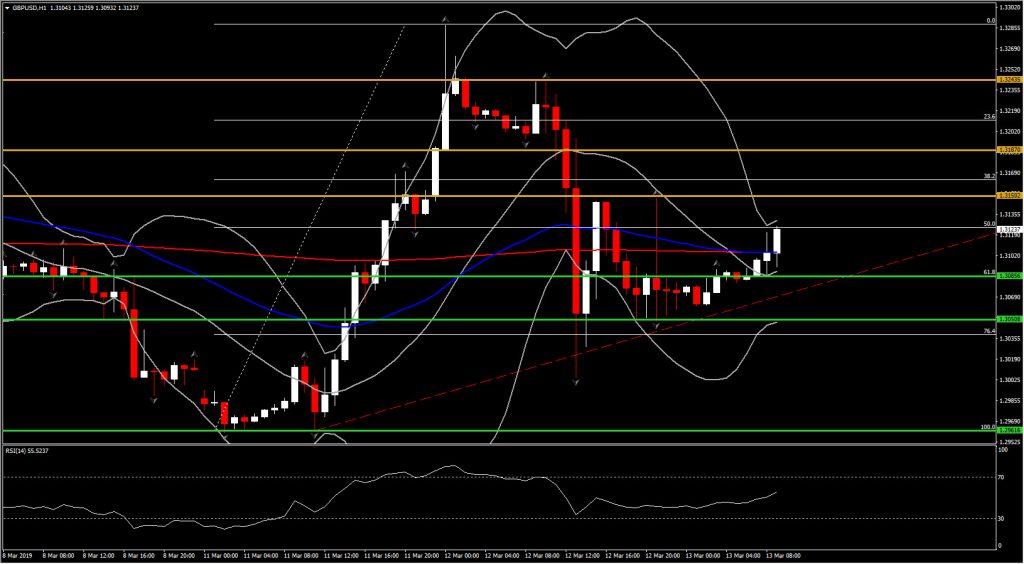

FX Update: Markets are more sanguine, with Sterling, which has been the conduit for market opinion on Brexit, trading about 30 pips firmer on the Dollar and about 20 pips higher versus the Euro from levels prevailing ahead of yesterday’s vote.

Away from Brexit, the Dollar has been trading softer in the wake of the benign US CPI data yesterday. EURUSD has been consolidating slightly off the four-session high seen at 1.1305. USDJPY has remained heavy, in the lower 111.0s, down about 0.5% from week-ago levels.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.