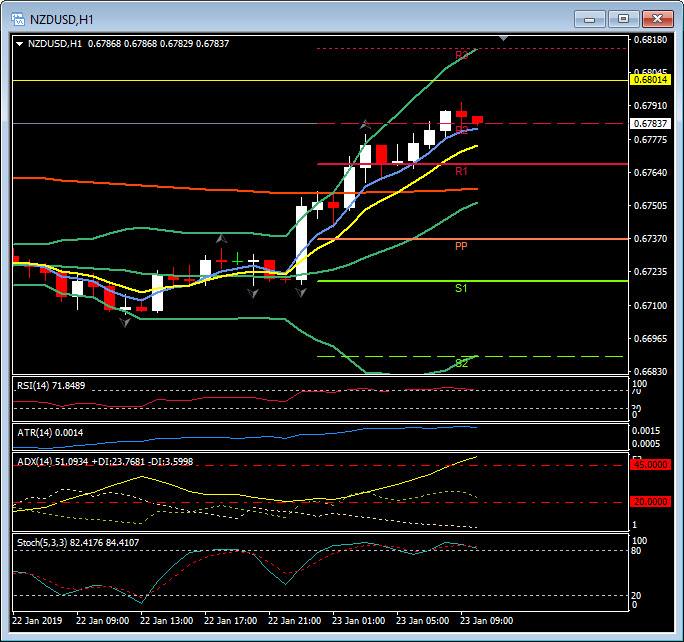

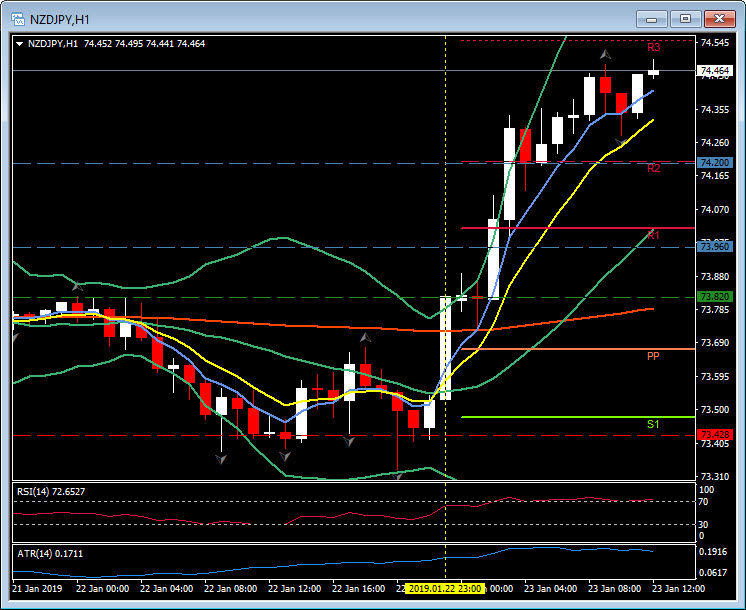

NZDUSD & NZDJPY H1

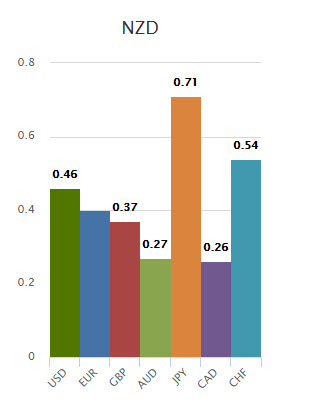

The Kiwi was the star performer overnight with the Japanese Yen the big loser. This is clearly demonstrated by our Traders Board currency strength tool http://goo.gl/wUB7m9

The Traders Board provides a simple “heads up” of currency strength, over two specific time frames; either the current trading day (24 hours) or the previous 5 trading days.

It was the strong showing for the New Zealand inflation report that helped the bid on the NZD. The fourth quarter of 2018 showed that consumer prices (CPI) had risen by 0.1% q/q versus expectations of 0.0%. The annualized figures for Q4 2018 came in at 1.9%, again better than the expected 1.8% and the same as Q3. The Construction, Transport and Alcohol & Tobacco sectors all saw increases over 3.5%, and the closely watched Housing sector also rose over 3%. Communications, and in particular the Telecommunication Equipment sectors, were the main drags down, 3.7% and 21% respectively.

NZDUSD rallied from 0.6720 to 0.6750 and the 200 period moving average, over R1 at 0.6765 before posting a high at 0.6792. Next key Resistance area is the daily 200-day moving average and psychological 0.6800 zone. H1 is now into overbought territory with the RSI approaching 72, the Stochastics at 82 and the ADX at 51. A cool of the up move could be expected with initial support at R1, the 200 and 20-period moving average convergence at 0.6756 and then the daily pivot point at 0.6735.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.