Coinbase Global Inc. revealed on Wednesday that it resumed operations on the cryptocurrency exchange platform after fixing an issue that caused a service outage amid the cryptocurrency selloff earlier in the day. In their tweets they said, “We have fixed and monitored the results but you should have no more problems signing in to Coinbase and Coinbase Pro. We sincerely apologize for the trouble this has caused and we thank you for your patience with us today. “

Coinbase Global Inc. said it planned to sell $1.25 billion in convertible debt, and on the same day its share price closed below a reference price of $250 for the first time since the crypto platform listed on the USA100 exchange in mid-April. Coinbase COIN and other users that dealing with bitcoin BTCUSD and ETHUSD experienced a sharp decline due to continued panic selling related to regulations. Although in the previous week the company reported strong Q1 results, in line with its initial release before going public.

Last week, Coinbase reported revenues of $ 1.8 billion, compared to $ 191 million in Q12020. They plan to add the popular DOGEUSD to their offering series within 2 months of the asset boom. Coinbase estimates users transact monthly from 5.5 million to 9.0 million for 2021, depending on performance in the crypto market.

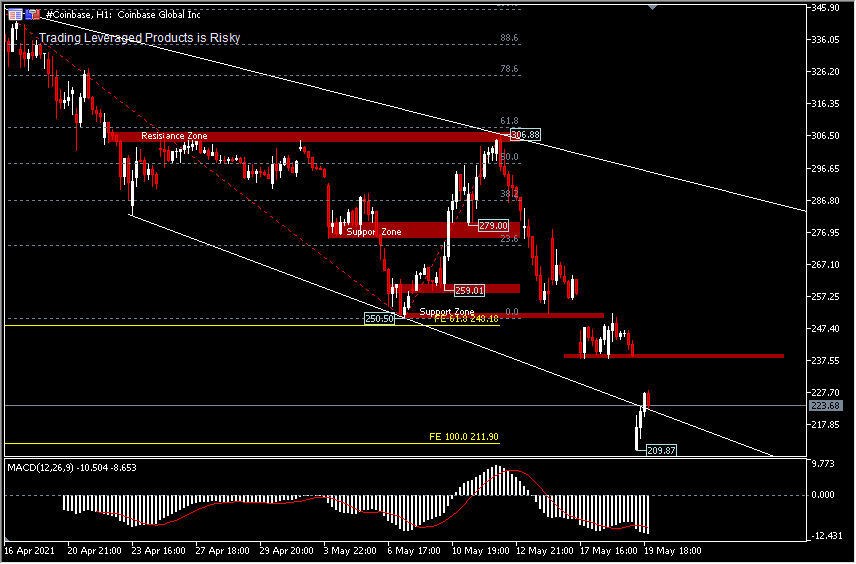

Coinbase is down around <30% since its public debut to this day, in line with the decline of the broader crypto complex, but a number of analysts remain bullish on the company’s share price. In the H1 period, the asset price made a new low at 209.87 after opening with a downward GAP jump, exiting the trendline’s bottom line. The weakness is expected to continue, as long as panic-selling on crypto assets continues targeting a possibility of up to 150.00.

Click here to access our Economic Calendar

Ady Phangestu

Market Analysts – HF Educational office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.