FX News Today

European Outlook: Global yields continue to trend higher as stock markets shrug off the latest escalation of the US-Sino trade spat. 10-year Bund yields are up 0.3 bp at 0.480% in early trade, the 2-year is up 0.4 bp at -0.531%. 10-year Treasury yields pulled back from yesterday’s highs, but remains above the 3% mark at 3.0465% and 10-year JGB yields rose 0.5 bp to 0.112% as stock markets continued to rally during the Asian session after a strong close in Asia overnight. FTSE 100 futures are moving higher with US futures ahead of key inflation data for the UK today, which is expected to show the headline rate falling back to 2.4% y/y from 2.5% y/y in the previous month. The data calendar also has Eurozone current account data and a German 10-year Bund auction.

Asian Market Wrap: 10-year Treasury yields are down -0.7 bp, but are still holding above the 3% mark at 3.05%. 10-year JGB yields are up 0.5 bp at 0.112%, despite the BoJ decision that, as expected, left policy unchanged. Yields remain elevated as stock markets extend their rally and investors look past the latest round of the US-Sino trade spat that saw Beijing announcing retaliatory tariffs on USD 60 bln of US goods and Trump threatening duties on virtually all imports. China’s Premier Li Keqiang said he won’t let the currency devalue to stimulate exports. With traders buying into the belief that a negotiated solution will be found eventually, Topix and Nikkei managed gains of 1.53% and 1.33% respectively despite the uptick in yields. The CSI 300 is up 1.54%, after already rising more than 2% yesterday, and the Hang Seng gained 1.25%. US stock futures are narrowly mixed, oil prices are slightly higher and the front end Nymex future is trading just under USD 70 per barrel.

Charts of the Day

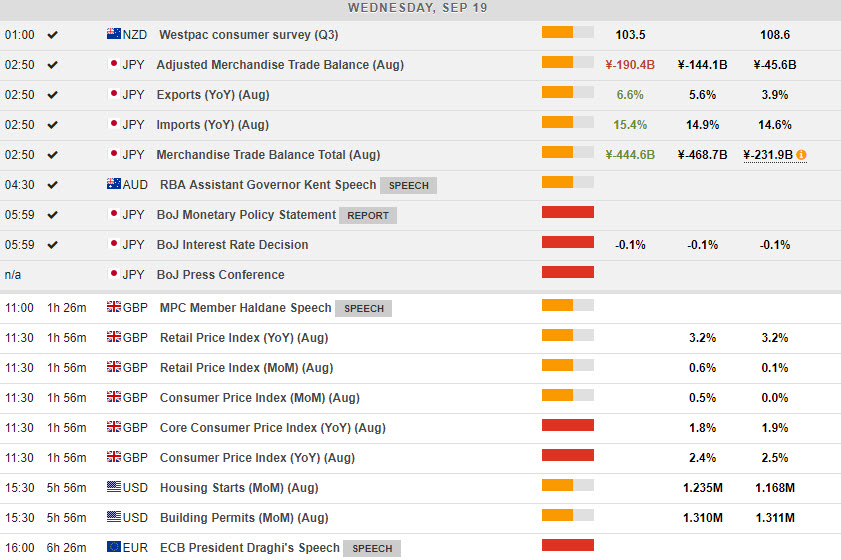

Main Macro Events Today

- UK Core Consumer Price Index – Expectations –Inflationary pressures are expected to have eased a bit in the UK and consensus forecasts estimate inflation to stand at 1.8% y/y, versus 1.9% y/y.

- US Housing Starts and Building Permits- Expectations – Housing starts should continue to move upwards according to consensus forecasts, while building permits are expected to remain at the same level as last month.

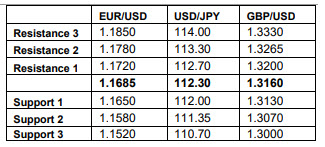

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/09/19 15:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Dr Nektarios Michail

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.