Stock markets sold off while Treasuries were rocked by the FOMC’s stance even as there weren’t really any surprises. The release of the document on “Principles for Reducing the Size of Federal Reserve’s Balance Sheet” that broadly outlined the shrinkage with no real details, and Powell’s suggestion that the runoff might have to be faster than in the prior cycle, struck a nerve.

The main takeaway from the FOMC statement is that policy is on track for a removal of accommodation soon. That was the only policy specific, which leaves the FOMC with plenty of flexibility. The statement and Chair Powell’s presser were vague by design, with no real specifics on the timing or size of rate moves, nor on the balance sheet. There were a couple of hints in the press conference for a March liftoff and a balance sheet reduction in June. Powell stressed that the FOMC will have to be “humble and nimble” as it removes accommodation while sustaining the expansion.

- New Zealand inflation hit 5.9% y/y in Q4, also fueling tightening expectations.

- Chinese industrial profit data showed a much reduced pace of 4.2% y/y – down from 9.0%.

- Surprise improvement in German GfK consumer confidence added to the rebound in local business confidence readings at the start of the year.

- USD (USDIndex 96.73) hits 1-month high.

- The 2-year note underperformed and rose 14 bps to hit 1.160%, the biggest 1-day jump since March 2020. The 10-year was up 10 bps to 1.876%. The 10-year JGB rate climbed 1.7 bp to 0.15%.

- Equities – Wall Street pared early gains in the later part of the session and the USA100 closed in the red, with the sell off intensifying overnight. Topix and JPN225 are currently down -2.6% and -3.1% respectively. The ASX lost -1.8% after returning from holiday, Kospi and Kosdaq have declined -3.5% and -3.7%. GER30 and UK100 futures are down -1.8% and -1.4% respectively.

- Earnings: Tesla beat on earnings and revenue, says the company will not release any new model vehicles in 2022. Deutsche Bank posted a surprise profit on strong investment bank performance. Intel earnings beat expectations, with non-GAAP revenue of $19.5 billion, up 4% from a year ago.

- USOil – up to $86.50, currently at $85.65 ;US rejects Russian demand to bar Ukraine from NATO; Russian and Ukrainian negotiators agreed that a permanent ceasefire in eastern Ukraine must be observed “unconditionally” following hours-long talks in Paris on Wednesday.

- Gold – down to $1809 from $1854.

- FX markets – USDJPY at 114.75. EURUSD down to 1.1210 & Cable drifts to 1.3420.

European Open – Bunds sold off in catch up trade at the start of the session and the German 10-year rate has lifted -0.38 bp to -0.041% now. Peripherals are underperforming and spreads widening as markets adjust their outlooks for central bank action in the wake of the hawkish FOMC announcement, which set the stage for a quick lift off.

Today – The heavy slate of earnings includes Apple, Visa, Mastercard, Comcast, Danaher, McDonald’s, SAP, etc. Data includes the Advance Q4 GDP report, December durables report, weekly jobless claims and pending home sales.

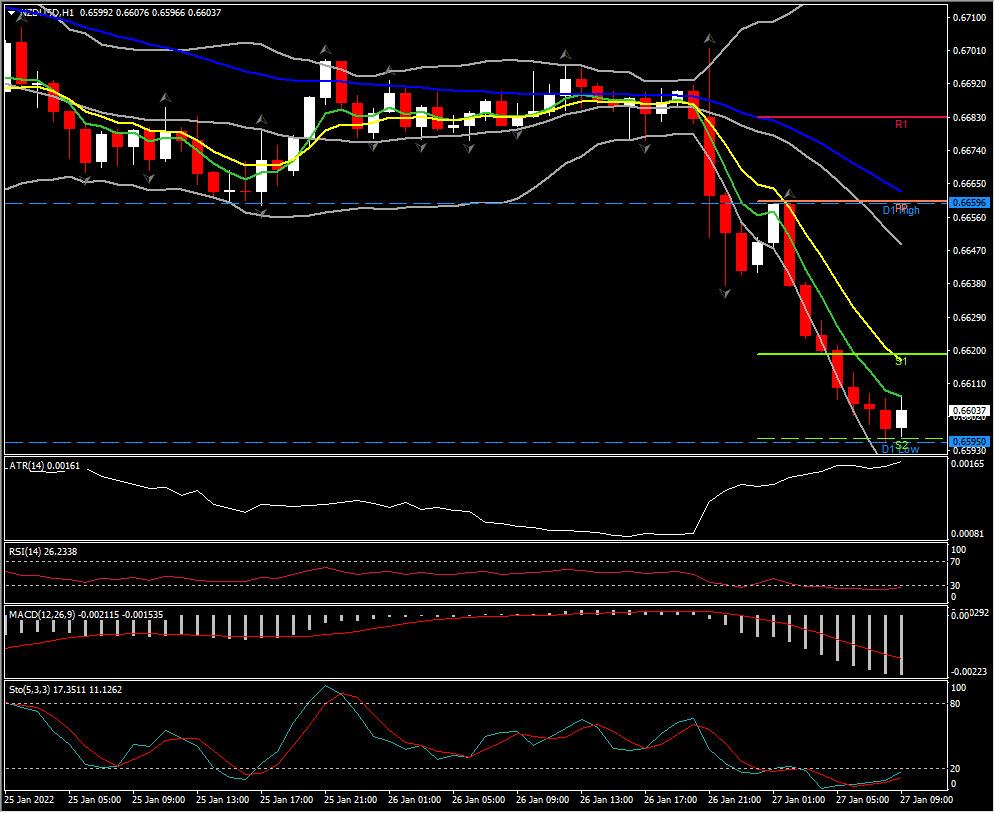

Biggest FX Mover @ (07:30 GMT) NZDUSD (-0.64%) – Breached 15-month support at 0.6660. Fast MAs aligned lower intraday with all momentum indicators pointing further lower. ATR (H1) at 0.0016 and ATR (D) at 0.0057.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our written permission.