- USDIndex – remains capped at 109.00 with support at 108.20 today. Tight JOLTS report adds to pressure for 75 bp next month; Fed Fund Futures now sit at 68.5%. 2yr yields traded to 15 yr highs. AUD outperformed overnight.

- EUR – German Inflation at near 50-yr highs, pressures ECB action and lifts EUR to 1.0033

- JPY holds between 139.00 & 138.00 having breached 138.00 Monday.

- GBP hit pandemic era lows (March 2020) yesterday at 1.1620. Recovered to 1.1675 now.

- Stocks US stocks weak again (S&P500 -44.00pts (-1.10%) 3986). Under 4k & 24-day low & under 50-day MA. Energy & Tech stocks led the decline. Futs. 4014 now.

- Oil lost over 5% yesterday but has recovered; API inventories better than expected. Touched $90.50 yesterday up to $92.50 now.

- Gold – crashed from resistance at $1736 and trades at support ($1724) now.

- BTC – tested Monday’s 33-day low ($19.5k) again yesterday, back over 20k now at 20.3k.

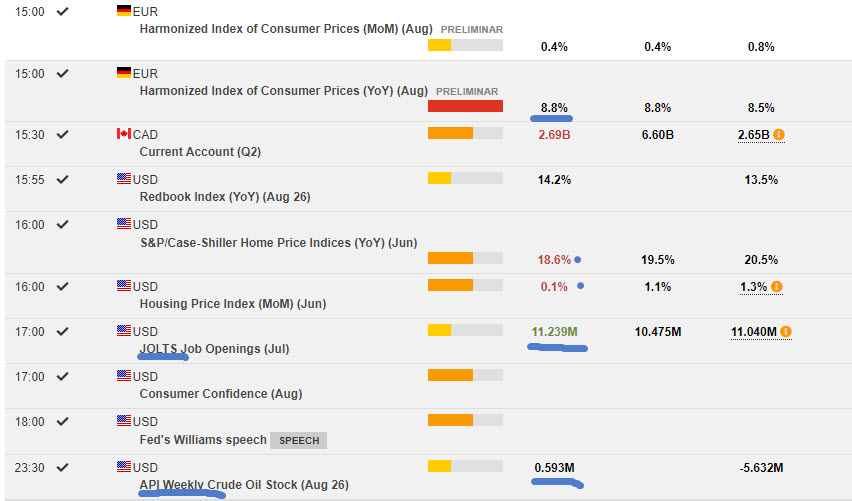

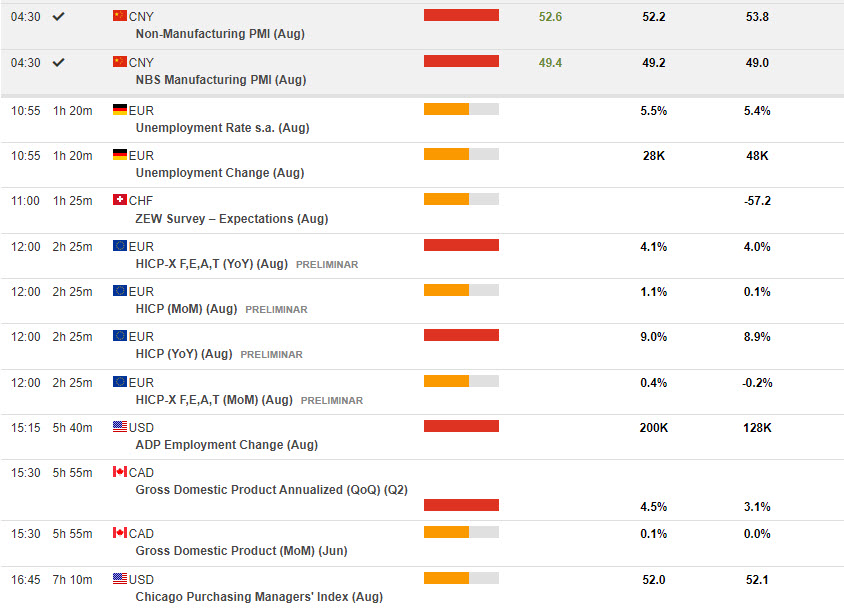

Overnight – Asian equity markets squeezed lower following weak Wall Street, European FUTS tick higher. NZD Strong Building Permits JPY Retail data also better than expected CNY PMI data beat but weaker than last month. Manufacturing (49.4) remains in contraction. German Import Prices and French CPI (m/m) weaker than expected. (1.4% & 0.4% respectively).

Today – German Import Prices & Unemployment, EZ CPI, Canadian GDP, US ADP & Chicago PMI, Speeches from Fed’s Mester & Bostic.

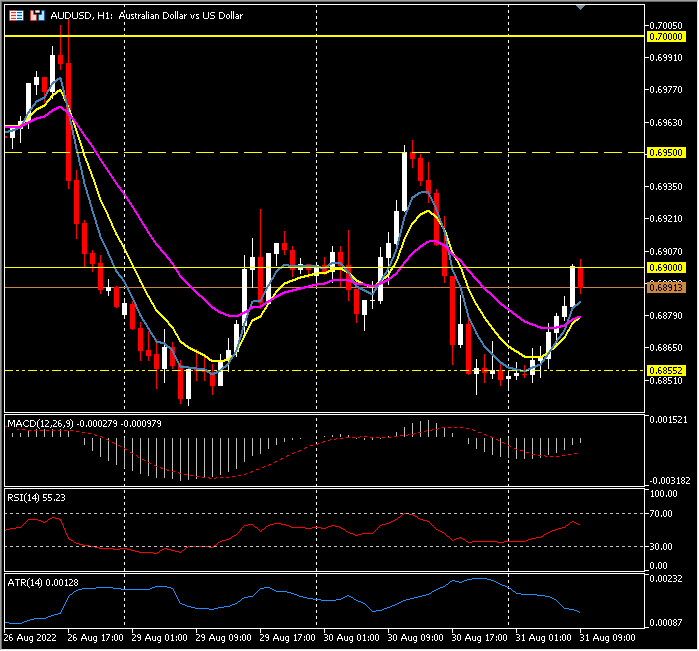

Biggest FX Mover @ (06:30 GMT) AUDUSD (+0.68%). Remains volatile, (100+ pip mover yesterday). Latest move; a rally from 0.6850 support to trade at 0.6900 resistance. MAs aligning higher, MACD histogram negative but signal line rising, RSI 56.00, H1 ATR 0.00128, Daily ATR 0.00823.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.