Amazon, H4 and Daily

US equities extended their bounce after Alphabet/Google earnings revived the FAANG trade and China stimulus hopes conspired to breathe some life back into the rally, despite headwinds from the $5 bln in EU fines on the former and a tariff war with the latter. The Dow is up 128-points, S&P500 gained 11-points and NASDAQ is up 27-points ahead of the opening gong.

Overall today, tech Stocks were boosted by a stellar earnings report by Alphabet, the parent company of Google, in a combination of signs that China is moving toward an easier policy stance. Meanwhile the agenda tomorrow and on Thursday has a plethora of earning reports, with Facebook report to be released after the US session today and Amazon on Thursday.

Additionally on tap today are: Advanced Micro, Align Technology, American Electric Power, Amphenol, Anthem, Barrick Gold, Boeing, Boston Scientific, Check Point Software, Citrix, Coca-Cola, Corning, Deutsche Bank, Equifax, F5 Networks, Facebook, Fiat Chrysler, Ford, Freeport-McMoran, General Dynamics, General Motors, Gilead Sciences, GlaxoSmithKline, Goldcorp, HCA Healthcare, Hess, Hilton, Ingersoll-Rand, Lab Corp., Las Vegas Sands, Mohawk Industries, Mondelez, Nasdaq, NextEra Energy, Norfolk Southern, Northrop Grumman, O’Reilly Automotive, PayPal, QUALLCOMM, Raymond James Financial, Rockwell Automation, Rollins, Sempra Energy, Sirius XM, Suncor Energy, T. Rowe Price, Thermo Fisher Scientific, UPS, Vertex Pharmaceuticals, Visa, Vodaphone, Waste Management, Xilinx

As the US stocks are now open, Amazon stock price was seen opening with a gap to the upside to 1,834.00 area, rebounding from yesterday’s lows at 1,772.80. The bullish movement was widely anticipated after the solid report from Alphabet.

Overall, the Amazon stock price retains a bullish bias with yesterday’s downside move considered as another short lived correction of the long-term upwards move since the sharp decline in March.

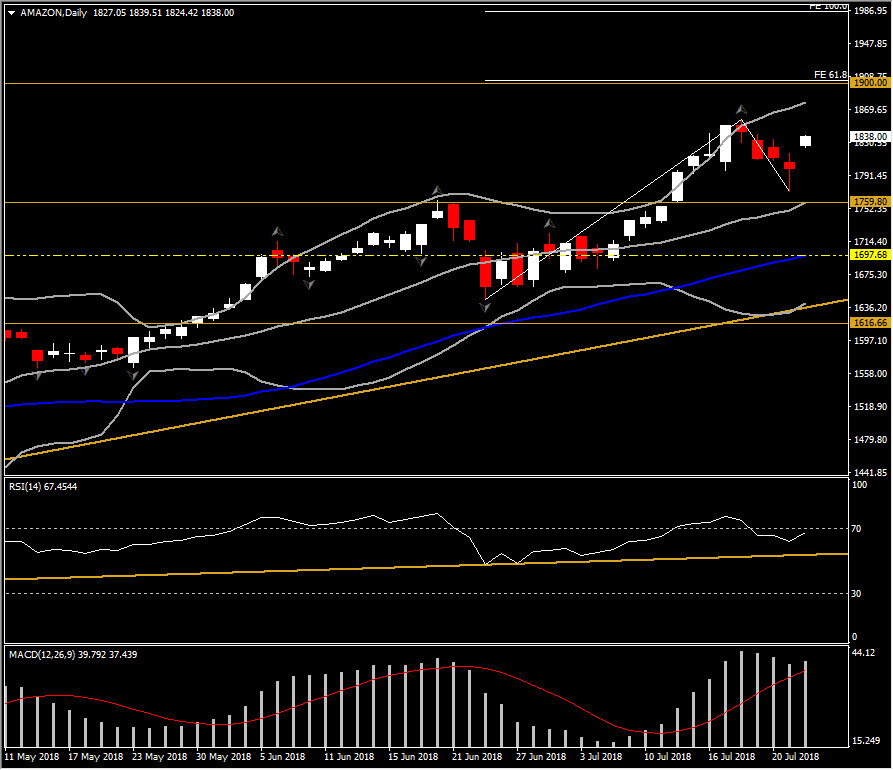

In the daily chart, the RSI indicator is sloping northwards close to the overbought barrier, while the MACD oscillator increases above its signal line suggesting further steam to the upside. In the 4-hour chart, the momentum indicators are mixed as RSI keeps presenting more of an upside movement in contrast to the MACD oscillator which shows a decline of the positive momentum. However the overall picture for Amazon remains to the bullish outlook.

Moreover, the next strong Resistance hurdle is at the 1,860.00 – 1,900.00 area, taken from the 61.8% Fibonacci extension level of the up swing from 1,645.72 to 1,858.18. Further gains above this area would lift the instrument up to next Resistance levels as per Fibonacci extension, at 1,985.00 and 2,040.00.

However, should a downside movement take form, immediate support will likely come from the 20-day SMA, at near 1,759.80. A slip below this area could boost the asset to 50-Day MA.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/25 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.