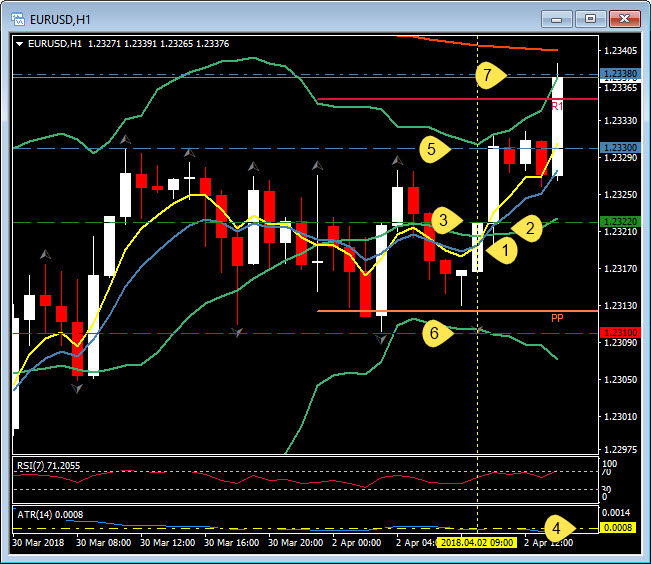

EURUSD, H1

The new quarter started cautiously, with investors weary about how the Trumpian era of protectionism will proceed. European markets are closed, and India Australian and New Zealand markets were also closed. President Trump is expected to outline his China tariff list this week, while Beijing is hitting back with tariff increases of up to 25% on 128 U.S. products. Meanwhile, overnight data showed China’s March manufacturing PMI fell to a weaker than expected 51.0, a four month low. Also, Japan’s Q1 Tankan disappointed. This will be a busy week of data and events in the U.S, with the focus on the March jobs report and a speech by Fed Chairman Powell, both Friday. For today, there is the March manufacturing ISM, the Markit PMI, and February construction spending. The Fed’s Kashkari speaks on monetary policy and the economy.

The Greenback has weaken during the the pre-US session with EURUSD breaking over 1.2330 to breach R1 at 1.2338, USDJPY slips from an overnight spike to 106.39 down to 106.25 and cable continues to out perform and targets the 200 moving average at 1.4075. The H1 EMA Crossing Strategy ran to T1 and T2 this morning in thin trading and low volumes fro a net gain of 16 pips.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/04/03 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Senior Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.