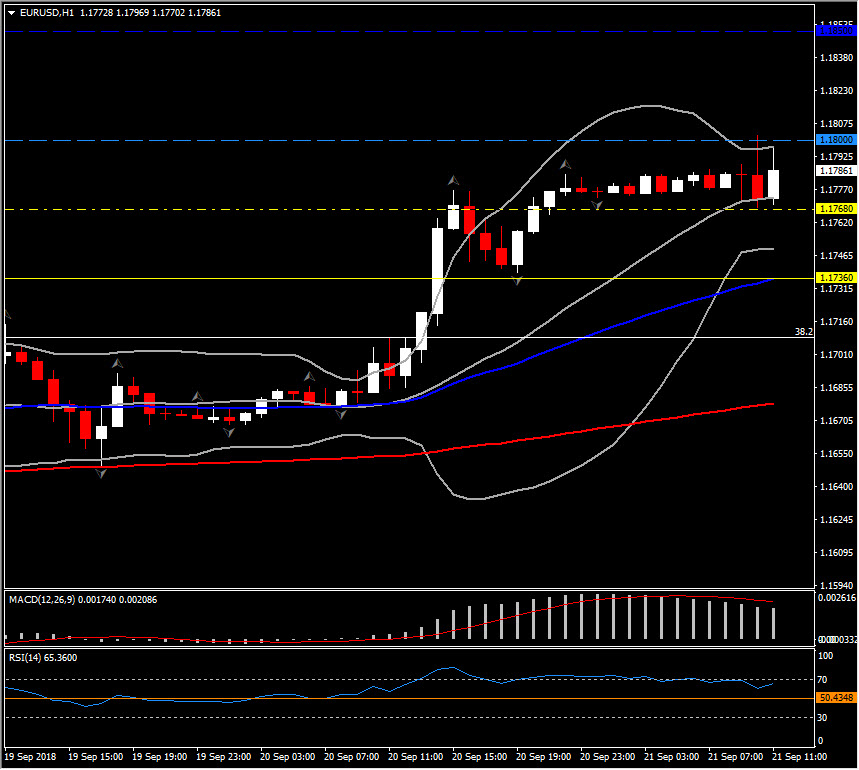

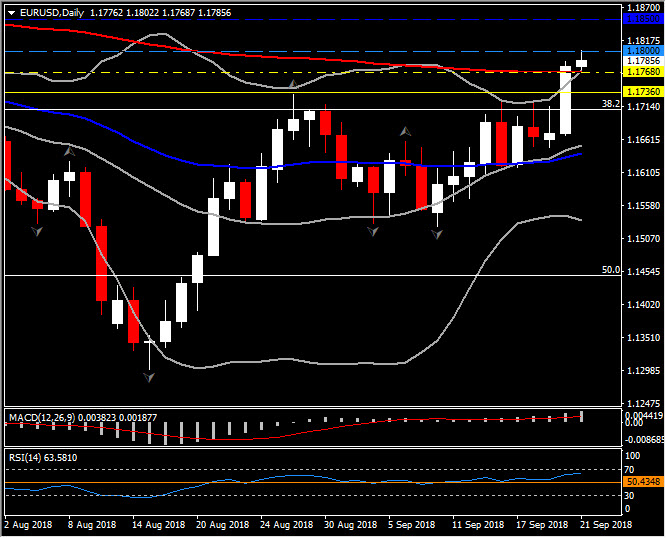

EURUSD, H1 and Daily

The Eurozone PMIs were hit by trade tensions, with the manufacturing PMI falling to a 24-month low of 53.3 in September from 54.6 in August, as export orders stagnated for the first time in over five years, according to Markit. The flash output reading dropped to a 28-month low of 52.8, down from 54.7 in August. Services activity by contrast lifted to a 3-month high of 54.7, but the uptick from the August number of 54.4 was not sufficient to compensate for the deterioration in manufacturing sentiment and the composite reading fell back to 54.2 from 54.5 in the previous month. So far data still points to robust levels of activity and part of the slowdown is also due to the fact that capacity constraints are limiting the room for further expansion. Still, Markit also reported that the backlogs of work declined for the first time since April 2015 as the inflow of work slowed. Not surprising then that companies are increasingly reluctant to take on more staff and the rise in factory payrolls was the lowest in more than one-and-a-half years. Despite all this, Markit reported that business optimism about future activity levels revived slightly from August, thanks to a pickup in services. Markit still expects a solid 0.5% growth for the third quarter based on the PMI readings to September, but the clearly warning bells are ringing as trade tensions and Brexit risks are likely to continue to weigh on exports and the manufacturing sector overall.

EURUSD has posted a fresh 2-month high at 1.1803, while EURJPY has lifted to 5-month high territory above 133.12, moves which reflect the broad Dollar and the Yen weakness amid a backdrop of rallying global stock markets. The critical juncture arriving next Thursday when the Italian government releases its Economic and Financial Document, which will outline the first real indication of the scale of the planned fiscal deficit for 2019, adds the potential bullish view of the Euro under caution. This comes with the jury still out on both the viability and ability of the populist Italian government to produce credible policy.

For now and as of yesterday’s strong closing at 1.1780, EURUSD seems to remain in a trend following approach as it holds above the upper daily Bollinger Bands, and is amid its longest and biggest rally phase since January. Support comes in at 1.1734-46 while the June high at 1.1851 provides an upside waypoint, if the pair breaks above the hourly consolidation range seen so far today.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/25 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.