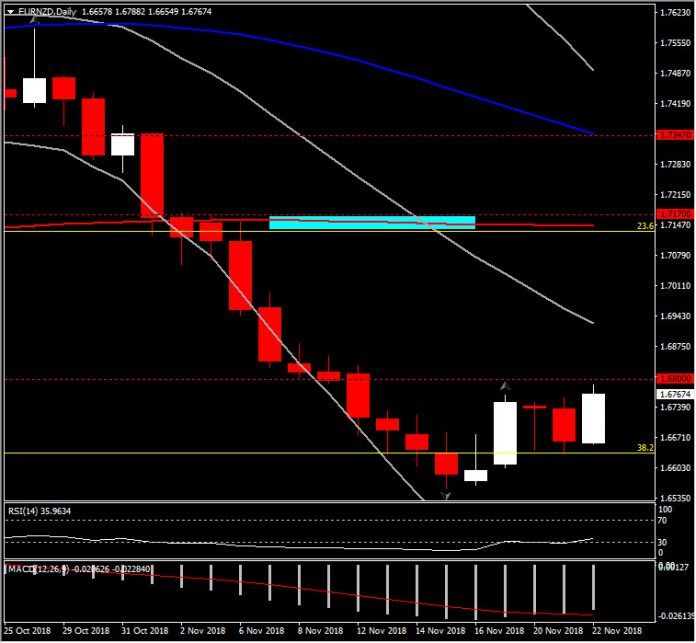

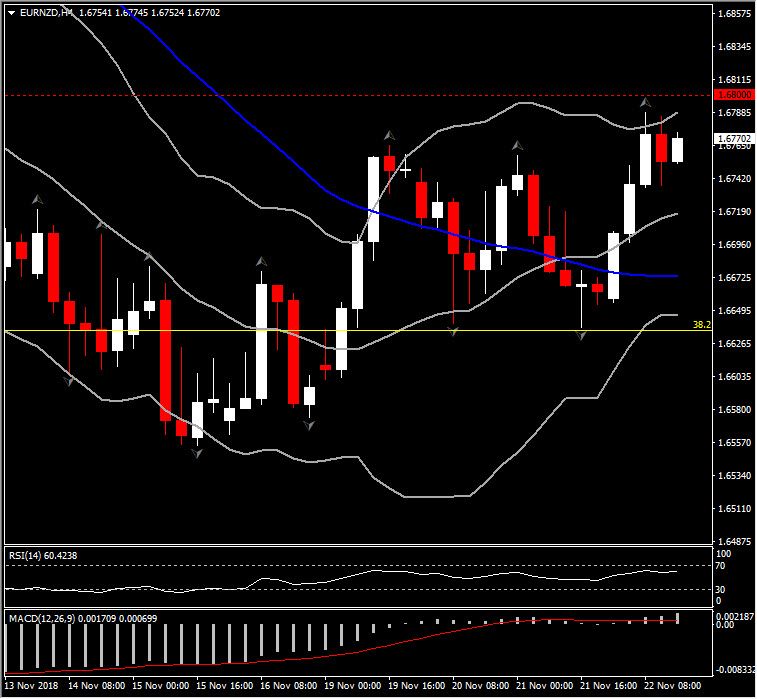

EURNZD, H4 and Daily

EURNZD has ebbed back above 1.6700, with the Kiwi declining concomitantly with a fall in stock markets in Europe and as US futures are also under pressure. A negative close on China’s equity bourses, where the SSE index finished with a 0.23% loss, was also a bearish cue for the Kiwi given the relative dependency of the New Zealand and Australian economy on China. Trade warring between the globe’s two biggest economies, coupled with signs of weakening corporate profits and a less accommodative liquidity environment have been fuelling a bearish sentiment in global equity markets, with valuations looking rich following a near decade-long bullish run.

This backdrop has been negative for the Kiwi currency. EURNZD has descended over the last 3 weeks, and we see the pair as remaining in an overall bear trend, which has been unfolding since early October from levels above 1.7900. Currently the pair is looking for another positive session, retesting 4-day Resistance at 1.6764. Support is set at 1.6640. A break and close above 1.6800 could suggest a bounce up to the 1.7100- 1.7170 area (the confluence of 50-week SMA, 20-day SMA and 23.6% Fib. level)

However, as mentioned on November 15’s post, by taking into consideration the constant declines of the price but also on momentum indicators, the pair remains strongly to the bearish outlook, without reversal signs yet.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.