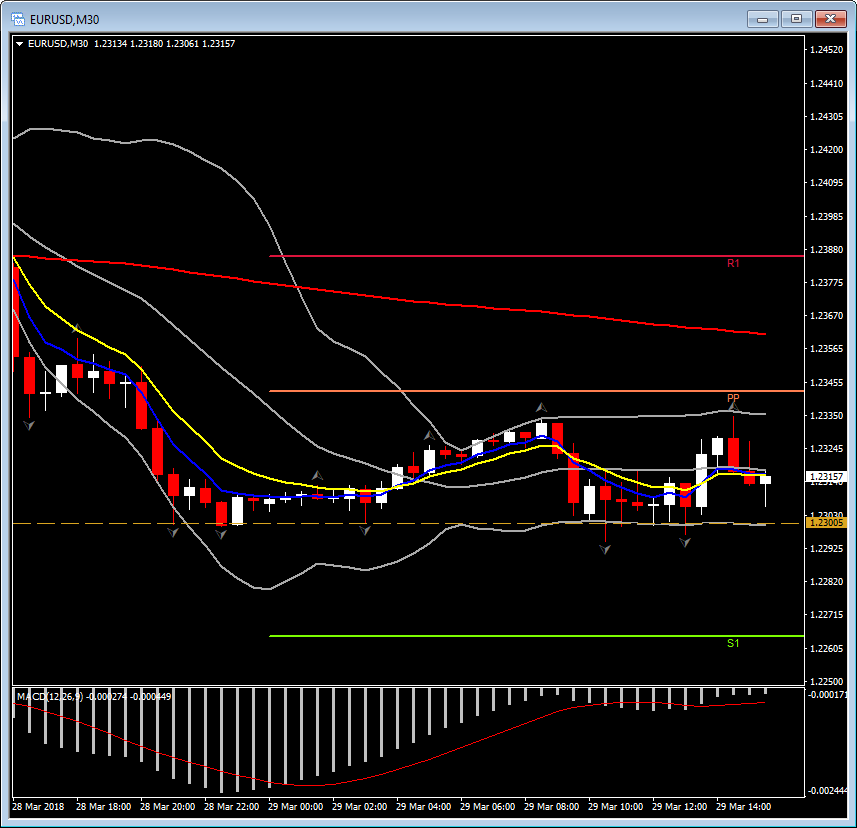

EURUSD, M30

The dollar edged higher after the mix of data, where income and spending were in line with forecasts, and jobless claims were lower than expected. USDJPY perked up a few points to 106.55, as EURUSD dipped to 1.2306.

Personal income remained healthy, though a drop in spending helped boost the savings rate and initial jobless claims sank again.U.S. initial jobless claims fell 12k to 215k in the week ended March 24 after rising 1k to 227k (revised from 229k) in the March 17 week. This is now the lowest level since January 1973. And it brings the 4-week moving average down to 224.5k from 225.00k (revised from 223.75k). Continuing claims rose 35k to 1,871k in the March 17 week after dropping 41k to 1,836k previously (revised from 1,828k). Meanwhile, US February personal income rose 0.4%, with spending up 0.2%, the same as in January. The PCE chain price index, the Fed’s preferred measure, increased 0.2% after the 0.4% January jump, with the core rate up 0.2% from 0.3% previously. On a 12-month basis, the headline PCE price index rose to a 1.8% y/y pace from 1.7% y/y, with the core rate at 1.6% y/y from 1.5% y/y. Though the price measured moved up, they remain below the Fed’s 2.0% target, yet they could give policymakers confidence inflation is moving higher.

Remaining on the docket are Chicago PMI and final U. Michigan sentiment.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/29 12:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.