FX News Today

European Fixed Income Outlook: The September 10-year Bund future opened at 163.16, up from 163.08 at yesterday’s close. The 10-year cash yield is down -0.1 bp at 0.326% in early trade, versus a 1.1 bp gain in US Treasury yields. Asian Stock and Bond markets traded mixed after China devalued the yuan, which saw Chinese 10-year yields jumping 5.6 bp, and Chinese stocks rallying, while Topix and Nikkei are still slightly down on the day. European Stock Futures meanwhile are heading south, with trade jitters continuing to weigh. Released at the start of the session German PPI inflation accelerated to 3.0% y/y as expected and largely thanks to base effects from higher energy prices. The data calendar still has Eurozone current account data as well as UK Public Finance numbers.

The PBoC devalued the Yuan by the most for a single day since June 2016, with USDCNY’s reference rate set at 6.7671, up from yesterday’s 6.7066 and the highest in a year. The offshore Yuan fell over 0.5% to a 6.8358 low versus the Dollar, a level not seen since late July last year, before recouping to 6.8212 amid reports of major state banks buying the Yuan in what most market participants and onlookers take as Beijing-directed intervention to prevent a rapid tumble in the currency. The weaker setting of the reference rate comes hot on the heels of President Trump’s latest venting about China’s currency valuation, deepening concerns about the evolving Sino-US trade war.

Charts of the Day

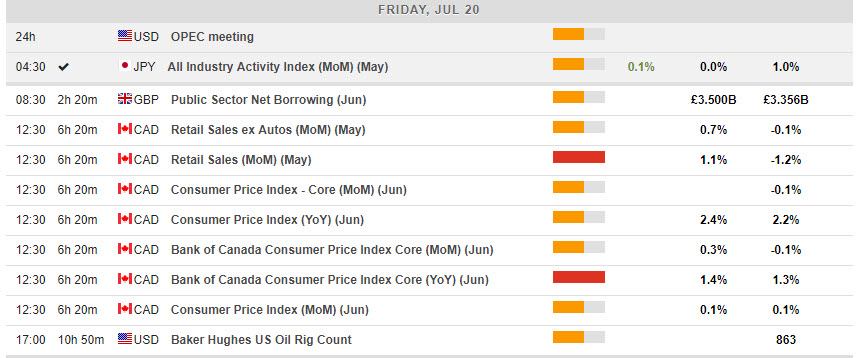

Main Macro Events Today

- UK Public Sector Net Borrowing – Expectations – is expected at 3.6B from 3.4B last month.

- Canadian CPI – Expectations – The CPI is expected to slip 0.1% in June (m/m, nsa) after the surprisingly slim 0.1% gain in May, as falling gasoline prices impact in June. The annual growth rate is seen at 2.2% (y/y, nsa), matching the 2.2% y/y clip in May. The three core CPI measures are expected to maintain 1.9% annual rate of expansion in June.

- Canadian Core Retail Sales – Expectations – Retail sales are seen snapping back 1.0% in May after the 1.2% loss in April that was blamed on poor weather during the month (ice storm!). The ex-autos sales aggregate is seen rising 0.5% after an 0.1% dip.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/07/24 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.