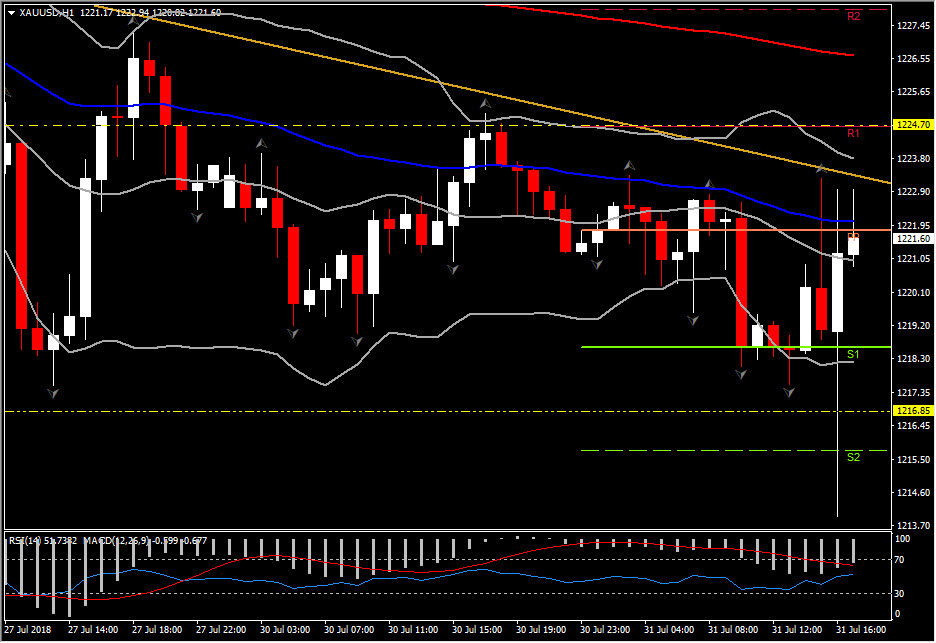

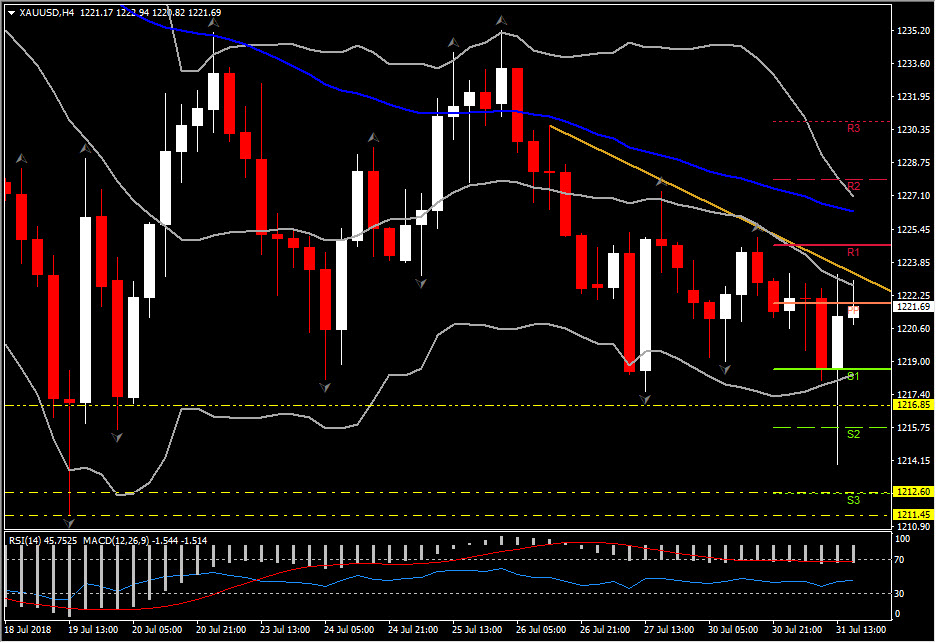

XAUUSD, H1 and H4

Personal income and spending rose roughly as expected, along with a gain in Q2 ECI. Core PCE prices came in at a very comfortable 1.9% y/y for the Fed vs the 2.0% target. Much of the report was presaged by the Q2 GDP report, though the data are still supportive for both bonds and stocks. Meanwhile, US employment costs rose at a 0.6% clip in Q2, as expected, following the 0.8% gain in Q1, and 0.6% in Q4. Wages and salaries were up 0.5% following the 0.9% Q1 jump, and the 0.5% Q4 pace. The tame quarterly pressures should keep the FOMC content with its gradual pace of rate hikes for now.

The Dollar was initially unmoved following the mix of data, where income was in line, consumption was a touch light, and the ECI was just shy of consensus. EURUSD bottomed at 1.1707, down from earlier highs of 1.1746.

However, the Dollar turned higher after the better Chicago PMI outcome along with the US/China trade talk news. News wires are reporting that the US and China are looking to resume talks to avoid a full-scale trade war, as US Treasury representatives are apparently in discussions with China’s vice-premier’s office. The report appears to have been behind Wall Street’s bounce. Chinese PMI data have shown distinct erosion in July, with slowing in manufacturing output and new orders, and with new export orders in contraction for a second month.

The possibility to resume US/China trade talks, boosted Gold Futures closer to overnight highs from near 2-week lows of $1,216.90 into the NY open. The instrument is currently trading above the confluence of PP level and 50-period EMA in the 1-hour chart at $1,221.83. On the upside immediate Resistance holds at R1 at $1,224.70.

Overall, the asset has kept a technical bias to the downside intact, as today marks the fourth consecutive lower daily high. The sell-off comes despite some dollar weakness seen this week. The market remains on the defence ahead of the FOMC announcement on policy. No changes are expected, but the Bank will likely maintain its “gradual” approach to tightening, with 2 more hikes in the cards this year. Higher rates will continue to weigh on gold prices. Next immediate Support is set at the latest 2 consecutive hourly low fractals, at $1,216.85. Daily Support comes at $1,211.45, the July 19 low.

Overall, as per momentum indicators, there is still plenty of space to the downside, as RSI slipped at the edge of the oversold area, at 30, whilst MACD oscillator increases downwards below its signal line, suggesting rise of negative momentum in the daily and medium-term frame.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/08/01 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.