AUDUSD, H1

AUDJPY is the biggest loser out of the main dollar pairings and cross rates yesterday, with cross down 1.3%. The move reflects part Aussie underperformance and part yen outperformance, as risk aversion continued to course through global markets on the realizing threat of Trumpian trade wars. The cross is widely considered a forex market risk appetite barometer for this reason, and has declined by nearly 9% since early-January levels, making a 16-month low earlier at 80.49.While Australia won an exemption from Trump’s steel and aluminium tariffs, the country will be exposed to U.S. tariffs via Trump’s action against China, which is the antipodean country’s biggest client for its vast natural resource exports, and more broadly to any global tit-for-tat trade way. The minutes from the RBA’s early-March board meeting showed there was some concern about a deterioration in Australia’s terms of trade. Meanwhile, the Japanese inflation data today may have given the yen an added bid, with the BoJ-watched core CPI reading rising to a rate of 1.0% y/y in February from 0.9% in the month prior, although the rate is still well off the central bank’s 2% target.

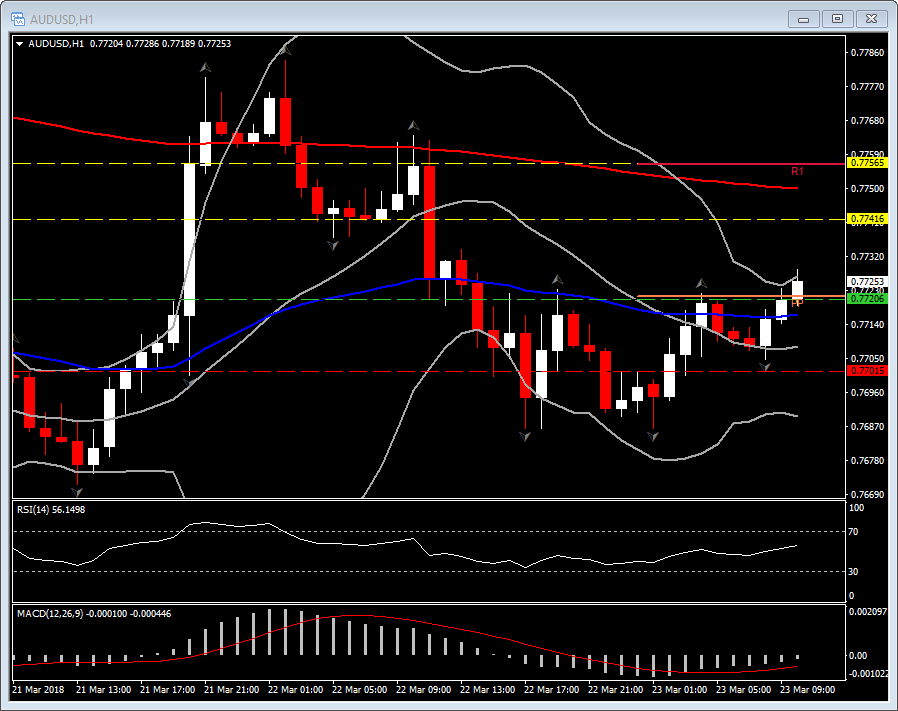

AUDUSD closed yesterday down by 0.7% on the day presently, returning focus on three-month low. However, the shorter timeframe of the pair, since early today, presents a rebound from 3-months lows, by nearly 30 pips up. Hence despite the fact that pair is in a continues downtrend since January 31, it seems that we could benefit intra-day with some possible corrections to the upside. Hence in the hourly chart the pair is traded for 7 consecutive session within the upper Bollinger Bands pattern, while on London open, it broke the 50-period EMA but also the latest upper fractal, suggesting positive short-term momentum. The momentum indicators present some positive signs with RSI crossing slightly above neutral Zone, while MACD is neutral. However we noticed that in the 30 minutes chart, both indicators look positive with RSI at 62 while MACD turned positive.

Hence a Long Position was triggered on the confluence of the PP level and the break of the fractal at 0.7720. Targets were set at yesterdays support area at 0.7742 and at R1 at 0.7757. Support comes at the round level, 0.7700 which is also the latest swing low.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/27 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.