Risk appetite continued to surge with Wall Street closing sharply higher on Friday ahead of the long Memorial Day weekend. Worries that an aggressive FOMC policy posture with officials intent on destroying growth to curb inflation have been dissipating. USD down from Friday’s highs (USDIndex 101.39) as Fed bets ease. Today, Stocks had a very strong start to the day as concern over aggressive tightening in the US and China’s virus lockdowns eased somewhat. (NASDAQ +1.4%, Nikkei +2.2%). Shanghai said on Sunday “unreasonable” curbs on businesses will be removed from June 1, while Beijing reopened parts of its public transport as well as some malls. US markets will remain closed for a holiday today, but across the Eurozone Yields are rising as confidence improves and the German 10-year has lifted 4.7 bp to 1.00% in early trade. The Swedish economy contracted -0.8% q/q in Q1, a much weaker than expected result. Spanish HICP inflation hit 8.5% in May, and German import price inflation came in at 31.7% in April readings, up from 31.2% y/y.

- USDIndex extends declines and trades at 101.39. Chair Powell confirming that a 75 bp hike is not on the table for now has helped stabilize investor sentiment and encourage bargain hunters.

- Equities – Nikkei up 1.8% at 27,263.37, a level not seen since April 21, Topix was up 1.59% at 1,916.88. Shares of shipping firms such as ISHIP.T fell 4.3 which was the worst performer. GER40 and UK100 are up 0.9% and 0.4%.

- Yields – German 10-year has lifted 4.7 bp to 1.00% in early trade.

- Oil & Gold up – USOil rallied to $115.80, and Gold retested the $1863 barrier, holding over $1850 at $1854. Markets waited to see if the European Union would reach an agreement on banning Russian oil ahead of a meeting on a sixth package of sanctions against Moscow for its invasion of Ukraine.

- Bitcoin holds on the back foot – below 31K.

- FX markets – EURUSD up to test 1.0770, USDJPY retests up to 127.34, Cable pull back to 1.2634 from 1.2656 this morning.

Today – German HICP, Fed’s Waller speech, New Zealand building permits and Japanese labor data and retail trade.

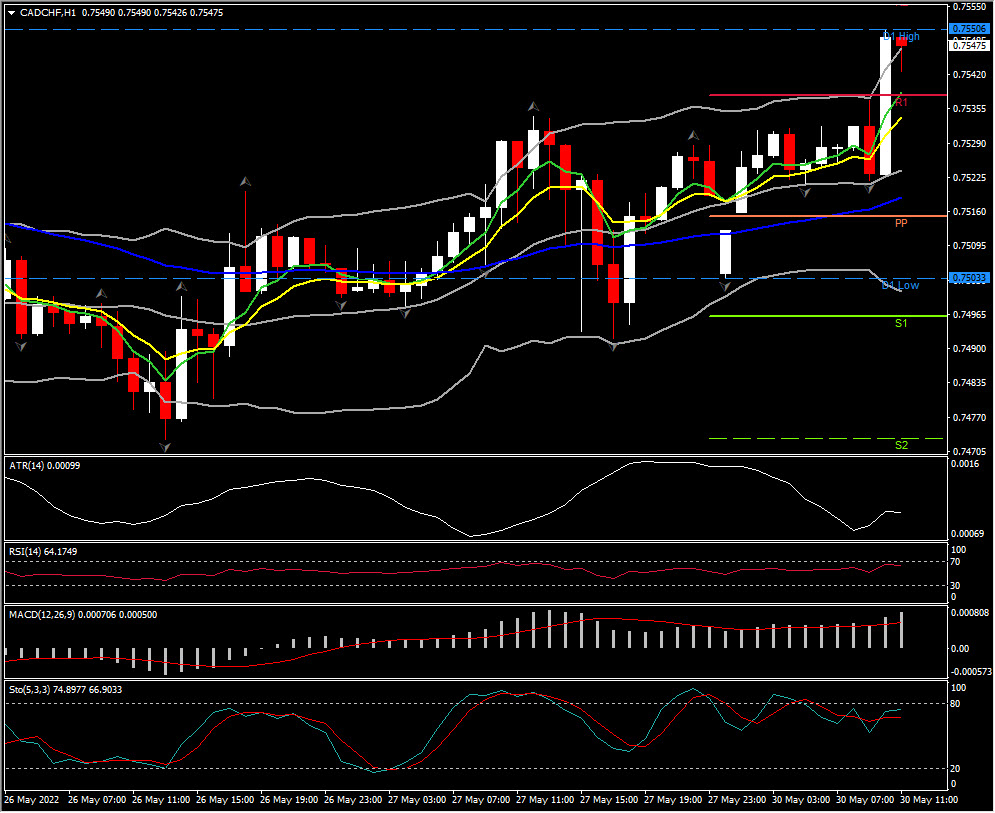

Biggest FX Mover @ (08:00 GMT) CADCHF (+0.39%) jumped to 0.7550 on EU open, and retook a place above the 50-day SMA. In the 1-hour chart, MAs aligning higher, MACD histogram positive & holds 0 line, RSI 64 & rising, H1 ATR 0.00099, Daily ATR 0.00747.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.