US 10-year Treasury Note

US consumer confidence rose to a third consecutive 18-year high of 137.9 from 135.3 (was 138.4) in September and 134.7 in August, versus “just” 127.9 in July and a previous 17-year high of 130.0 in February. The current conditions, expectations, and jobs strength diffusion indexes also all rose to 18-year highs in October, with all four October gains from the consumer confidence survey reflecting downward revisions in September. All the major confidence surveys are oscillating around remarkably high levels. For other October surveys, the Michigan sentiment index fell to 98.6 from 100.1 in September, versus a 7-month low of 96.2 in August, to leave fluctuations just below the 14-year high of 101.4 in March. The IBD/TIPP index popped to 57.8 from 55.7 in September, versus a similar 58.0 cycle-high in August. The Bloomberg Consumer Comfort index posted a 4-week climb to a 61.6 cycle-high in the final week of September to leave a 60.3 monthly cycle-high average, before slipping to leave a 60.1 average thus far in October. Confidence, producer sentiment and small business optimism have climbed since October of 2016 thanks to a factory rebound, faster U.S. and global GDP growth with strength in trade despite a market focus on tariffs, fiscal stimulus, and limited inflation risk.

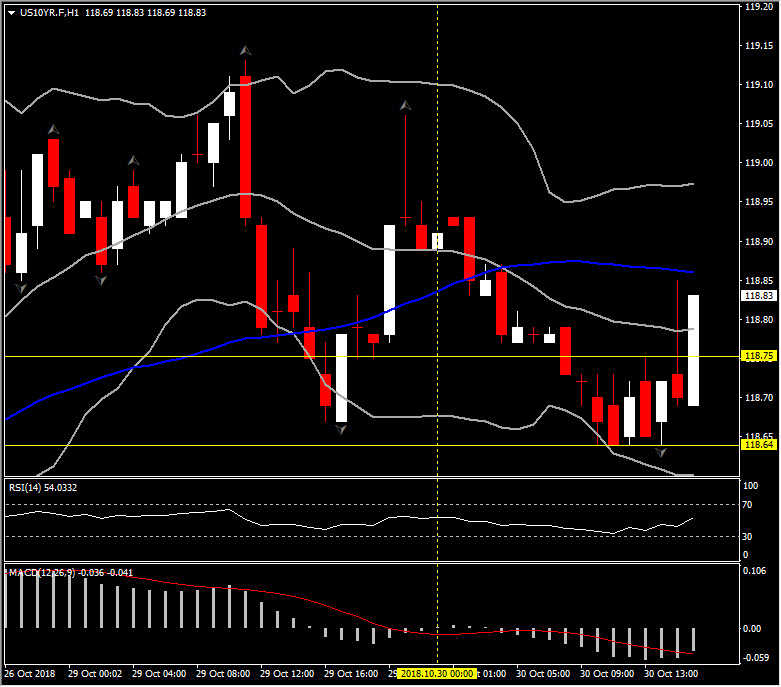

Reflecting the reversed course again in stocks, which snapped higher after rolling over into the red ahead of the open, and by the news of another gain in consumer confidence, the 10-year bond future spiked 2.6 bps higher to retest 3.11% and the 118.85 level, just 1 bps below 50-period SMA in the hourly chart. The bond yield is keeping for the 3rd consecutive day a floor at 118.64 level. In general, bonds weakened globally amid a mixed performance in equities.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/10/31 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.