The BoE wrong-footed markets and kept rates unchanged at today’s meeting, and while the central bank sent a clear signal that the Bank Rate will move higher in the coming months, the details of today’s report highlighted that market pricing on the speed and extent of rate hikes in coming years was overdone. Bailey focused on supply constraints, which are acting as a speed limit for the recovery this year and the bank also turned less optimistic on the outlook for 2022.

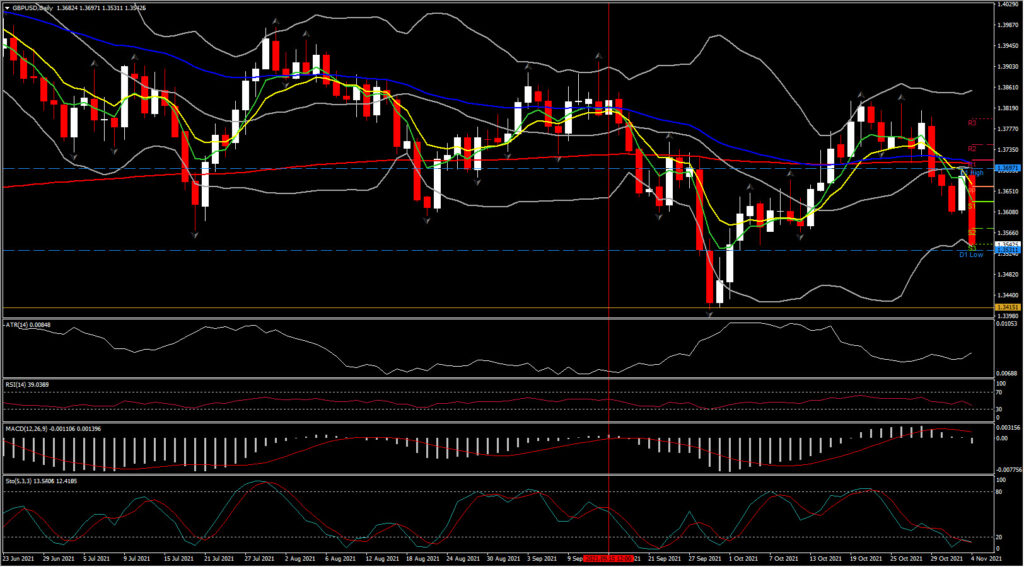

GBPUSD fell to one-month lows of 1.3531 from 1.3640 following the BoE announcement, where rates were left unchanged at 0.10%. There had been some speculation for a small 0.15% hike, but that was not to be. GBPUSD resistance is at the 20-day SMA 1.3700, with support at between the 2021 low and 200-week EMA, at the 1.3390-1.3410 area.

The vote, however, was 7-2 in favour of keeping rates steady, but Bailey said in a statement that the Bank Rate will have to rise over the coming months to meet the inflation target. That means the ground is prepared for a hike in December or early next year. Three MPC members voted to cut the QE target. Two MPC members opted for a 15 bp rate hike and 3 wanted to trim the QE target, but while the statement confirmed that the Bank Rate will lift off in coming months, the main message today was that market pricing on the speed and extent of tightening in coming years was overdone. 10-year Gilts moved higher although the curve is flattening slightly as the short end outperforms, and we suspect the rally could fade, once the details are digested. The BoE clearly is on the way to scale back support and lenders have already started to pull their best deals.

BoE more cautious on the growth outlook. Like the ECB the BoE highlighted that disruptions in supply chains are keeping a lid on output growth although unlike its counterpart in Frankfurt, the central bank in London also seems pretty cautious on the medium term outlook, saying that growth will be “relatively subdued” from the middle of next year onwards. Output is likely to reach pre-crisis levels early next year, rather than at the end of this year, as previously hoped. The 2021 estimate was cut back to 7% from 7.25% back in August and the forecast for GDP was shaved to 5% in 2022 from 6% expected previously, while the 2023 projection was left unchanged at 1.5%. Inflation is seen undershooting the 2% target in three years’ time, if rates rise to around 1% by the end of 2022, as markets had pencilled in ahead of today’s meeting.

Gilts have led a broad rally in EGBs as the BoE defied market expectations and left the Bank Rate and QE on hold today, in line with the Bloomberg consensus.

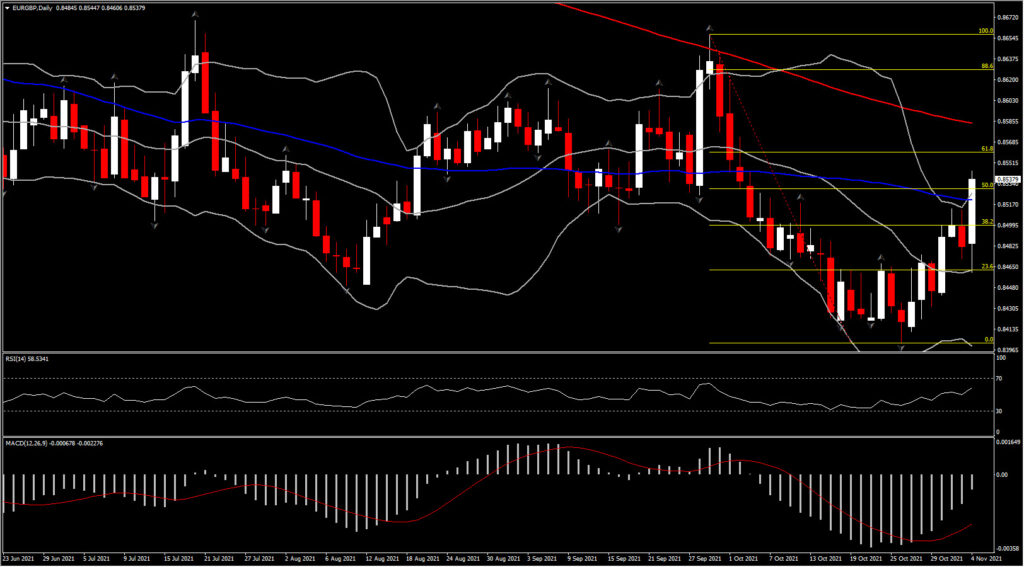

The Pound has also extended losses against the Euro, with EURGBP spiking to a 0.8544 high breaking above the 50-day SMA and reversing more than 50% of losses seen since September. The UK currency is expected to remain under pressure given the policy divergence of BoE, which led the 10-year Gilt yield lower to 0.918% and the 2-year rate to fall 12 bps to 0.54, while the December 2022 short-sterling futures contract (a proxy for where the BoE bank rate is expected to be next December) rose sharply, indicating that markets are pricing in a rate hike by 20 bps by next December.

Bunds also got a bid from the BoE decision and Eurozone spreads narrowed, while stock markets were supported as fears that central banks will kill off the recovery with early tightening moves evaporated. That said, the BoE/ECB December 2022 interest rate differential dropped today, suggesting that if this differential continues to deduct over the coming weeks as markets pare back on a hawkish BoE, this could continue to lift EURGBP. Next Resistance for the EURGBP is at the 200-day SMA at 0.8585.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.