CitiGroup Inc.

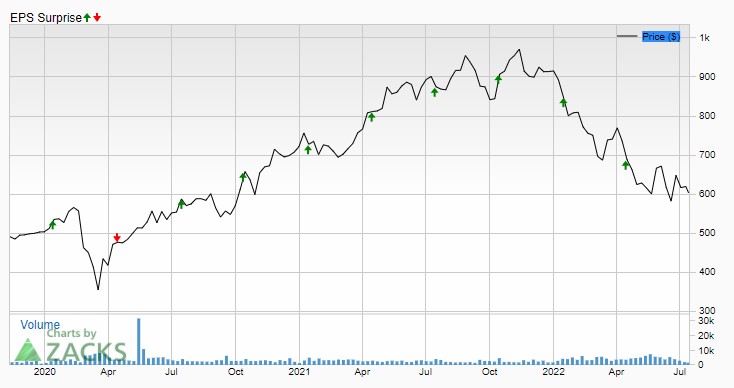

Citigroup is a bank with a capitalization of 91,498 mln. CitiGroup Inc is expected to report its Q2-22 earnings and EPS results on Friday, July 15, before the market opens. Zacks ranks CitiGroup a Rank 3 “Hold” at #160 in the Regional Major-Bank Industry. For this earnings data an EPS of $1.63-$1.65 is expected with an ESP of 0.78% and earnings of $18.29B. In the last 3 months there have been 3 upward revisions and 8 downward revisions.

Due to the pandemic and global shrinkage, CitiGroup shares have fallen 23.5% so far this year.

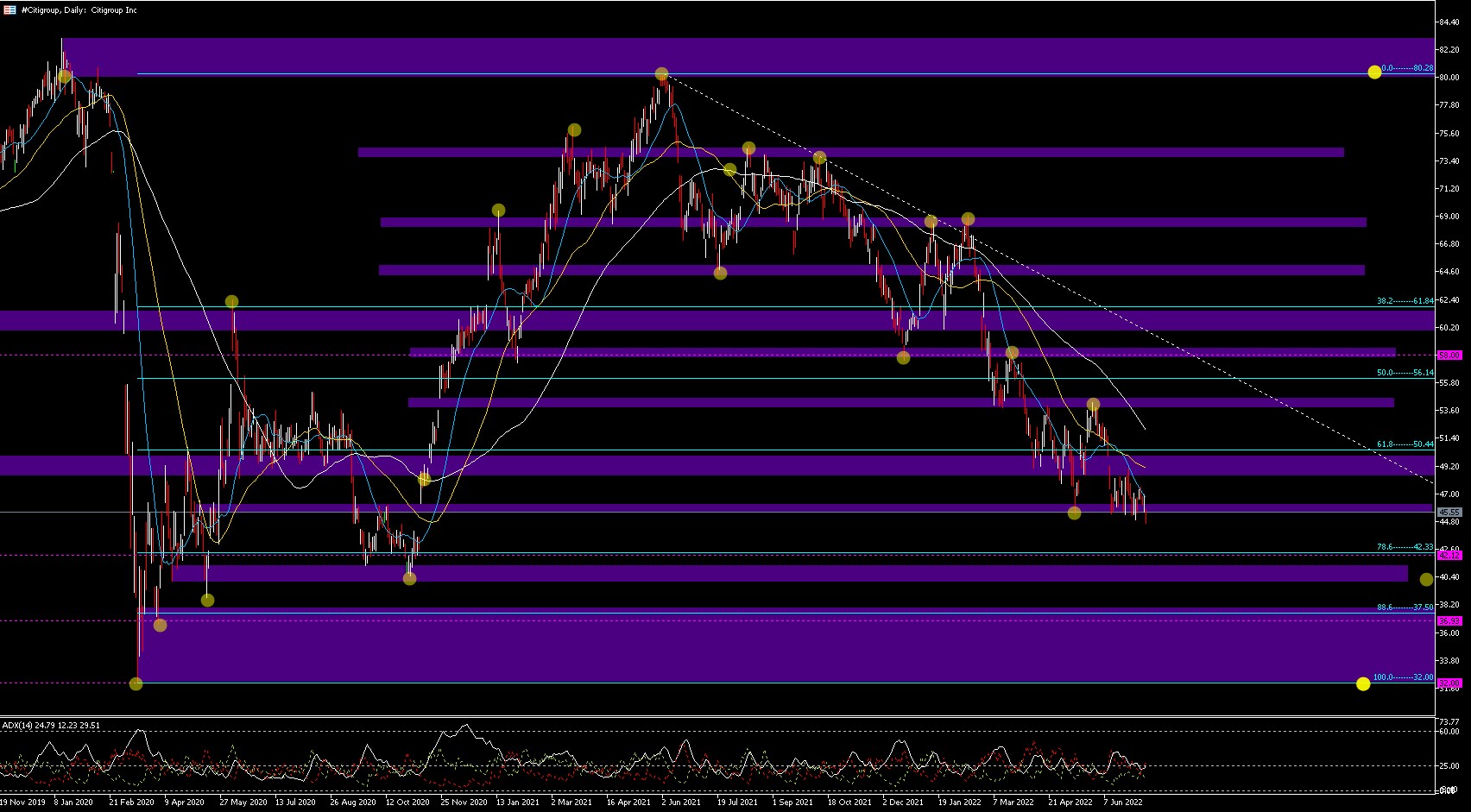

Technical analysis

Citigroup is coming off a downtrend since July of last year, falling over 70% from a high of 80.28 to a price of 45.55 today. Support is at the 78.6% Fibo at 42.33 until the psychological level of 40.00, then until the 88.6% Fibo level at 37.50 and until the April 20 low at 36.66 and to close the cycle it would need to reach the March 20 lows right at the psychological level from 32.00. Resistance is at the latest highs at 54.24, then the psychological level of 58.00 and until the low of July last year at 64.36 to go to the highs of February this year at 69.10.

ADX at 24.79 with bullish bias, DI+ at 12.23 DI- at 29.51 possible bearish continuation.

BlackRock Inc.

BlackRock, which has a capitalization of 93,432 mln, is the world’s largest asset management company and a leading provider of financial technology with assets under management exceeding $10B.

BlackRock Inc. is expected to report its Q2-22 earnings and EPS results on Friday, July 15, before the market opens. The company has beaten estimates for the last 8 quarters with an average of 7.7%, despite the company’s increased expenses as it wants to improve its workforce and operational efficiency. However, this quarter is expected to see an increase in revenue year-over-year but a cut in earnings.

Zacks positions BlackRock a Rank 5 “Strong Sell” at position #218 in the Finance-Investment Management Industry. For this key earnings data an EPS of $7.72-$8.83 is expected with an ESP of -12.57% and earnings of $4.73B. In the last 3 months there have been 9 downward revisions and no upward revisions.

The company’s investment advisory performance fees are forecast at $190M, an increase of 93.9% q/q. Total income from investment advice, administration fees and securities lending stands at $3.86B giving a marginal sequential increase. The outlook for distribution rates is $394M, this being an increase of 3.4% q/q.

BlackRock said in a public note on Monday that the company cut its exposure to developed market stocks, following central banks and their aggressive inflation control.

“Right now, we think the Fed has boxed itself in responding to political pressures to control inflation.”

“Eventually, the damage to growth and jobs from fighting inflation will become apparent, in our view, and central banks will live with higher inflation.” -Jean Boivin, BlackRock Strategist

In addition, a quarterly cash dividend of 4.88 per common share has been declared payable on 23/09/22 to shareholders according to Zacks.The company has been a leader in the ETF market given its iShare. iShares is a collection of exchange-traded funds (ETFs) managed by BlackRock, which acquired the brand and business from Barclays in 2009. iShare inflows have been strong which would increase the company’s AUM balance giving a positive impact.

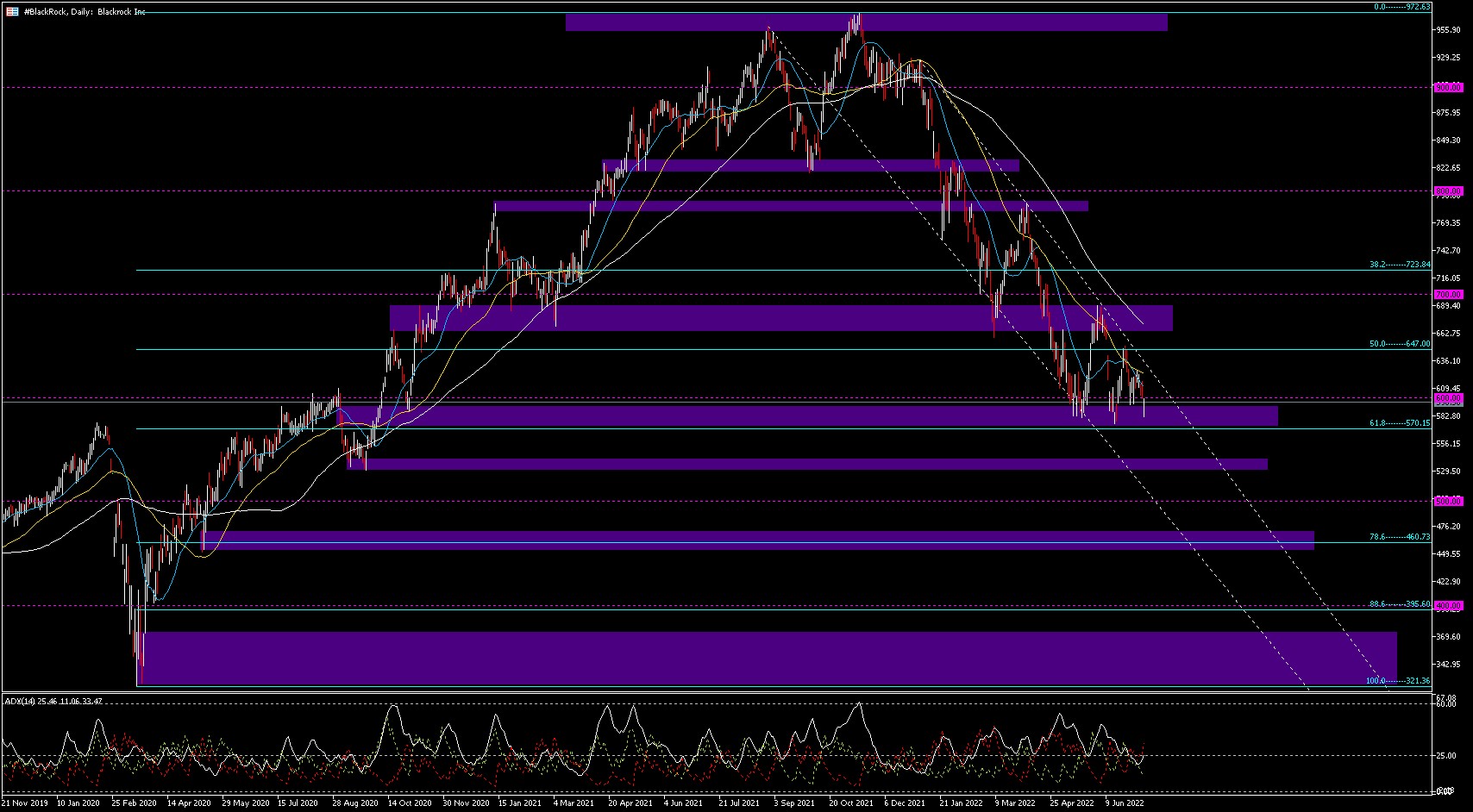

Technical analysis

BlackRock has been in a strong downtrend since Nov. 21, when the price started to fall from its highs at 972.63. YTD has given a close to Fib. 61.8% discount at 570.15 and it is currently trading at 596.36. Supports are set at the low of September 20 at 530.00, followed by the psychological level of 500.00, the Fib. 78.6% at 460.73 until the low of May 20 at 488.01, and the cycle would close after the psychological level of 400.00. Resistances are at the latest Fib. 50% highs at 647.00 followed by previous highs at 689.10-700.00 assuming it breaks the channel’s downtrend.

ADX at 25.49 with bullish bias, DI+ at 11.06 DI- at 33.47, downtrend resumption after pullback.

Sources:

- https://www.zacks.com/stock/quote/BLK

- https://www.zacks.com/stock/quote/C

- https://www.zacks.com/research/get_news.php?id=b4vgqbaadb

- https://www.zacks.com/stock/news/1951263/blackrock-blk-to-report-q2-earnings-whats-in-store?art_rec=quote-stock_overview-zacks_news-ID03-txt-1951263

Click here to access our Economic Calendar

Aldo Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.