The April nonfarm payroll estimates vary from 850k to 978k, though market estimates are skewed to the high side of the forecasts likely due to big declines in initial claims through the month, and big increases in both consumer confidence and producer sentiment. Yet, that “restrained” rise is consistent with our 9.0% Q2 GDP growth estimate, and the diminishing downtrend in continuing claims. We expect the April workweek to hold steady at 34.9, with gains of 0.7% for hours-worked and 0.2% for hourly earnings, alongside a jobless rate drop to 5.7%.

The latest release left us with net revisions from “as reported” figures of +89k in February, +184k in January, and -166k in December. For 2020 we saw a -444k net downward revision from “as reported” headlines. We saw a net upward revision of 82k in 2019, and a -111k net downward revision in 2018. We saw prior net upward revisions of 9k in 2017, 200k in 2016, and 12k in 2015.

The market has so far been in narrow ranges ahead of the NFP but also due to the anticipation of the BOE’s Monetary Policy Report. Today’s US Nonfarm payrolls and Canadian jobs data are expected to impact the market and more precisely the US Dollar and Canadian Dollar. On the back of this, ultra-easy monetary and fiscal policies, massive government stimulus, vaccines, and robust corporate earnings are increasing optimism in the recovery. Even though this optimism is already priced in the jobs reports might be a source of volatility for the currency market today.

However after today’s data the attention afterwards will fall on whether the ability of vaccines to cool down hotspots will continue, and whether there will be further assurances by central bankers that rate lift off is a long way away. In the meantime the mix of growth and inflation in the economic data will continue to drive markets in May.

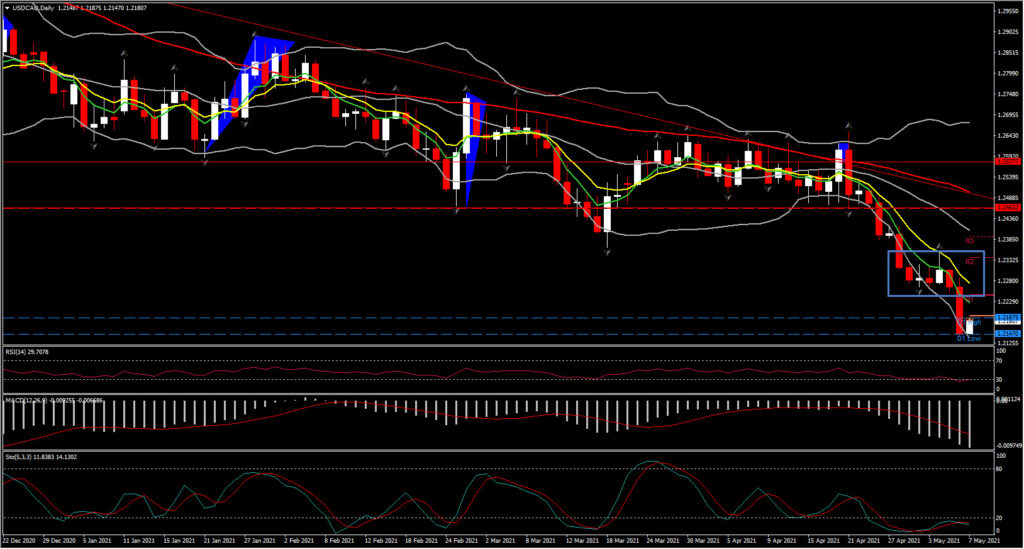

Now from the technical perspective, focus today turns to USDCAD on the release of jobs data from both counties. Currently the USDCAD has steadied after hitting its lowest level since September 2017, at 1.2144, yesterday, on the USOIL rise due to a large draw on US crude stockpiles, though this has been offset by the pandemic situation in India, which is in crisis and is accordingly imposing lockdown restrictions. India is the world’s third biggest oil importer. Canada’s April jobs report is expected to show a 300.0k plunge in headline employment, which would largely reverse the 303.1k surge that was seen in March, and which was a consequence of increased pandemic lockdown restrictions in Ontario and other regions. The unemployment rate is seen jumping to 8.4% from 7.5%. In the bigger picture, the Canadian Dollar outlook remains bullish, as USDCAD remains in a downwards channel since March 2020.

Medium term momentum indicators are negatively configured with daily MACD extending southwards, RSI at 30 and Stochastics at 12.70. In terms of trend, the next Support area for the asset is at multiyear lows, i.e. the 1.2000-1.2050 area, and if that breaks the next Support is from back in May 2015 and the 1.1920 low.

In summary, the negative bias for the asset sustains as the trend reversal signal remains absent, while in the short term only a move back above the 1.2240 area could trigger a near term bullish wave towards a 1.2300-1.2350 high.

Back to a quick breakdown on today’s upcoming NFP release. Even though there is an upside risk on today’s release, the seasonal impact through the year on payroll changes is mostly positive, but tends to be negative in December, January and July. Distortions of last year’s COVID-19 would have produced negative averages for March and April now as well. For disruptions to employment from weather as gauged in the household survey, the biggest disruptions occur in the winter months generally with the average peak in February. There has been an additional climb through the late-summer months due to disruptive hurricanes in some years.

In addition, the average net birth/death effect rises to 215k in April from 80k in March, 117k in February, and -306k in January. Its annual high typically occurs in April and its annual low in January. After the January low, the month of July marks a summer trough for the average which becomes more volatile in the second half of the year, oscillating between negative and positive territory with a second half trough in September and a peak in October.

Key as always along with the NFP number is the Average hourly earnings, which are assumed to rise just 0.2% in April, as we further unwind the December distortion that left a 1.0% earnings surge with a big drop in low-wage workers. The y/y wage gain should fall to -0.2% from 4.2% as we hit a hard comparison. Swings will likely still largely reflect the percentage of lower paid workers in the jobs pool, as seen with the 4.7% surge last April and the 1.0% pop in December.

We previously saw a 3.5% expansion-high pace for y/y wage gains in both February and July of 2019, before the pandemic boost to an 8.0% peak in April of 2020. We expect a robust payroll trajectory in 2021 following the winter lull, thanks to stimulus deposits and vaccines.

Nevertheless, after yesterday’s ADP undershoot with a 74k April ADP rise and 780k private BLS payroll estimate, there is a neutral signal for the nonfarm payroll estimate. Even though the April rise was the biggest increase since the 821k gain in September, the “as reported” ADP figures undershot the BLS payroll data in both February and March, and have generally posted undershoots through the pandemic, though we did see overshoots in December and January.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.