FX News Today

FX Action: Both the Dollar and the Yen have risen against most other currencies, with the Japanese currency outperforming its North American counterpart. This comes amid a risk-off backdrop, with Asian stock markets having come under pressure following a firm start. Japan’s Nikkei 225 declined 1% at its close, while the Shanghai Composite reversed out of an AM-session gain, and is presently at its lows and showing a 0.6% loss in the second hour of the PM session. EURUSD and EURJPY have ebbed to respective one-week lows of 1.1691 and 131.67. USDJPY edged out a three-day low at 112.60, while EURJPY posted a one-week low at 131.77. AUDJPY, which has been the biggest mover out of the main Dollar pairings and associated cross rates, also traded at one-week lows with a loss of 0.5%. Focus will now fall on Italy. There have been reports that a Cabinet meeting is scheduled today to finalize the Economic and Financial Document after being postponed “due to new complications” as the coalition government struggles to find common ground over the budget. This issue, if unresolved, has the potential to send the Euro sharply lower.

Asian Market Wrap: 10-year Treasury yields lost earlier gains and are down 0.9 bp at 3.039%, 10-year JGB yields declined -0.3 bp to 0.110% and bonds were generally sought as stock markets declined. Wall Street turned negative late in the session following the FOMC meeting, which hiked rates as expected and removed the “accommodative” language. At the same time the “neutral” rate was lifted and Fed continues to pencil in another move this year, and three more for 2019, with Powell saying that Fed could raise rates past the neutral level. Topix and Nikkei are down -0.81% and -0.54% respectively, Hang Seng and CSI 300 declined -0.27% and -0.32% and the ASX lost -0.19% so far. US stock futures are trying to move higher though, indicating that investors will quickly recover from the Fed statement that is, in some ways, ambiguous for the markets. Oil prices are higher and the front end Nymex future is trading at USD 72.34 per barrel.

Charts of the Day

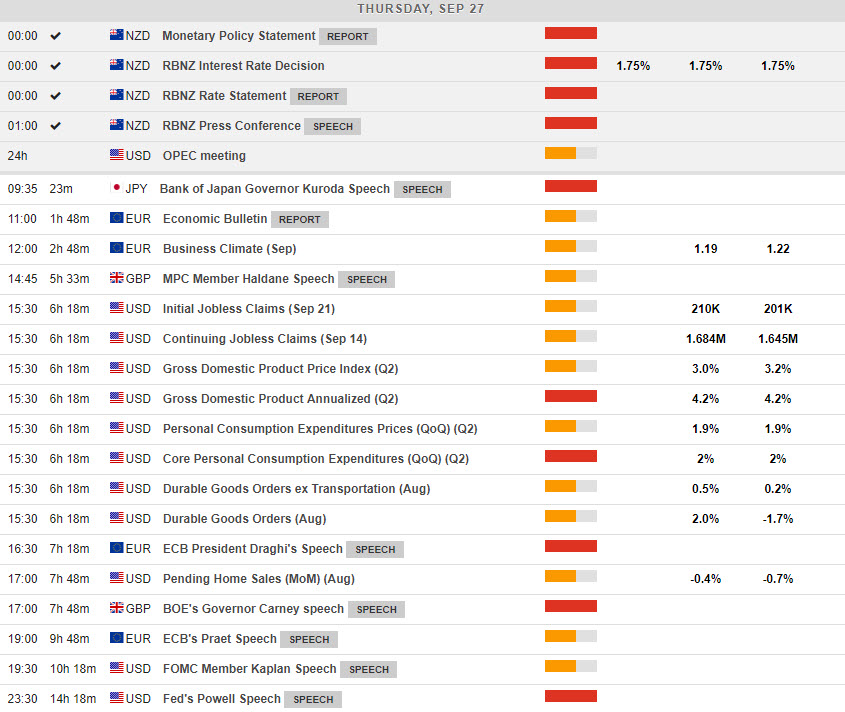

Main Macro Events Today

- US Jobless Claims – Expectations – Jobless claims are expected to increase, with consensus forecasts putting the number of new claimants at 210,000 compared to 201,000 last month.

- GDP Price Index – Expectations – The GDP Price Index is a broader index than the CPI, with different weights, and also provides a different view of price developments in the economy. Consensus Forecasts suggest that prices will have increased by 3.0% in Q2, compared to 3.2% in Q1.

- Personal Consumption Expenditures – Expectations – The Fed’s favourite inflation index is expected to increase by 1.9% in Q2, same as last quarter, with the core index expected to increase by 2%.

- Durable Goods Orders ex Transportation – Expectations – Durable Goods orders are expected to have increased by 0.5% in August, compared to 0.2% in July.

- ECB Draghi Speech – The ECB President is due to deliver opening remarks at the European Systemic Risk Board annual conference in Frankfurt.

- Fed Powell Speech – The Fed President is set to speak at the Business Leader’s day in Washington.

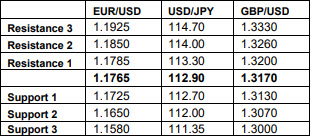

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/25 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.