The fast-growing cannabis stock boomed last week on news that its top shareholder would hold on to its shares even after the IPO lockup period passed. This period, which ended on January 15, prevents insiders from selling any of their shares for a specified time, and usually, early investors tend to sell large chunks of their ownership after the period has ended in order to cover their investment cost and, if possible, record some gains.

In the case of Tilray, whose price has soared 340% since its IPO, early investors would have a lot to gain. Still, they chose not to bring the price down by selling early and ride the train of cannabis growth for at least a bit longer. Tilray seems poised for growth, as 41 countries around the world have legalised cannabis. Germany is the largest potential market, boasting a population of 82 million people, which is more than double its home, Canada. The fact that Tilray appears to have a line of edibles waiting for market promotion, and its deal with AB Inbev, the large beer manufacturer, potentially make it well-placed in the market, once the cannabis-related legislation is finalized in 2019.

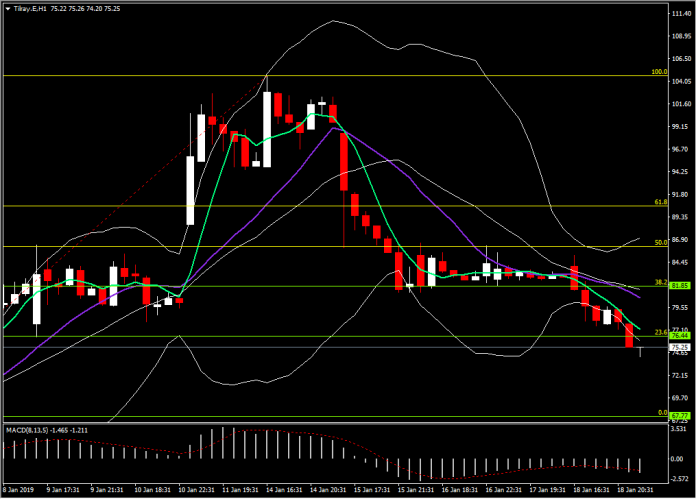

At the moment though, the stock appears to be trading at $75.25, registering a sharp decline from its peak of $102.86. Tilray’s price has recorded much volatility, as both the industry and the company are in their infancy and valuations may appear to be either too low or too high on different occasions. At the moment, Tilray has broken the $76.44 mark (23.6% Fib.) and appears to be trending towards the next Support level, at $67.77 (0% Fib.). In the case that the trend reverses, after breaking through the $76.44 level, the next Resistance should be put at $81.85.

Click here to access the HotForex Economic Calendar

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.