USDCAD and CADJPY, H1 and H4

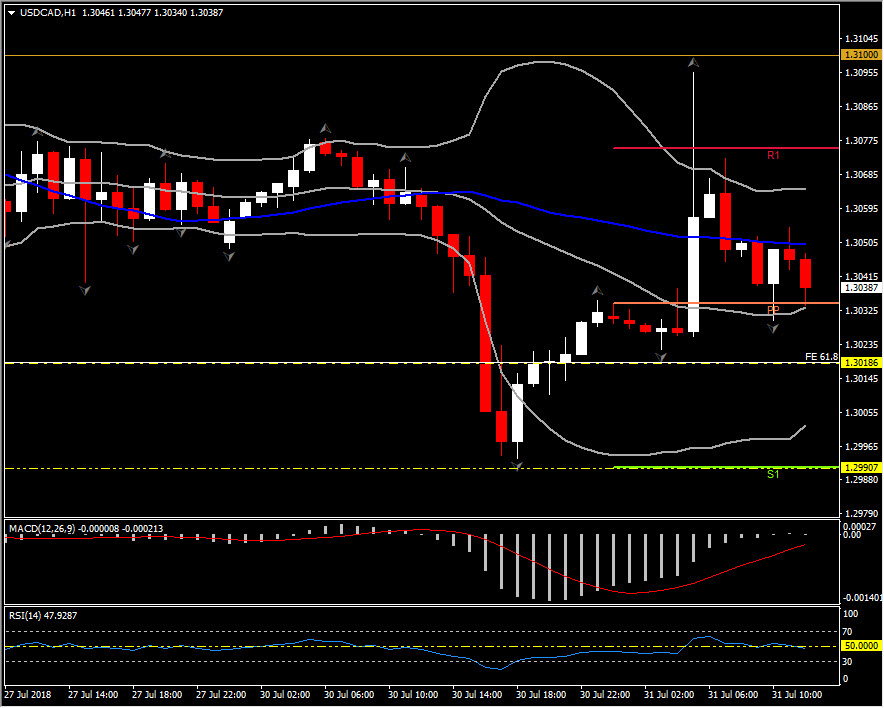

USDCAD recouped back above 1.3000 after printing a near 6-week low at 1.2994 yesterday. However it failed to move above 1.3100 level since it revert immediately back to 1.3035 from 1.3095. As stated in last Friday’s post: ” The USDCAD is currently consolidating around the 50% Fib. level at 1.3060, however the confirmation of the head and shoulders formations along with the negative momentum indicators, the breakout of upside trendline since April and the fact that the pair is moving below 20 and 50-day SMA, continue to strongly support the bearish scenario for the pair.” – This is likely to remain the case as long as the pair remains below 1.3100-1.3150 area (50-day SMA and 20-day SMA). Next intraday Support levels come at 1.3018, 1.2990 and 1.2950. Momentum indicators are very much neutrally configured in the 1-hour chart, as RSI stalled at 51 and MACD lines are almost flat around zero above signal line suggesting slight increase of the positive bias. However the short-term positive bias remains improbable to suggest a potential strong swing to the upside, as medium term and longterm pictures suggest that the negative momentum is likely to strengthen.

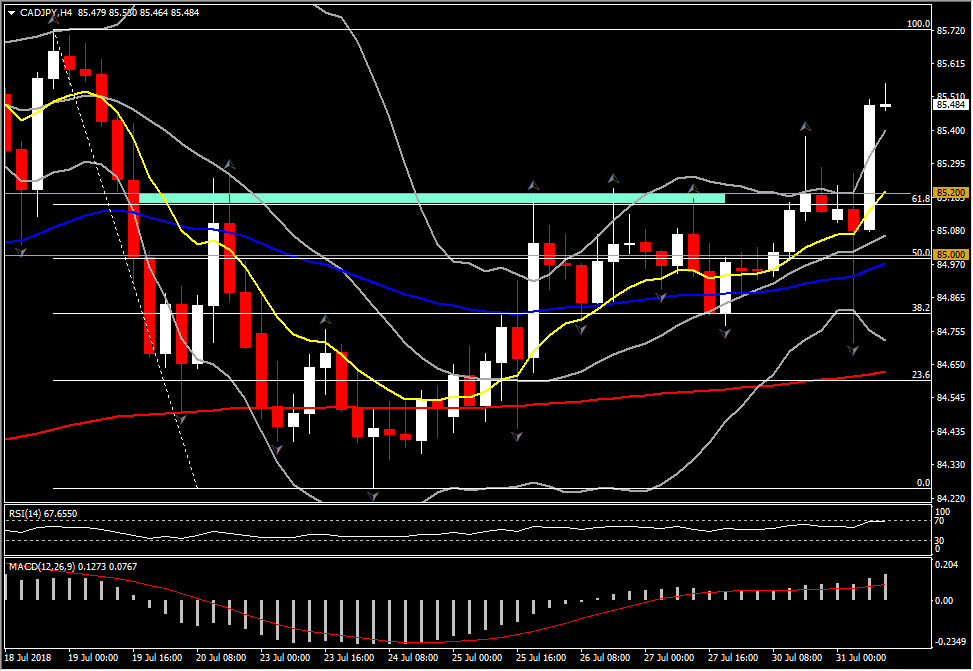

More of the same could be identified in CADJPY, which rallied to 85.55, as Yen has continued to weaken on the BoJ pledge to maintain low interest rates. Next Resistance for the pair is at July’s peak at 85.75 and at Fibonacci extension 161.8, at 86.60, if the pair boosted above July’s high.

The 2% rally in Oil prices yesterday helped, given the Canadian Dollar a lift. There have been some encouraging noises from officials involved in NAFTA negotiations, which has also been in the mix.The lack of a revised NAFTA agreement has been the main source of uncertainty in Canada’s economic outlook. BoC Governor Poloz noted last week that the passage of a revised NAFTA would be a sizable upside boost to the outlook, as tariffs would fall off and uncertainty would be eliminated for firms, which would allow delayed investment to proceed. This weeks docket in Canada brings May GDP and June June industrial prices (both released today), the July manufacturing PMI survey (Wednesday), and June trade figures (Friday).

GDP is expected to grow 0.2% m/m in May. Retail sales rebounded in May after a weather driven drop in April, supportive of firmer GDP growth. Manufacturing and wholesale shipments also improved, though some operations at some refiners remained shut down for maintenance, which could exert a sizable drag on total GDP growth. We expect the trade deficit to narrow to -C$2.3 bln in June from -C$2.8 bln in May, and industrial product price index to slip 0.3% in June (m/m, nsa) after the 1.0% surge in May.

The Markit manufacturing PMI for July anticipated to show some slippage in activity after climbing 0.9 points to a record high of 57.1 in June, with strength in new orders.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/31 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.