USDJPY edged out a fresh high, at 110.77, which is the loftiest level seen since Friday, in what has been directionally-limited trading in the forex and global equity markets so far today.

The MSCI Asia-Pacific (ex-Japan) stock index is fractionally lower, although near the four-month highs seen last Wednesday. Market participants are waiting for clarity on the US-China trade situation, with hopes generally high that the two sides will reach a compromise in this week’s round of discussions, which will commence today in Washington DC.

The optimism is reflected by the 6.6% rise in China’s Shanghai Composite equity index since the start of February. BoJ Governor Kuroda did his version of a dovish turn earlier, saying that if the Yen were to strengthen and was “having an impact on the economy and prices,” and if it was considered necessary to achieve the price target, “we’ll consider easing policy.” He said that this could be by cutting short- and long-term interest rates, and/or expanding asset buying. Given the undesirable effects long-term ZIRP has been having Kuroda was cautious, remarking that “we need to carefully balance the benefits and the costs of the step such as the impact on financial intermediation and market functioning.”

This sparked a dip in both the Yen and JGB yields, though the impact has been limited as this is pretty much consistent with ongoing policy, and was less noteworthy compared to the dovish turns at the ECB and, more specifically, the Fed.

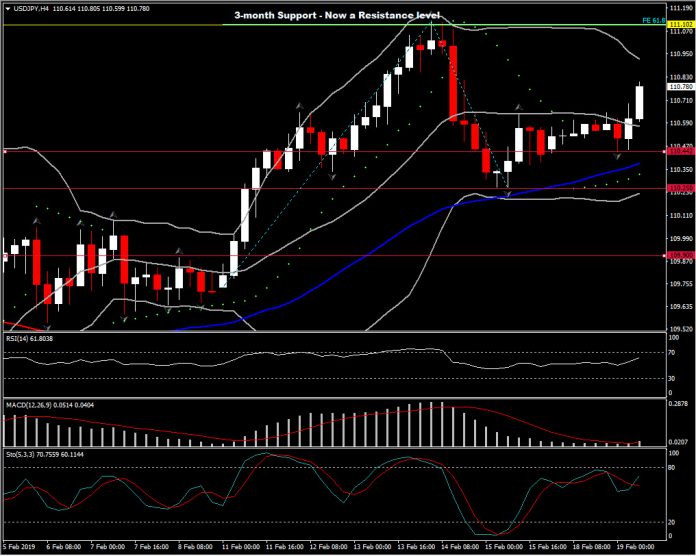

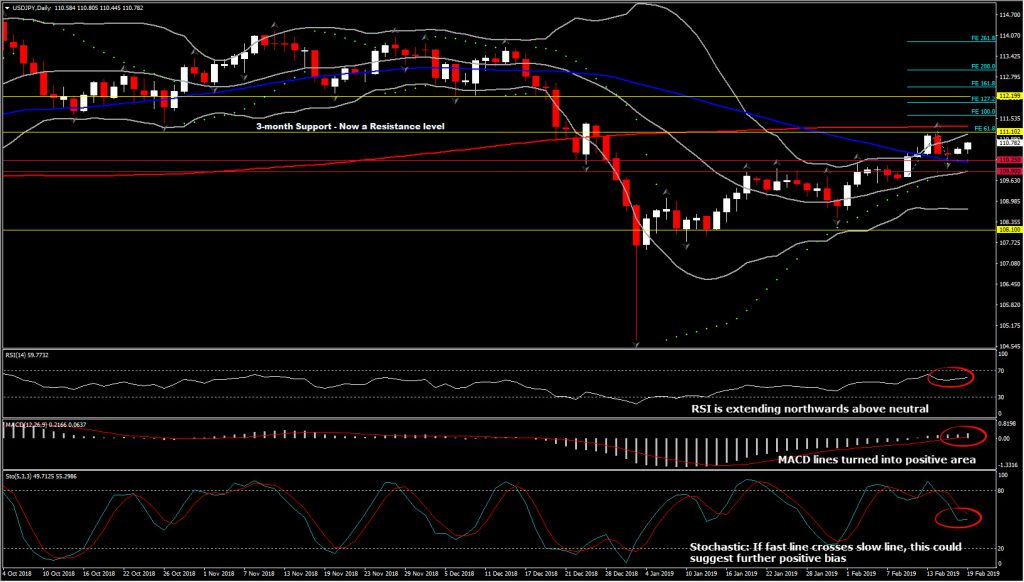

USDJPY recovered half of the losses, as seen on Thursday’s pull back, giving hopes for a move higher after last week’s correction. Hence the move away from 50-week SMA (110.53) and northwards of 20- and 50-day SMA, with Parabolic SAR being positive for 30 trading days, and RSI rising above 50, turns outlook to a bullish one, with next Resistance above 111.00. More precisely, Resistance is set at 110.10, which coincides with Thursday’s peak, 61.8 Fibonacci expansion and the daily upper Bollinger Band boundary. Immediate Support holds at 110.25 (last week’s low), while in the medium term Support is set at 109.90 (20-day SMA).

Further gains above 110.10 along with a move above 200-day SMA could retest 112.00 area ( November’s Support at 112.20 converted into Resistance).

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.