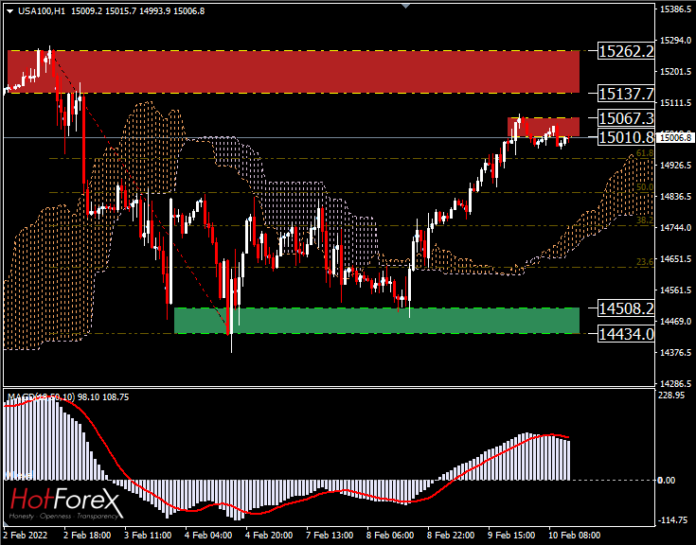

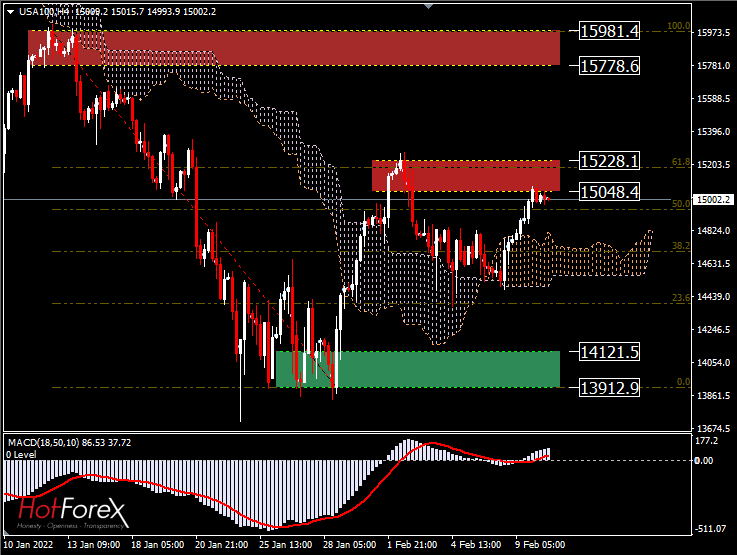

The USA100 declined from its highest key resistance at 15,262.2 . The lowest support was reached at 14,434 on February 4th, but then it moved into a side channel and went back up again and breached the 61.8% Fibonacci retracement level. It is trading at 15,006 . The indicator broke through the Ichimoku cloud which was represented as a support on February 3rd and fell slightly and moved into a side channel. On February 8, the index broke through the Ichimoku cloud, which was a resistance and continued to rise after that, but fell slightly today.

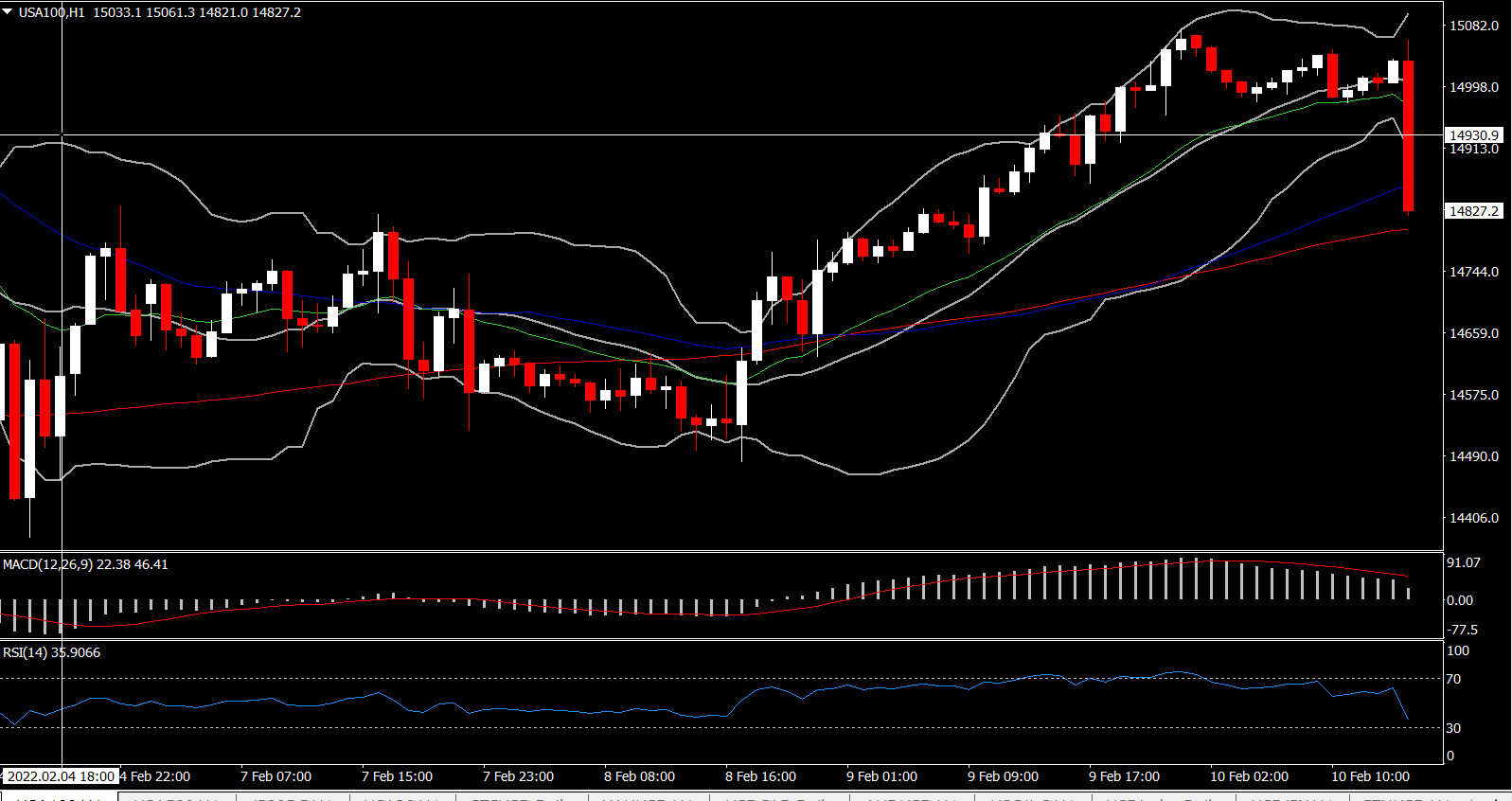

However, following the hotter CPI outcome the yields moved higher, and equity futures slide further, with USA100 drifting to 14,830. Slightly better jobless claims were overlooked. EURUSD slipped from over 1.1435 to six-session lows of 1.1387, while USDJPY rallied to one-month highs of 116.16. The 10-year note hit a two-year high of near 1.99%, while equity futures, which has been on either side of flat ahead of the data, are now all well underwater.

US CPI rose 0.6% in January on both the headline and the core measures, on the hotter side of expectations. Those follow the same sized 0.6% December gains for each. The 12-month pace accelerated to 7.5% y/y from 7.0% y/y previously, with the ex-food and energy gauge at 6.0% y/y from the prior 5.5% y/y. These are the highest since 1982. Strength was broadbased with nearly every component rising. The exception was gasoline which slipped -0.8% from the prior 1.3% (was -0.5%) surge. Energy prices climbed 0.9% from 0.9% (was -0.4%). Services costs rose 0.6% versus 0.3%. Housing costs jumped 0.7% from 0.5% (was 0.4%) with owner equivalent rent up 0.4% from 0.4% previously. Food/beverage prices increased 0.8% from 0.5%. Transportation costs edged up 0.4% versus the prior 1.4% (was 0.8%) gain. Apparel costs surged 1.1% from 1.1 (was 1.7%) previously. Recreation rose 0.9% from -0.1% (was -0.2%). Education inched up 0.1% from 0.1% (was unchanged).

MACD signal line and histogram are above the 0 line but are declining, RSI is at 35, Stochastic continues declining, implying to a decreasing bullish bias.

In the Daily timeframe, the Bollinger Bands indicator narrow, with the upper band of the volatility channel is located at 15,063 and the lower band of the volatility channel is located at 14,951. This indicates a period of low volatility, and a possible beginning of ranging market. Standard Deviation Index (20) at 27.51 in oversold territory.

Click here to access our Economic Calendar

Εslam Salman & Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distribution.