UK CPI inflation nudged today up to a 30 year high of 5.5% y/y at the start of the year, from 5.4% in December. The RPI rate, which remains a major focus for unions in wage talks was expected to drop back slightly, but instead jumped to 7.8% y/y from 7.5% y/y, which coupled with the robust labour market report yesterday will keep pressure on the BoE to continue to act and fuel market speculation for a bold 50 bp move at the next meeting.

The rest of today’s inflation report also flagged upside risks. RPIX, the index excluding mortgage interest payments reached 8.0%, and PPI input price inflation came also in higher than expected at 13.6% y/y. Meanwhile the rise in unexpected output price inflation to 9.9% y/y highlighted the companies are increasingly willing and able to pass on higher costs and that will continue to feed through the product chain and keep CPI numbers underpinned for a while. Coupled with the tight labour market the risk of second round effects clearly is building and will force the BoE to deliver more hikes, although we agree with chief economist Pill that unusually aggressive action could see markets running too far ahead with the tightening story.

Gilts outperformed in what looked like a case of sell the rumour and buy the fact, with the 2-year rates correcting -6.2 bp despite higher than expected inflation numbers that saw CPI lifting to a 30 year high. The inflation report while it adds to speculation that the BoE will deliver a 50 bp rate hike at the next meeting, the UK 2-year rate is actually down. By contrast the German 2-year rate has lifted 0.8 bp to -0.35%. 10-year rates are up 1.6 bp in Germany and 1.5 bp in the UK. Treasuries are outperforming slightly, but the US paper has also lost overnight gains, leaving the 10-year rate up 0.5 bp to 2.05%.

EGBs have been in demand and yields dropped, as the rally on stock markets started to fade. Concerns over Russia returned and the rally in stock markets faded. Bund underperformance owed also something to hawkish ECB speak from Schnabel and Villeroy, with the Executive Board member warnings against the risks of acting too late, while Villeroy flagged that net asset purchases could be phased out through the second and third quarters, which would effectively pave the way for a rate hike in Q4.

Sterling on the other hand spiked higher against USD and EUR, breaching 1.3571 and 0.8380 respectively. In general GBPUSD has been range bound in Ferbuary. The near term urgency to buy US Dollars on the back of the Russia/Ukraine situation allowed the Pound to head modestly higher, though with a highly uncertain course in the region, follow through Sterling buying will likely be limited.

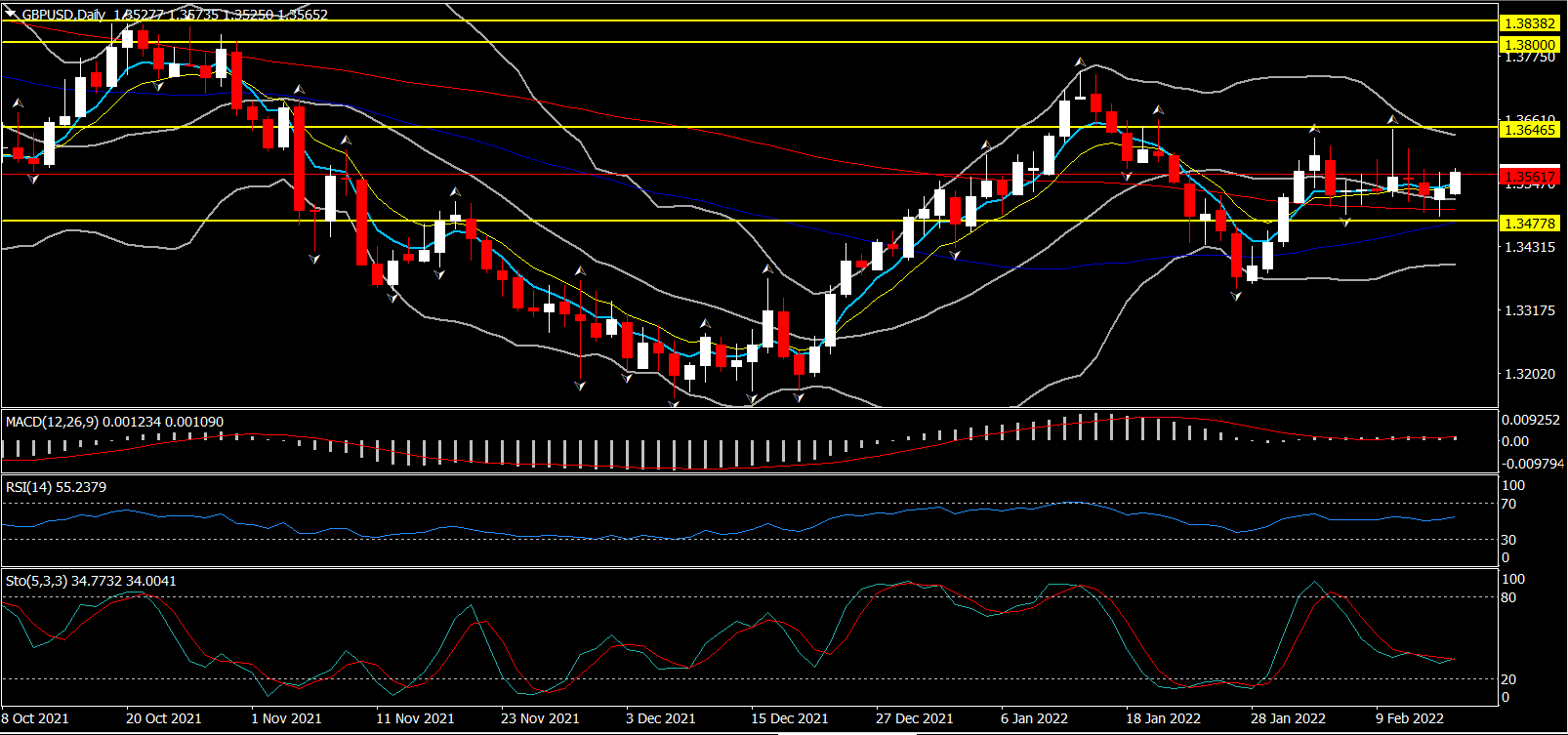

GBPUSD remains above its 50- and 100-day SMA, which is currently at 1.3470 and 1.3500 Overall, Cable has run up on the anticipation of the repo rate to 0.50%, the highest in the G7, which likely to provide further support to the Pound. Given however that same scenario holds for Fed, with markets pricing in 50 bp hike next month and 170 bps in rate increases this year, we might see Cable holding in 1.3470-1.3650 range. Additionally, the medium term oscillators comply with the neutral outlook of Cable as Bollinger’s along with SMA have flattened, while the MACD is holding along with its red signal line close to 0. The RSI is creeping sideways at 55.

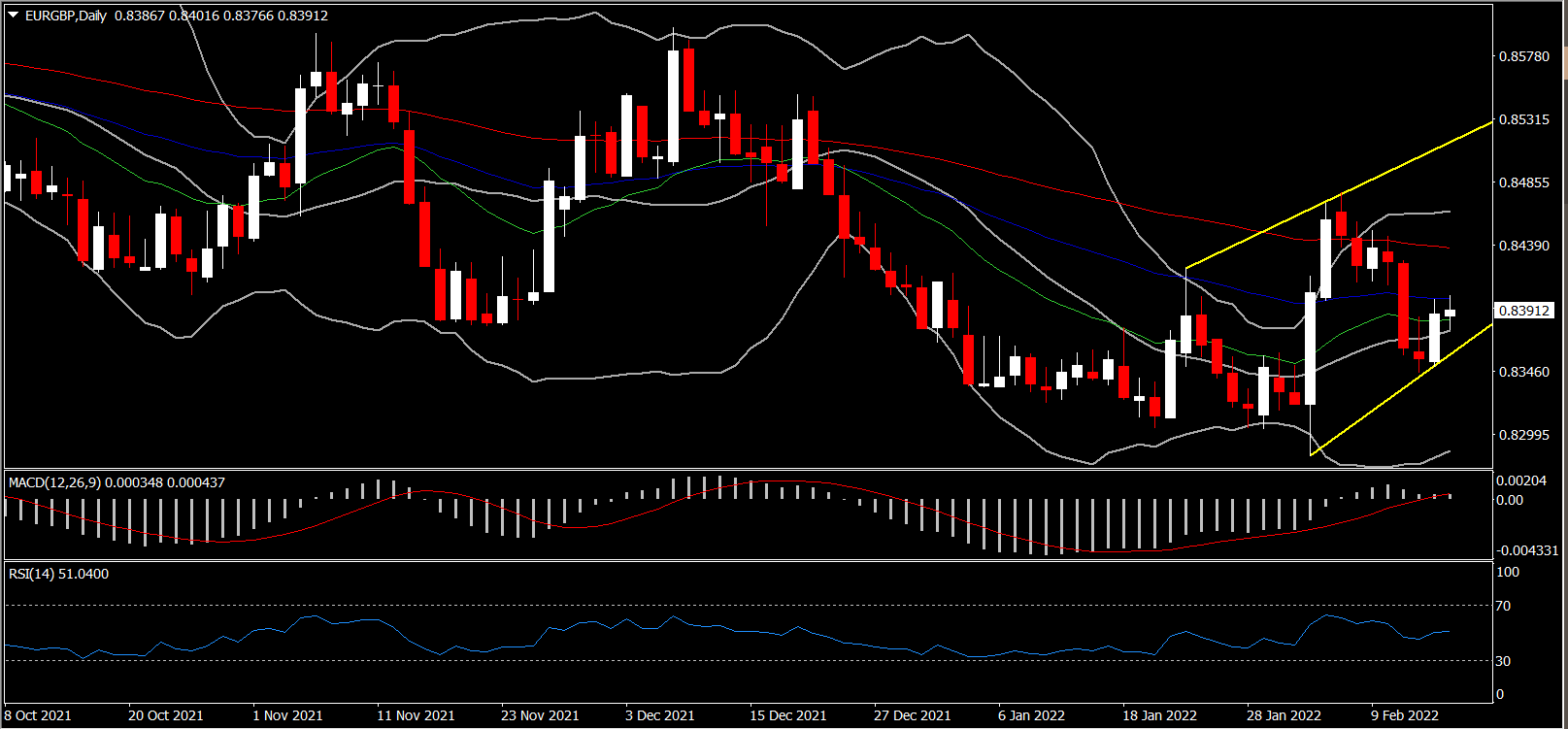

EURGBP meanwhile, has manage to sustain a move above 20-day SMA for a 3rd day in a row, following the underperformance of Gilts as the yield differential which favored the euro last week has been faded. The asset presents a neutral to bullish outlook since the momentum is neutral for now however the rally seen since end of January along with the expectation of more rate hikes from BoE soonish, while the ECB remains sidelined until likely late in the year, should that should keep a floor under Sterling and pressure on Euro.

To the upside, the 0.8400 resistance (50% Fib from February’s downleg) could delay price gains from gaining pace. However, if this barrier breaks is could keep growing bullish pressures at bay, to the 0.8440 and 0.8480 highs, with the latter identified in the 7th of February.

Central bank moves will remain key drivers going forward, although Sterling also remains vulnerable to bouts of risk aversion.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.