Markets are back today. European as well as US stock futures are moving higher, after a mixed close across the Asia-Pacific region overnight. Heightened geopolitical risks weighed on confidence and mainland China bourses failed to get a real boost from the PBoC’s pledge to support the economy. The Ukraine war and central bank moves will remain in focus, amid further signs of weakening growth and rising inflation in particular in Europe. Hawkish IMF and World Bank meetings are a highlight this week and the World Bank already slashed its growth forecast. RBA: closer to raising interest rates for the first time in more than a decade due to accelerating inflation.

The World Bank lowered its forecast for 2022 growth. The markets also monitored a Goldman Sachs estimate of a 35% risk for a recession over the next two years. – 15-month crisis response package of around $170 bln.

- Yields – The 10-year Treasury yield is down -0.6 bp at 2.85%, while the German 10-year has lifted 2.1 bp to 0.86%, after the extended break.

- Stocks waffled between gains and losses through the session, but finally settled slightly lower with losses of -0.1% on the Dow and NASDAQ, and a -0.02% dip in the USA500. Nikkei closed 0.7% higher. China bourses underperformed and the Hang Seng plunged -2.5% after returning from the extended weekend.

- USDIndex remains on bid, at 100.99 highs.

- Oil edged up to $109.81, from an overnight low of $106 amid the continued supply-demand tug of war. Supply was more of a focal point as two Libyan ports were shut amid anti government protests and the National Oil Corporation declared a force majeure on loadings. Currently steady above $107.00.

- Bitcoin spiked to $41,223.

- FX markets – EURUSD choppy around 1.0780, Cable tumbled below 1.3000, AUDUSD +0.3% supported by RBA minutes at 0.7385.

Today – There is little on this week’s calendar data-wise and today’s slate has just the Housing Starts and Building permits from US. There is Fedspeak from Evans and SNB’s Chairman Jordan.

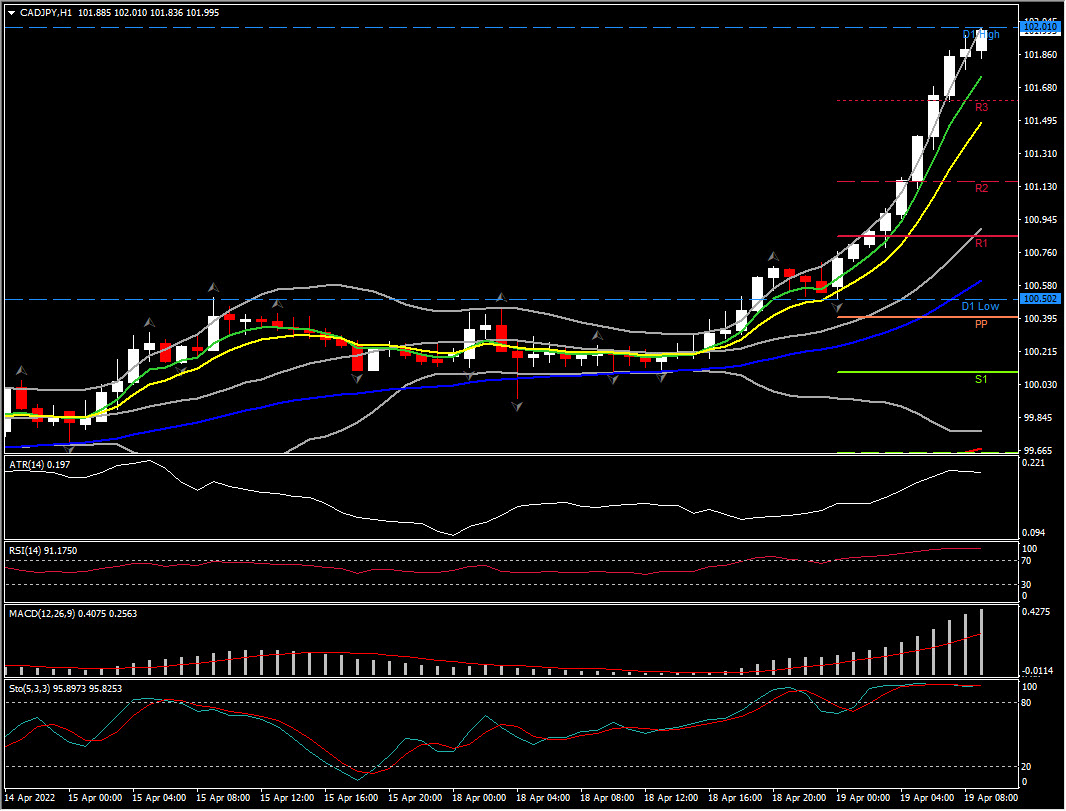

Biggest FX Mover @ (07:30 GMT) CADJPY (+1.40%) Breached 102.00. MAs still aligned higher, MACD signal line & histogram moving higher, RSI 91 but flattening, H1 ATR 0.197, Daily ATR 0.892.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.