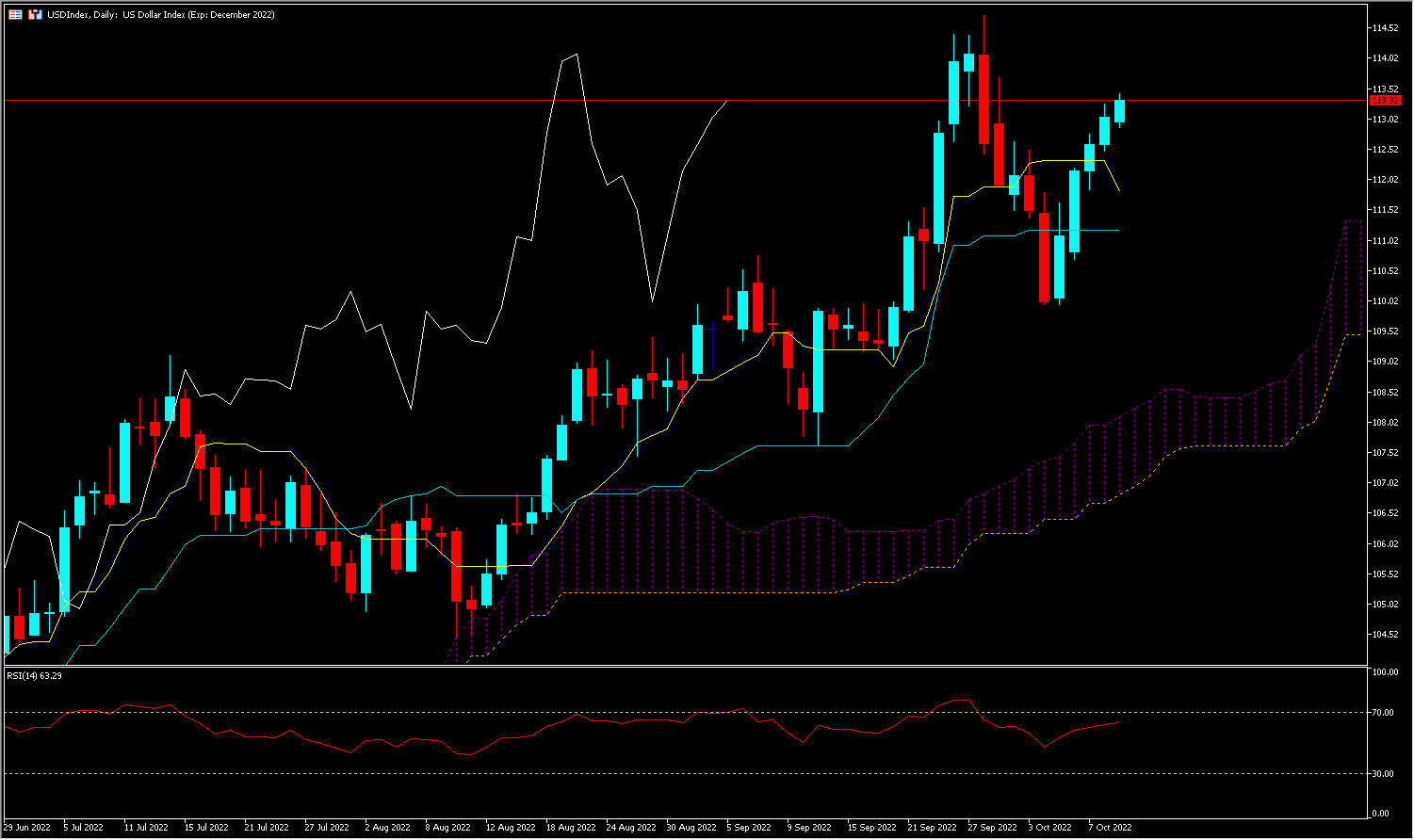

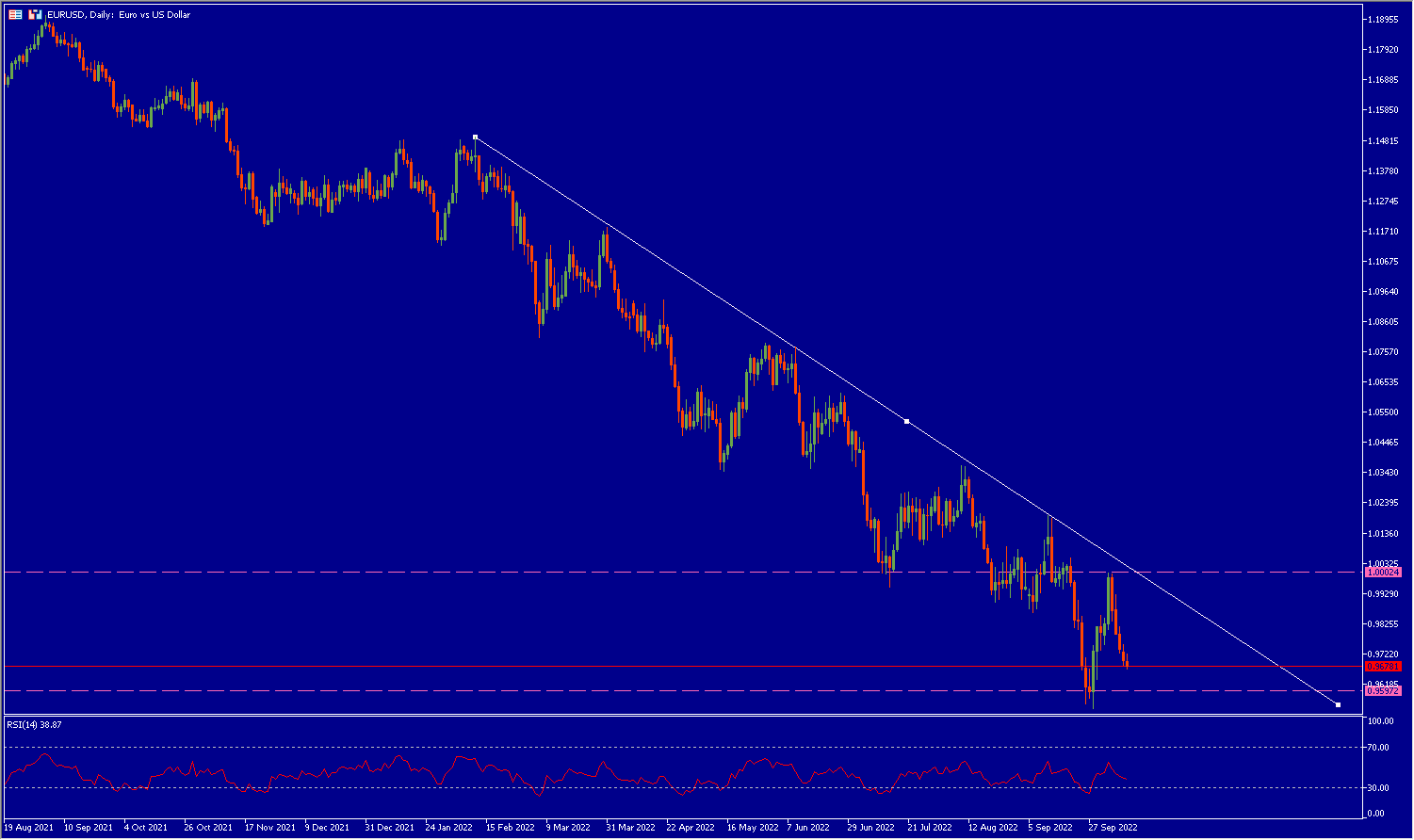

The underlying trend for the EURUSD could not be clearer and remains bearish against a dollar that continues to strengthen, following last Friday’s excellent NFP survey data (263k vs 250k) and a drop in unemployment (3.7% vs 3.5%). The USIndex, which measures the greenback against a weighted basket of six major currencies, has risen to 113.44 and is nearing a 52-week high of 114.75. (see below).

ING believes that “the dollar’s late September highs are well within reach”, and the event of the week, which is none other than the CPI expected this Thursday 13 October (USD, GMT 12: 30), could confirm this trend.

Indeed, even though headline inflation has fallen consecutively over the last 3 months from a record 9.1% in July to “only” 8.3%, the figures are still four times higher than the Fed’s target (2%).

Headline inflation in October is expected to fall from 8.3% to 8.1%, but the CORE index, which excludes food and energy prices and is closely monitored by the Fed, is expected to rise from 6.3% to 6.5%. The question remains as to whether the US has seen its “inflation peak” or whether inflation will remain high over the long term. (/fr/523821/)

Institutional investors expect the Fed to releve ces taux directeurs de 75 Pdb for the fourth time in a row, a first in history. This monetary policy has the effect of tipping the balance in favour of the dollar at the expense of the pair.

EUR/USD

Fed vice-chair Lael Brainard suggested that the US central bank would continue to pursue its mission of lowering inflation, despite the deteriorating growth outlook. “I now expect the rebound in the second half of the year to be limited, and real GDP growth to be essentially flat this year,” said Ms Brainard, referring to the consequences of “a significant increase in interest rates”.

These comments echo those of FED Chairman Jerome Powell, whose aim is to bring interest rates back towards his main target of 2% sooner rather than later, at the expense of economic growth.

Analyse Technique

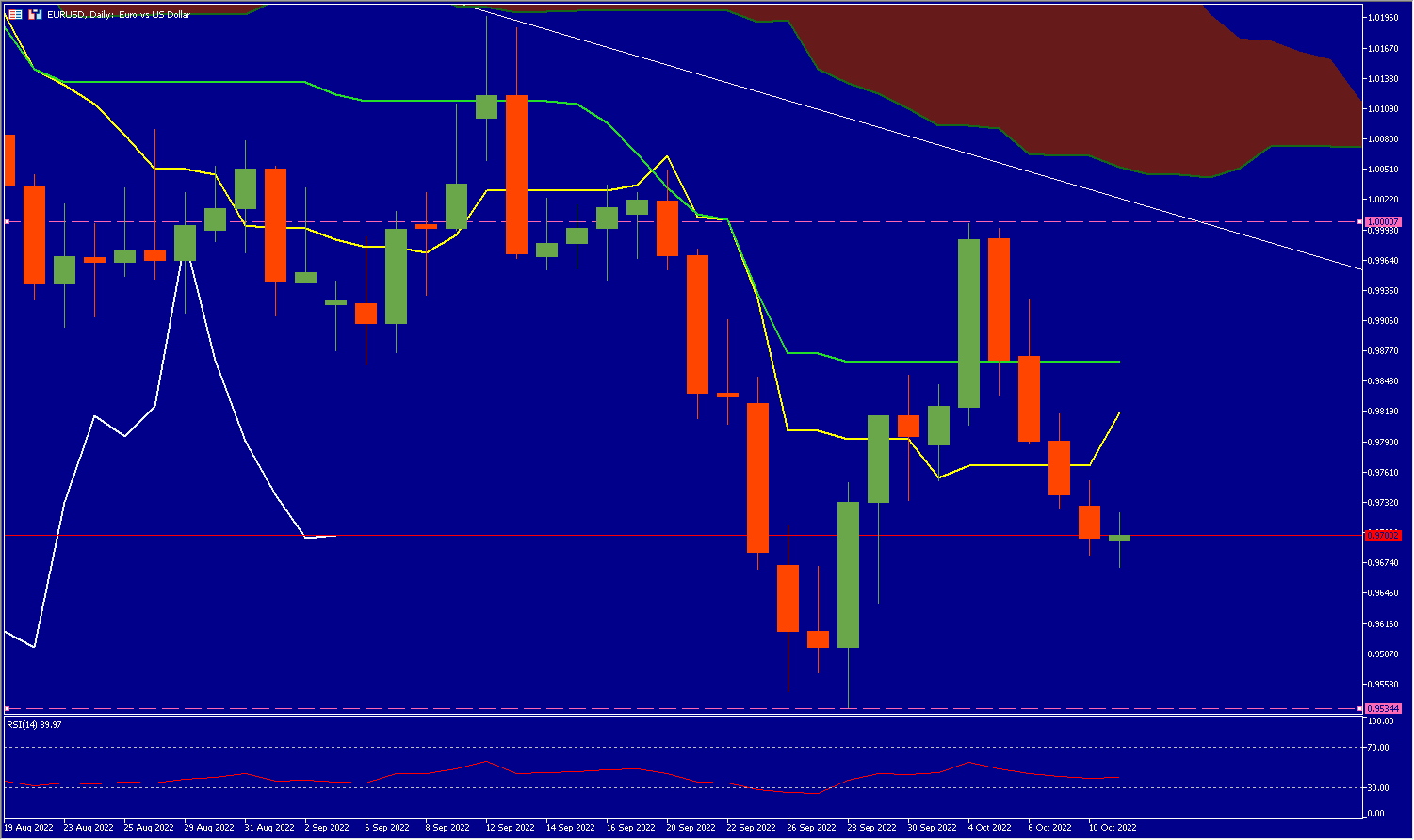

The EUR/USD is currently at 0.9698 below its cloud, its Kijun (green line) and its Chikou Span (yellow line). The Laguin Span (white line) is below the cloud and its counterparts, clearly signifying a bearish momentum, the price could reach its support at the level of 0.9534, on the other hand, it could initially go for its Kijun at 0.9866 and then eventually reach parity (1).

Standard Chartered Bank consistently summarises what could happen and does not hesitate to state that “EUR/USD should weaken over the next 3 months, potentially testing support around 0.9000, before settling around 0.9300-0.9400.“

Click here to access our Economic Calendar

Kader Djellouli

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.