Swiss under-performance continues following yesterday’s sudden short-lived drop, which might have been caused by the lack of liquidity. Today’s collapse however has come from US Dollar demand.

News that US lawmakers have reached an “agreement in principle” on border security that would avert another government shutdown at the end of the week has been tonic for USD, along with optimism about the US-Sino trade talks and the positive reports from Michelin underpinning sentiment. As SNB Chairman Jordan stated, the biggest concerns for 2019 are “political mistakes,” pointing to the US-China trade war and “Brexit and the European situation”.

These along with the evident slowing in the Eurozone economy have been a factor in making the US currency a relatively attractive proposition and safe-haven flows into the Dollar have been underway for the week. Nevertheless, there has been underperformance in the Swiss franc, often accompanied by talk/suspicions of SNB intervention since early January.

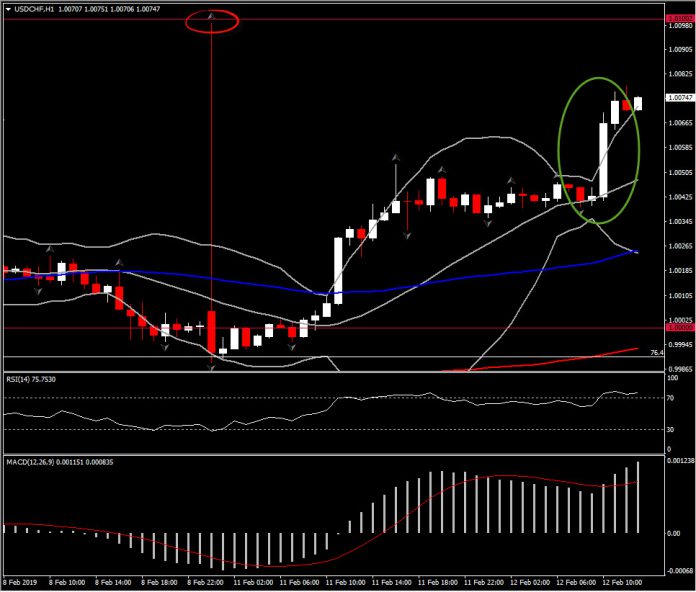

USDCHF rose to a near 13-week high of 1.0098. EURCHF has settled to a consolidation in the mid-to-high 1.1300s after printing a two-week low at 1.1310. The Dollar has entered a consolidation after a run of 8 consecutive up days by the measure of the narrow trade-weighted USD Index, which is the most sustained rally the index has seen in 2 years.

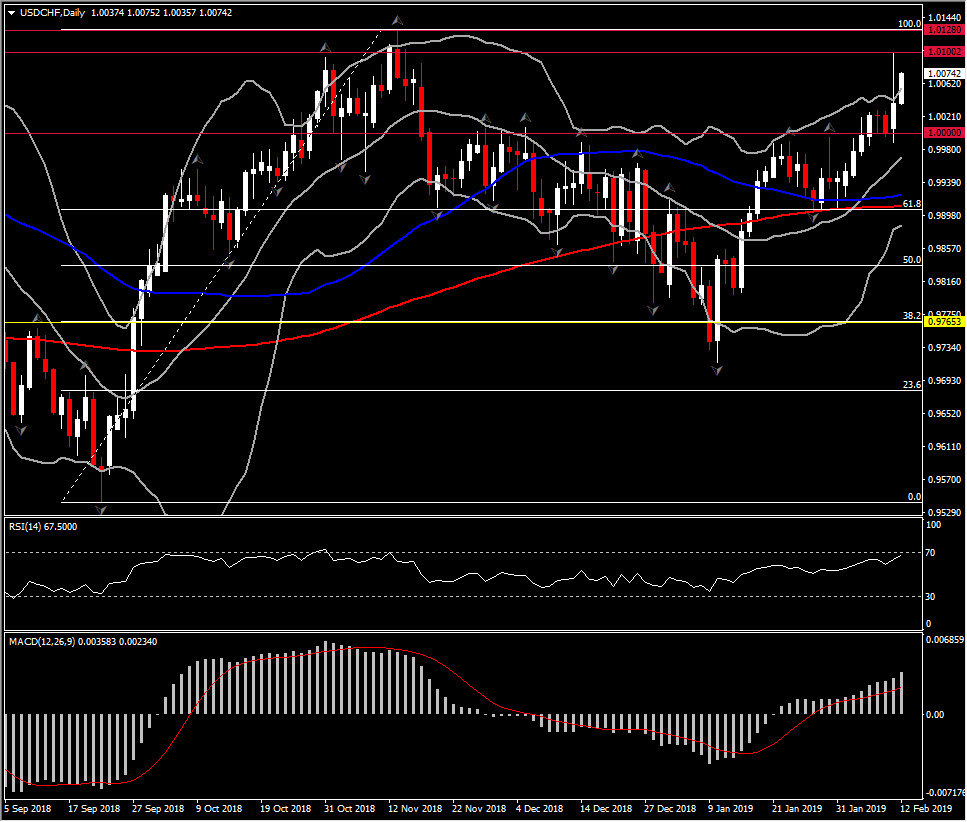

USDCHF has been in a consolidation mode since April 2018, within 0.9540-1.0128 range, with the 2019 rally reverting nearly all losses seen since November peak. The asset is trading above 1.000 level for a second day, reinforcing the possibility of a full retracement to 1.0128 high.

If on the breach of this level, momentum indicators continue to be configured positive, then this could open the doors towards the nearly 2-year’s peak, at 1.0169. Daily RSI is at 67, looking upside, while MACD oscillator formed a bullish cross last week and continues rising above signal line. Both suggest the strengthening of positive outlook for USDCHF, and therefore the depreciation of Swiss franc. Support holds at yesterday’s low (0.9988) and the round 1.0000 level.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.