FX News Today

- 10-year Treasury yields are up 0.2 bp at 2.704% and JGB yields fell back -0.8 bp to -0.025% as the rally on stock markets faded.

- Wall Street still closed with slight gains, but there wasn’t enough momentum to sustain a further broad move higher in Asia.

- Topix and Nikkei closed little changed and the Hang Seng is down -0.26% while CSI 300 and Shanghai Comp are up 0.33% and 0.13% respectively, after Chinese data showed a rebound in exports at the start of the year.

- The tech hub of Shenzhen outperformed with a gain of 0.93%, but the ASX closed with a marginal loss.

- US futures as well as European futures are moving higher though, so there is still some life in markets after reports that the US is considering delaying China tariffs for 60 days. President Trump had already told reporters that trade talks are making good progress.

Charts of the Day

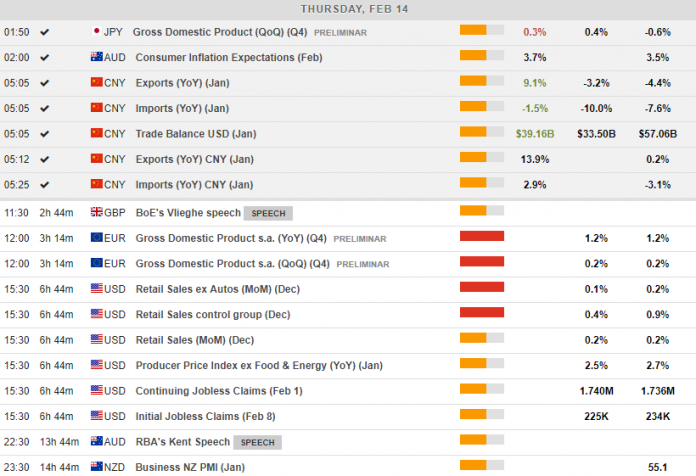

Main Macro Events Today

- EU GDP – The common currency’s GDP is expected to have grown by 1.2% y/y in the final quarter of the year, the same growth rate recorded in Q3.

- US Retail Sales – One of the most important indicators of consumption, Retail Sales ex Autos are expected to have grown by 0.1% m/m in December, compared to 0.2% m/m in November.

- US PPI Inflation – In accordance with the slowdown picture in the US, PPI inflation is expected to have slowed to 2.5% y/y in January, compared to 2.7% y/y in December.

- US Jobless Claims – Continuing Jobless Claims are expected to have increased to 1.74M on the week ending at January 8, compared to 1.736M last week. Initial Jobless Claims are expected to have decreased to 225K compared to 234K the previous week.

- Brexit Vote –Theresa May has put a new motion before Parliament asking to allow her to continue negotiating, in order to seek changes to the backstop.

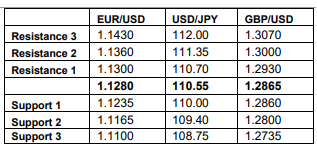

Support and Resistance

Click here to access the Economic Calendar

Dr Nektarios Michail

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.